Tesla reports earnings after the bell on Wednesday. After last […]

⛽ Shock at the Pump = TSLA (and RIVN?) profits

In the early 1900s, the Ford Model T revolutionized the automotive industry, making cars accessible to the masses. But it was the oil crisis of the 1970s that truly shifted consumer behavior, leading to a demand for more fuel-efficient vehicles.

Memories of long lines at gas stations and skyrocketing fuel prices lingered in the minds of consumers for decades.

Today, we find ourselves on the brink of another transformative moment in automotive history. Rising gas prices are not just a temporary inconvenience; they are a catalyst for a profound shift in consumer behavior.

The Impact of Rising Gas Prices on Consumer Behavior

The recent surge in gas prices, with Brent International prices nearing $85 per barrel and the national average for regular gasoline at $3.85 a gallon (with 11 states already over $4/gallon), is more than just a financial burden.

It's a psychological trigger.

Car buyers tend to have long memories, and the shock of high prices at the pump can linger.

While these price spikes may not result in immediate increased sales of electric vehicles (EVs), they plant a seed.

The next time a consumer considers an automotive upgrade, memories of price shock at the pump may lead them to an EV they would not have considered otherwise.

Tesla's Continued Dominance and the Emerging Competition

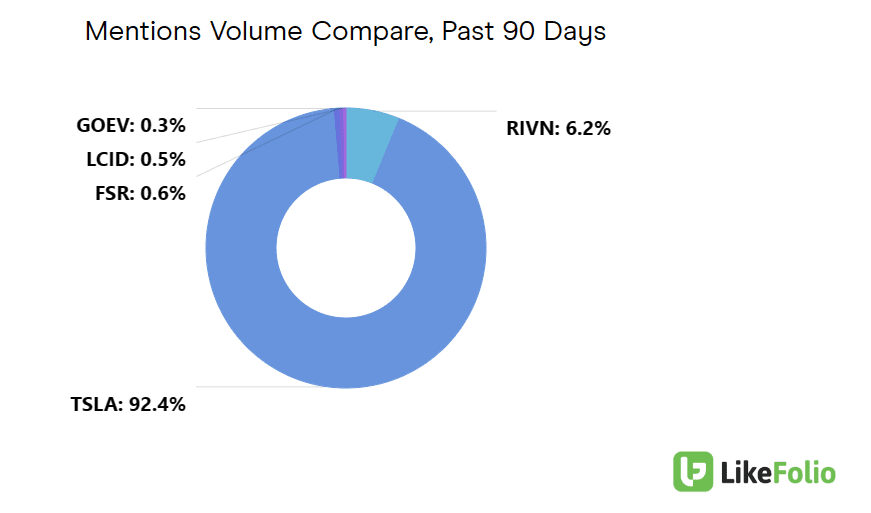

With it’s stock soaring by over 100% in 2023 and capturing over 92% of total EV company mentions, Tesla (TSLA) remains the most likely beneficiary of this shift.

But the landscape is evolving. Rivian (RIVN) and Ford (F) are hinting at competent competition, adding dynamism to the market.

From this point on, TSLA's dominance may be challenged by emerging players like Rivian and Ford, who are making significant strides in the EV market.

The Connection Between Gas Prices and EV Demand

Rising gas prices create a ripple effect:

- Awareness: Consumers become more conscious of fuel costs and start exploring alternatives.

- Consideration: EVs, once seen as niche, become a viable option for many.

- Long-term Impact: Even if gas prices stabilize, the memory of the shock remains, influencing future purchasing decisions.

The Future: An Electric Horizon

The current rise in gas prices is not an isolated event; it's part of a broader trend. With global oil demand expected to hit record highs and production cuts by major players like Saudi Arabia, the volatility is likely to continue.

But this volatility is more than a challenge; it's an opportunity. An opportunity for innovation, growth, and a future where EVs are not just an alternative but a preferred choice.

TSLA remains at the forefront of this electric revolution, but the race is far from over.