Drinker’s tastes and priorities are shifting in a major way. […]

5 Stocks to Watch This Week (NCLH, RBLX, RL, SAM, Z)

November 8, 2022

Another week packed with earnings opportunities!

Here are some names that are poppin' and droppin' this week:

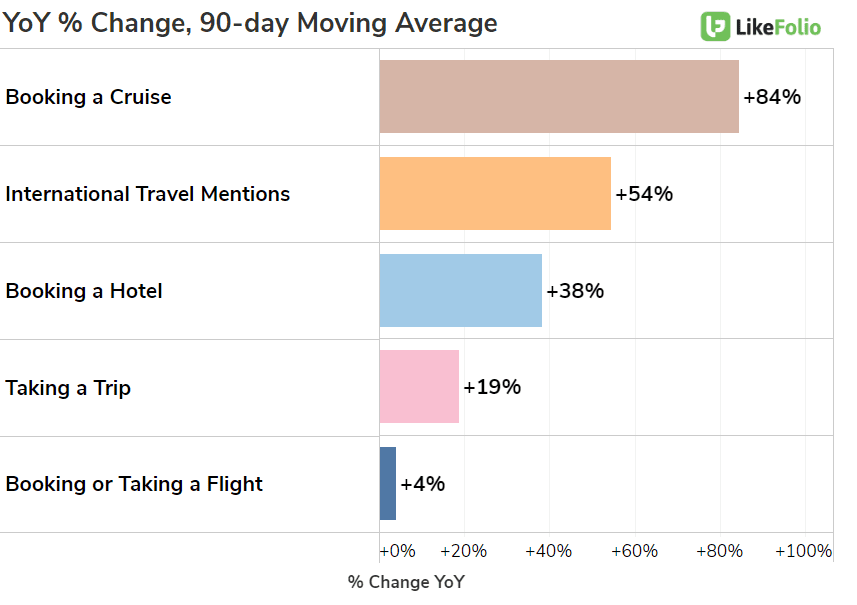

- Travel demand is strong and pent-up cruise demand leads the way. Consumer mentions of booking a cruise have increased +146% YoY, outperforming other forms of travel experience trends tracked.

- Norwegian Cruise Line, which sets sail in the Caribbean, Bermuda, Alaska, Hawaii and Europe, is significantly outperforming peers RCL and CCL. Mentions of booking a cruise with NCLH are building in the current quarter: +105% YoY and +9% QoQ.

- Brand happiness remains high (+6% QoQ) as consumers praise superior dining experiences and entertainment options.

- Norwegian is bolstered by increasing consumer demand to get out of the country, especially to European destinations. International travel mentions have risen by +55% YoY.

- Market expectations are rising for NCLH. Shares are trading nearly +30% higher this month, suggesting a high bar. LikeFolio's Earnings score is officially neutral, with cautiously bullish undertones.

| Roblox (RBLX) |

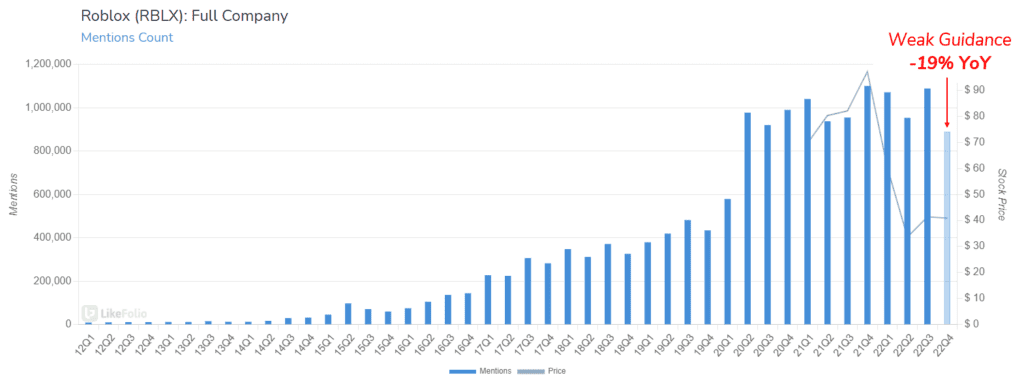

- A month ago we praised Roblox for outperforming market expectations. Data looked solid and gameplay mentions were logging significant YoY growth. Overall consumer buzz increased +14% YoY in the third quarter.

- The company reported that daily active users increased +23% YoY, driving hours engaged higher. While this number was high, it was a drop from August numbers, attributed to its younger audience returning to school.

- This fade is continuing – Roblox mentions are falling sharply in 22Q4: -19% YoY. This could be a red flag when it comes to company guidance.

- While we think numbers in the current quarter will be strong, forward projections could ding the market reaction.

| Ralph Lauren (RL) |

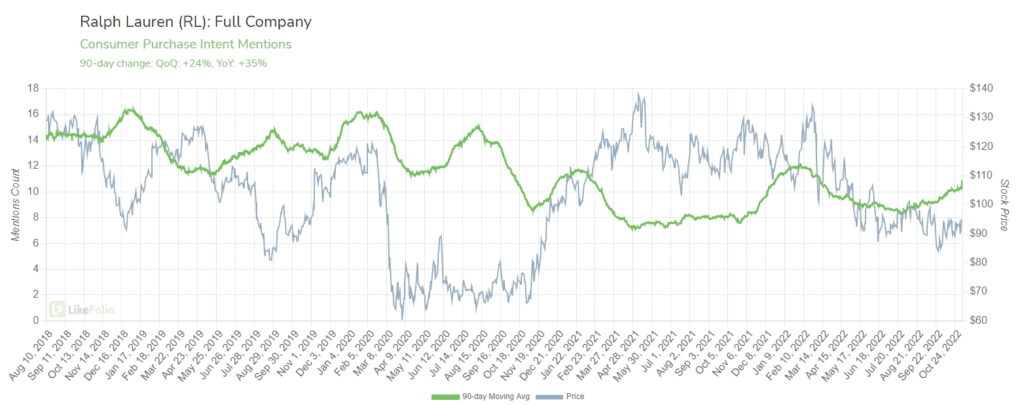

- Ralph Lauren is getting its groove back with consumers. Consumer demand is rising – +35% higher vs. last year – and sentiment levels have increased by nearly +10% in the same time frame.

- Improvements are most notable among the retailer’s younger audience. RL is benefitting from fashion cycles favoring 90’s trends and from partnerships in the “Metaverse” with names like Fortnite.

- Ralph Lauren’s renewed brand image supports a higher price point. Across the board, LikeFolio has noted that “luxury brands” are faring better vs. other brands due to their higher-earning consumer being more insulated from the pains of inflation.

- RL shares are trading -25% lower YoY while demand and sentiment recover, presenting a bullish divergence opportunity.

| Boston Beer Co. (SAM) |

- Analysts are keeping a close eye on SAM, touting its “meaningful growth profile” and its potential as a defensive play in a volatile market environment.

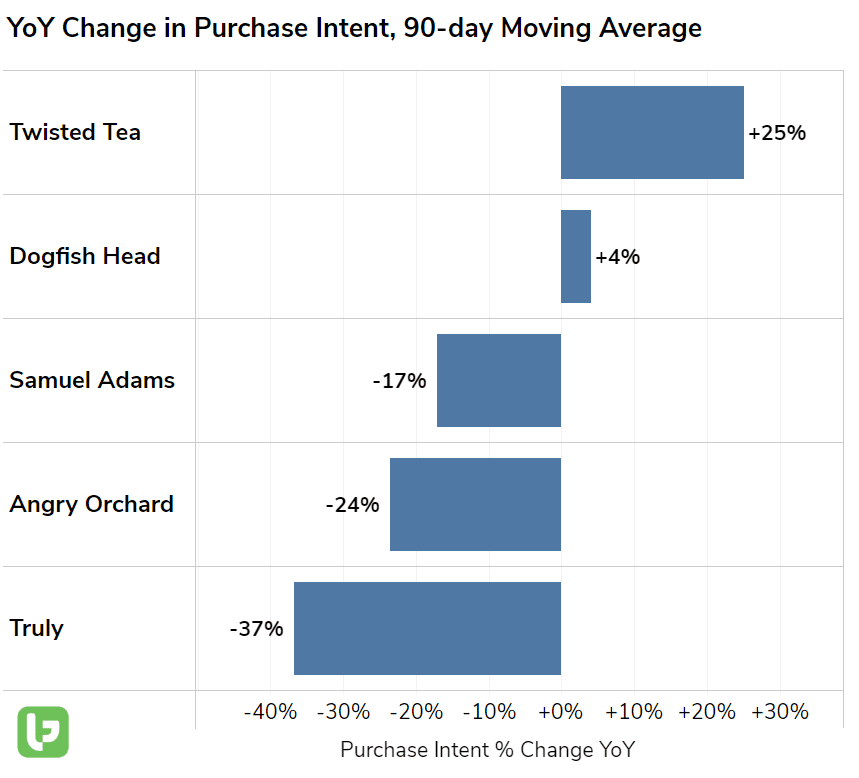

- LikeFolio data reveals continued growth in its Twisted Tea and craft-beer-esq Dogfish Head beer brand. On the flip side, its namesake Sam Adams beer and Truly hard seltzer are recording relative consumer weakness.

- The softness of SAM’s larger brands is weighing on comprehensive company demand. Across the board, consumer mentions of purchasing or drinking a Boston Beer Co. bevvy are pacing -15% lower YoY, worsening from -4% in 22Q3.

- SAM’s next earnings event isn’t expected until mid-January, but current data doesn’t support a bullish bet at the moment. We’ll be tracking through the end of quarter for updates.

| Zillow (Z) |

- The real estate market remains in cool-down mode. Mortgage rates slipped slightly for the first time in two months (7.16% to 7.06%) but remain significantly higher vs. rates available at the beginning of the year.

- The pressure of high rates is holding down potential buyers. Mortgage applications remain -85% lower YoY. LikeFolio trends confirm weakness on the buy side, with moving mentions dropping by double digits YoY while interest rate concerns rocket.

- Last week Zillow shares surged following a better-than-expected third quarter report. However, the company noted the 2023 market looks “challenged.”

- LikeFolio data confirms weakness for Zillow ahead. Consumer mentions of using Zillow’s platform to search for a home have dropped off severely, trending -18% lower QoQ and -35% lower YoY. We’re avoiding this name for now.

Want FULL Access? Click Here for LikeFolio Pro

Tags: