Happy earnings season! Here are some stocks that we're watching […]

AXP Long-term Outlook

American Express: A Leader Among Specialized Winners in Consumer Space

An interesting trend has emerged in LikeFolio data: companies excelling and capturing consumer attention are those with specialization, a clear mission, a vivid vision, and superior offerings.

Giants like Delta, SoFi, and even Tesla, despite recent market responses, exemplify this trend.

American Express (Amex) also stands prominently in this league of victors, and here's why.

Amex: Besting its Peers

While Amex's mention buzz has displayed some signs of weakness, this doesn't tell the whole story.

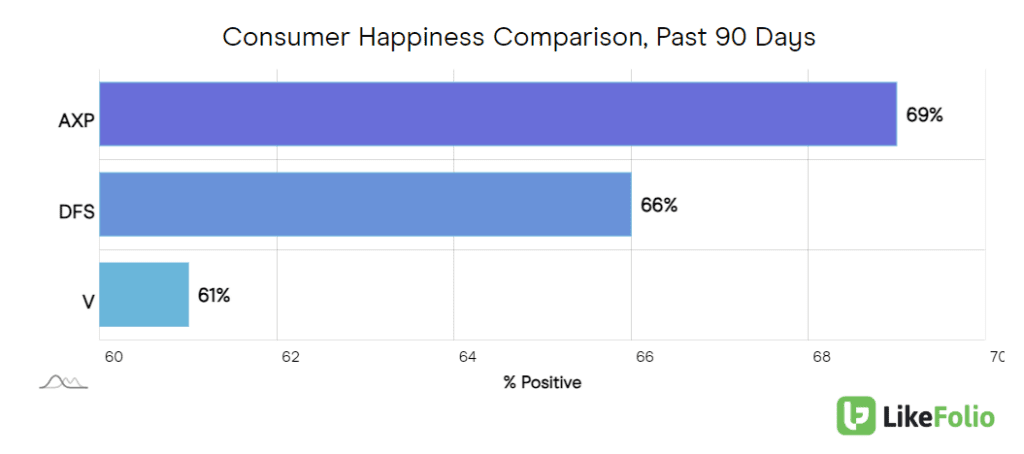

The rest of the LikeFolio data points to a clear overperformance compared to its peers.

Notably, there's been a 7% YoY increase in web visits…

And an impressive 69% positivity in customer happiness levels.

Amex has consistently attracted a consumer base that values status, perks, and superior service. This focus on high-value experiences and services resonates with affluent consumers, offering the company a degree of insulation against economic downturns affecting the lower and working classes.

Its stock performance reflects this strength, with shares trading 30% higher over the last three months, significantly outpacing competitors like Visa, which saw a 14% increase in the same period.

The LikeFolio Perspective: Recognizing Amex's Best of Breed Status Early

LikeFolio picked up on Amex's 'best of breed' status as early as last April, comparing it favorably with Delta Airlines (DAL) – both are providers of high-value and high-quality experiences. This insight aligns with the continuing consumer trend of prioritizing spending on experiences, a trend that particularly benefits Amex and one we see continuing in 2024.

American Express's Unique Business Model

Amex distinguishes itself with its closed-loop payment system, a contrast to the models of Visa and Mastercard, which rely on banking partners for credit extension. By acting as both the credit card issuer and payment network, American Express not only assumes default risk but also retains most transaction revenue.

Recent Performance and Future Outlook

Despite a strong performance last quarter, AXP shares experienced a drop immediately following its earnings report, suggesting a high market expectation. Looking ahead, LikeFolio remains bullish on Amex for the long haul. The company's high happiness levels among consumers indicate promising long-term growth prospects. Moreover, Amex is experiencing robust growth among younger customers, with Millennials and Gen Z constituting its fastest-growing cohorts.

A Cautious Stance for the Upcoming Earnings Event

There's a note of caution, however, regarding the brand's buzz growth, which has shown some volatility. Amex has signaled softer shopping trends at the beginning of the fourth quarter, following a strong Cyber Monday performance. Given the extremely high expectations, LikeFolio suggests a more cautious earnings approach, advocating buying on dips rather than aggressive bets before the earnings event.

In conclusion, American Express's specialized approach, coupled with its unique business model and strong consumer appeal, particularly among affluent and younger demographics, positions it well for sustained success. While the immediate future may have some uncertainty, the long-term outlook for Amex remains highly promising.