PayPal (PYPL) Last week we touched on a huge crypto […]

Are we Bullish on … PayPal (PYPL)?

PayPal is a perfect case study (ironically alongside eBay) of how a first mover in a space can drop the bag.

But now with new leadership, the company is trying to claw its way back.

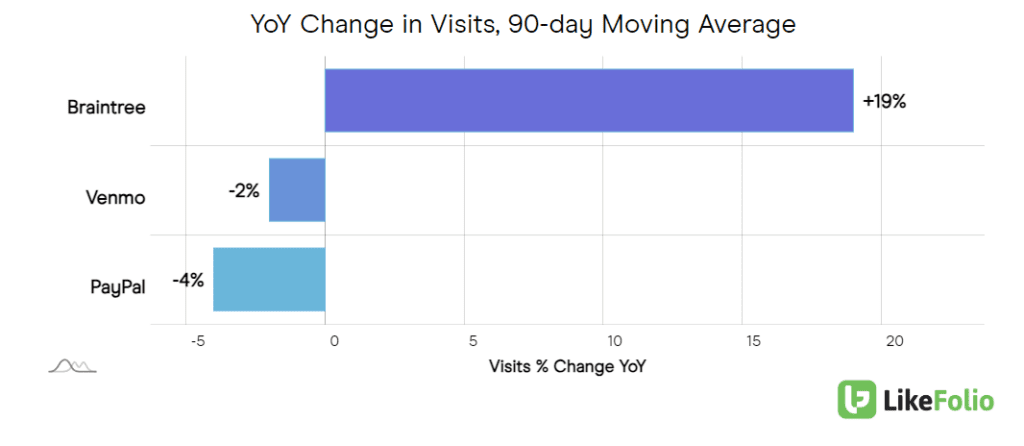

While PayPal and Venmo lag on a YoY basis, one brand in PYPL's arsenal is growing: Braintree.

Braintree web visits are up +19% YoY -- and based on a recent PYPL report, the brand is providing more value to the company, comprising 30% of PayPal's payment volume, an increase of +40% YoY.

Braintree's acquisition just over a decade ago was part of PayPal's strategy to strengthen its online payment system and expand its capabilities in mobile payments. This strategy is helping to offset weakness in its namesake brand. In 2023, Braintree processed approximately $450 billion in TPV, capturing about 10% of the global market for large enterprise e-commerce spending.

Major clients include Uber, Airbnb, and and Dropbox.

And some investors reference this arm of PayPal as an argument in their bullish thesis, coupled with the fact that the stock is starting to trade above its 52-week low around $50, is generating more than $4 billion in annual cash flow, and has a PE ratio less than 13 (it previously averaged ~47).

The bullish bet: the worst is behind PayPal and leadership will begin to make positive changes to drive profitable growth.

The bearish bet: PayPal will struggle to maintain even the status quo, being replaced by competent competition.

LikeFolio data suggests it may be time to start looking at PayPal... here's why:

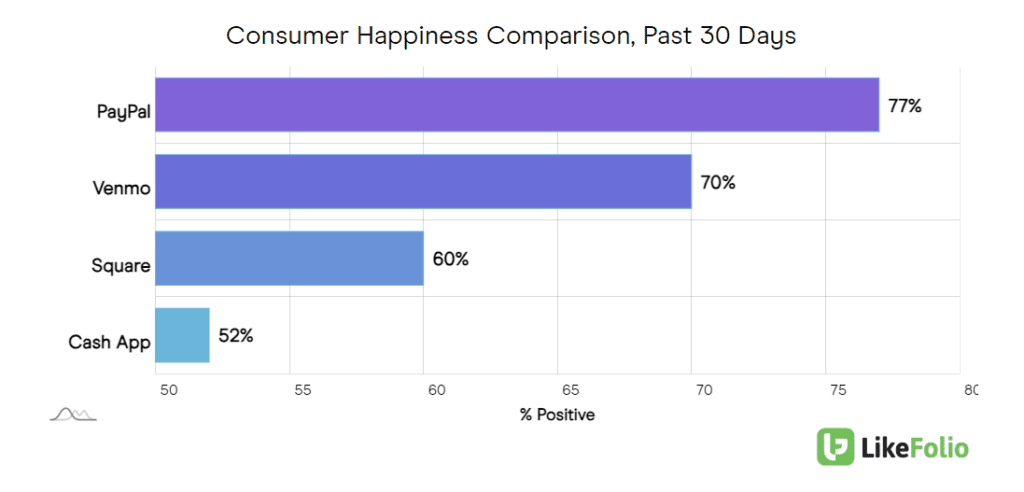

- Not only is Braintree gaining some web traffic momentum, but PayPal and Venmo best peers Square and Cash App in consumer happiness, perhaps LikeFolio's best long-term growth indicator. PayPal happiness at large is up +6 points YoY.

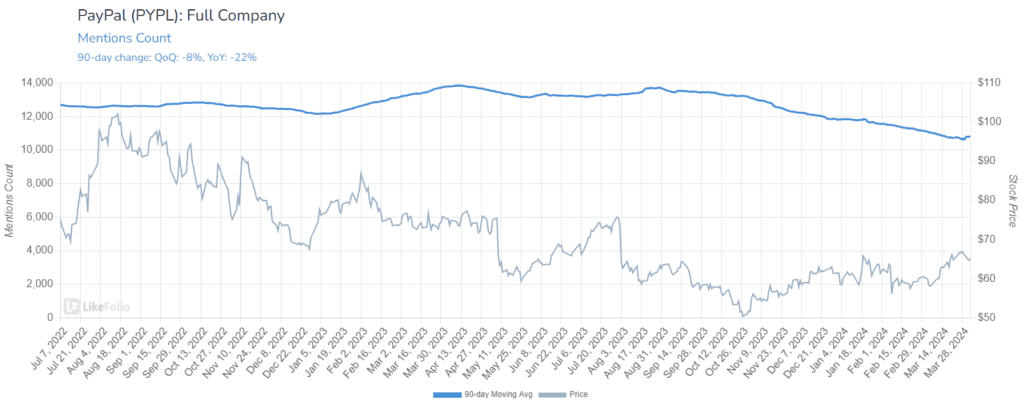

- Overall mention buzz is less encouraging, but it looks like the bleeding is slowing (a 30-day MA looks better in regard to YoY change vs. a 90-day MA).

- Last quarter the company posted better than expected results but disappointing guidance, and also indicated it would no longer provide annual guidance as it undergoes significant internal transformation. Leadership appears committed to ushering PayPal into an innovative phase, stepping up to meet demand by leveraging macro trends from AI to crypto.

Earnings aren't until May, and we'll be watching very closely until then...