Last September we used Purchase Intent data to predict that […]

All eyes on Apple

All eyes on Apple Ahead of Developers Conference

AAPL doesn't have earnings on deck (it reported Q2 results in early May) but the stock is trending ahead of the company’s Worldwide Developers Conference, or WWDC.

This event is NOT as significant as the annual keynote event typically held in the fall, but holds special weight this go around. The big watch item for investors?

Apple may be introducing a new VR headset (priced at $3,000). If this IS announced, it could send shares higher. And if not, investors may run out of patience...this would be Apple's first major new product in ~10 years.

Last quarter Apple overall sales dropped for the second consecutive quarter (rev down -3% from $97 billion in prior quarter). On a product level, iPhone revenue beat expectations while mac, iPad, and services underperformed. Shares rose slightly (+2%) on the better than anticipated iPhone sales.

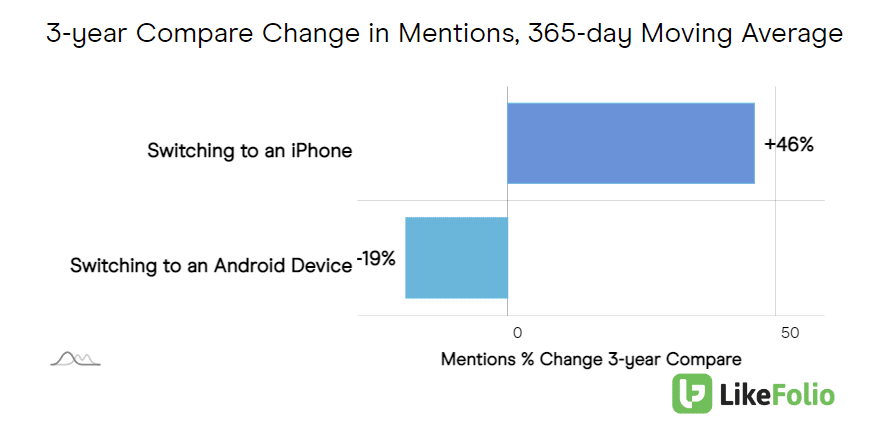

iPhone sales grew YoY as the smartphone industry contracted ~15% -- this is significant. It's beating the competition. You can see this long-term trend take effect when you look at mentions of switching to an iPhone vs. switching to an android device -- drastically different paths.

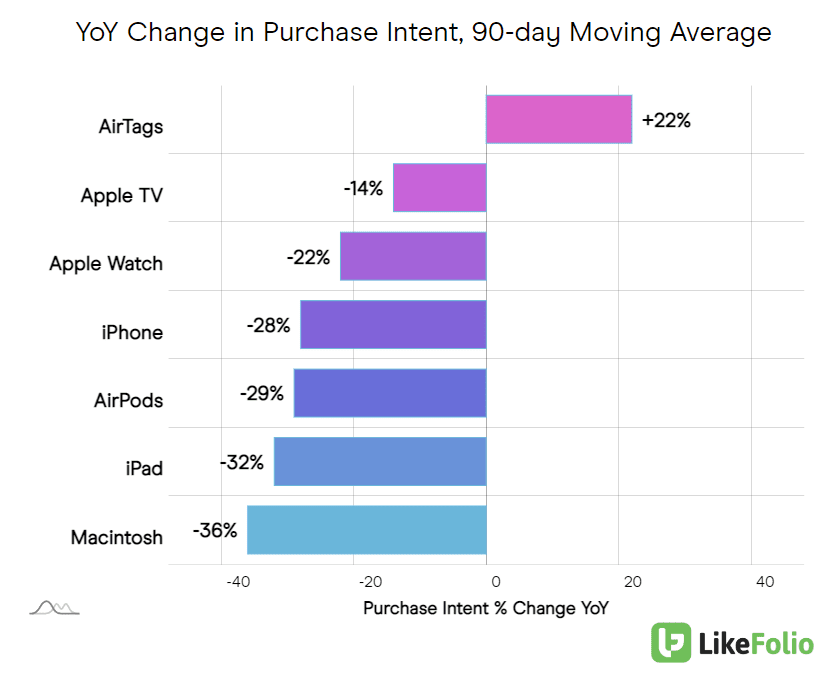

Looking ahead data does show some weakening in device demand, with Mac demand continuing to underperform alongside other "non-essentials" high ticket items like the iPad and Airpods…even iPhone is losing some steam.

Apple’s current earnings score is neutral but does lean bearish (-12). Its long-term score is also on the verge at -20. Apple demand collectively has slipped vs. last quarter (-23% YoY vs. -11% YoY). With the stock trading near all-time highs, economic tightening does appear to be having some impact on its bottom line. Is a pull-back in store?

Earnings Surprises on Deck: $ASO $SJM $LOVE $CPB $SFIX PLAY

Week 8 of earnings season features 18 companies in the LikeFolio universe, with a handful of trade ideas for members.

Some big names reporting include:

- Academy Sports (ASO)

- Smuckers (SJM)

- Lovesac (LOVE)

- Campbell Soup (CPB)

- Stitch Fix (SFIX)

- Dave & Busters (PLAY)

At a high level, watch for consumer trade-down activity in grocery to potentially impact well-known brands like SJM and CPB.

In addition, discretionary purchases continue to show signs of weakness, which could spell trouble for PLAY, LOVE, and SFIX.

On the flipside, we’ve recorded relative strength in consumer demand at Academy Sports. Is the stock’s recent pull-back overdone?