Travel Update: Airline Earnings It's time for the airline industry to report […]

Is Delta Feeling the Impact of Flight Cancellations?

Delta Air Lines will report its Q1 earnings after the close, and as we have mentioned before, the travel recovery is well and truly underway…

TSA checkpoint data shows continuous travel recovery, but it is still ~10% to 15% below 2019 levels.

In its previous earnings for 21Q4, DAL beat expectations, with revenue still down -17% vs 2019 levels.

Furthermore, Delta added in the previous report that it expected costs to rise in 22Q1 amid weaker-than-expected bookings due to Omicron. As a result, it expected a 22Q1 revenue decline of ~24% to 28% vs 2019 levels.

In addition, airlines have had to contend with flight delays and cancellations (which have been well documented recently) due to Omicron and staffing shortages which has resulted in consumer happiness declining.

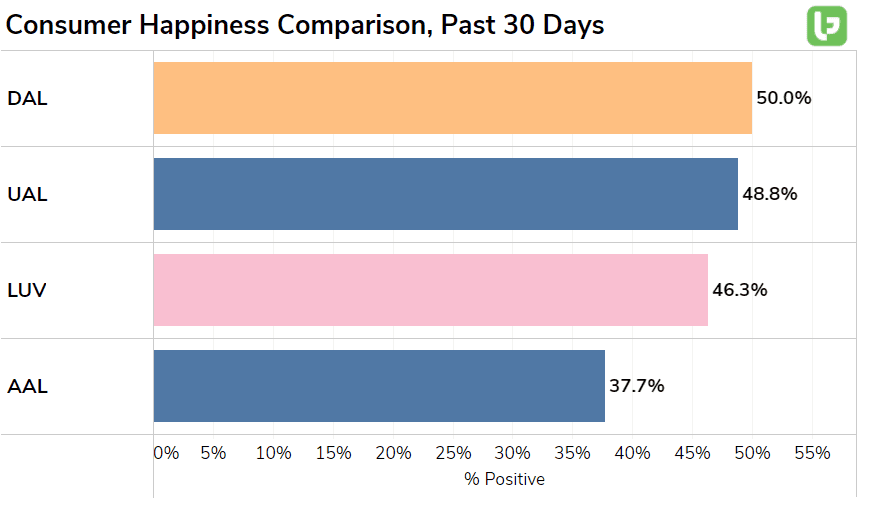

DAL’s Consumer Happiness is trending at -7% YoY, holding a Happiness Score of 50%.

While that’s nothing to write home about, it is above competitors UAL, LUV, and AAL.

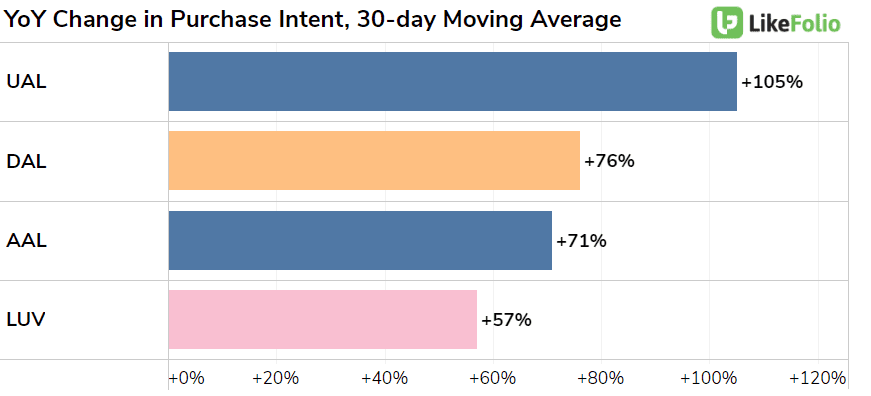

When it comes to a comparison vs those same peers, Delta performs fairly well with a Purchase Intent change of +76% YoY. However, United Airlines has taken the top spot.

Airlines overall were hit hard by Omicron and the resulting staffing shortages. Rising fuel costs are also of concern lately.

Bottom line: The macro-tailwinds that airlines are currently experiencing make for a cautious outlook from LikeFolio.