“You know it's time to sell when shoeshine boys give […]

3 reasons Bitcoin could go (much) higher

Earlier this week, Bitcoin topped $50,000 for the first time ever.

Major investments from the likes of Tesla (TSLA) and Microstrategy (MSTR) have helped fuel the ongoing Bitcoin (BTC-USD) bull run.

Obviously, this institutional adoption of Bitcoin has delivered credibility to the cryptocurrency that was previously lacking.

But what about consumer enthusiasm?

Ultimately, the success of Bitcoin and other cryptocurrencies is heavily dependent on individual user adoption rates.

So we decided to turn the sights of LikeFolio’s incredible consumer insights engine toward the cryptocurrency market.

What we found was incredible.

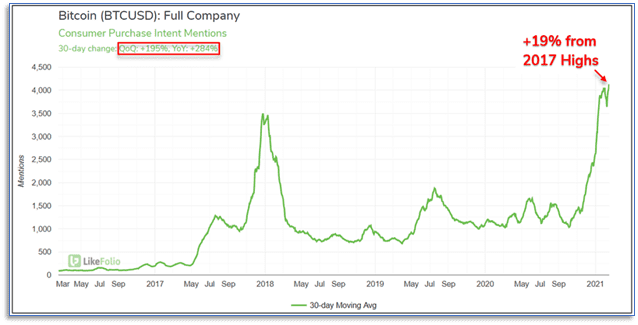

1. Consumer Interest in Bitcoin is Making ALL TIME Highs

Mentions of buying Bitcoin are up +284% YoY in the past month, +19% above the highs seen during the 2017 bull run.

Last time we saw consumer mentions this high, they quickly retreated… followed by the price of Bitcoin.

But this time could actually be different.

We will keep a close eye on consumer mentions of Bitcoin moving forward as a clue to the likely price action.

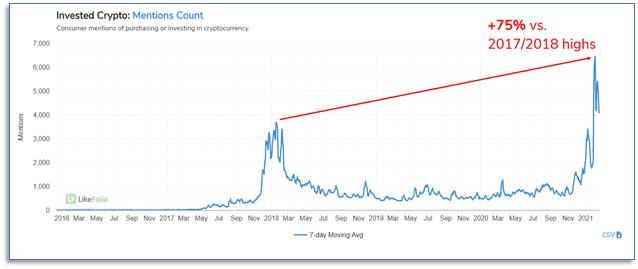

2. General Cryptocurrency Enthusiasm is Booming

Of course, Bitcoin isn’t the only player in town.

Alternate cryptocurrencies (think Ethereum, Ripple, Litecoin, etc) are also getting more attention.

Just look at this chart of the number of people talking about investing in cryptocurrencies:

That’s a 703% Year over Year increase, and already at 75% greater enthusiasm levels than the 2017 peak.

This tells me that the public is more serious about crypto long-term than they were in the initial, more speculation-driven bubble.

3. Cryptocurrency is Producing a Tailwind... For Itself

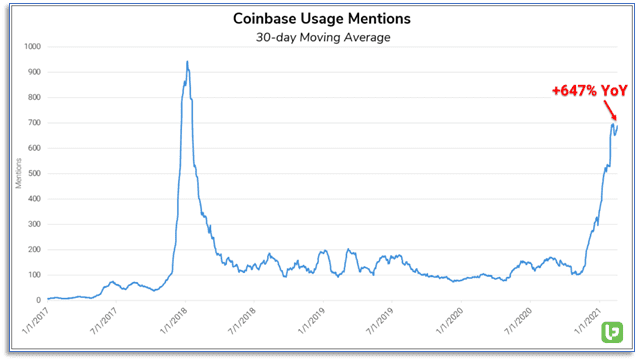

Since the 2017 crypto bubble, huge investments have been made in the infrastructure of cryptocurrencies.

Most notably, platforms and exchanges have emerged that make it much easier for ordinary individuals to trade or invest in Bitcoin and other tokens.

One of the earliest “easy” providers of crypto-investing technology was Coinbase, which plans to go public in the next few months.

As you can imagine, consumer mentions of investing through Coinbase have skyrocketed over the last few months:

One thing you’ll note on this chart is that unlike every other crypto chart in this article, Coinbase has actually failed to surpass the 2017 bubble highs in terms of consumer enthusiasm.

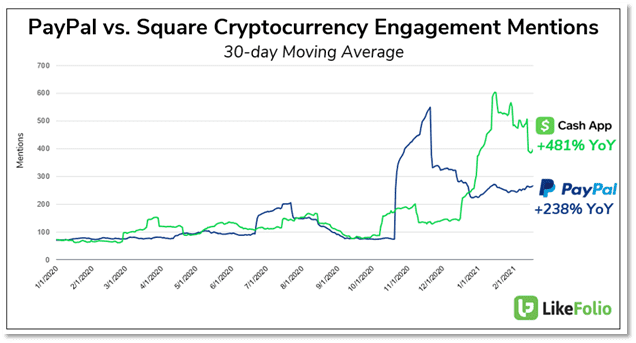

So where is all this crypto-mania coming from?

Big, big players. Specifically, PayPal and Square’s Cash App:

The success of these two entrants alone has been a huge boon for the cryptocurrency market over the past six months.

Because now, instead of having to take your money to the cryptocurrency platform, the cryptocurrency investing platform came to your money. Instantly, consumers could turn their existing Cash App and PayPal balances into Bitcoin investments.

This, along with the rising price of the coins, has created a feedback loop that makes consumers more likely to participate in, and benefit from, the rise of crypto adoption.

What's next for Bitcoin?

At LikeFolio, we follow the consumer data on everything we do.

Right now, it’s all systems go for cryptocurrencies, and with no technical ceiling to stop it.

Volatility is likely to remain extremely high, so we’ll continue to watch our powerful consumer insights data for key developments in crypto adoption and enthusiasm levels.