Happy earnings season! Here are some stocks that we're watching […]

Is American Express the Ultimate Luxury Play?

As we approach American Express's (AXP) Q3 earnings, LikeFolio's consumer insights are painting a bullish picture. Despite recent dips in the stock market and some policy changes, our data indicates that AXP is a luxury play that's resonating powerfully with the younger and affluent demographics.

Here's why we're seeing green when it comes to AXP:

LikeFolio Data Speaks Volumes:

- Bullish Sentiment: AXP's current LikeFolio earnings score sits at a robust +29.

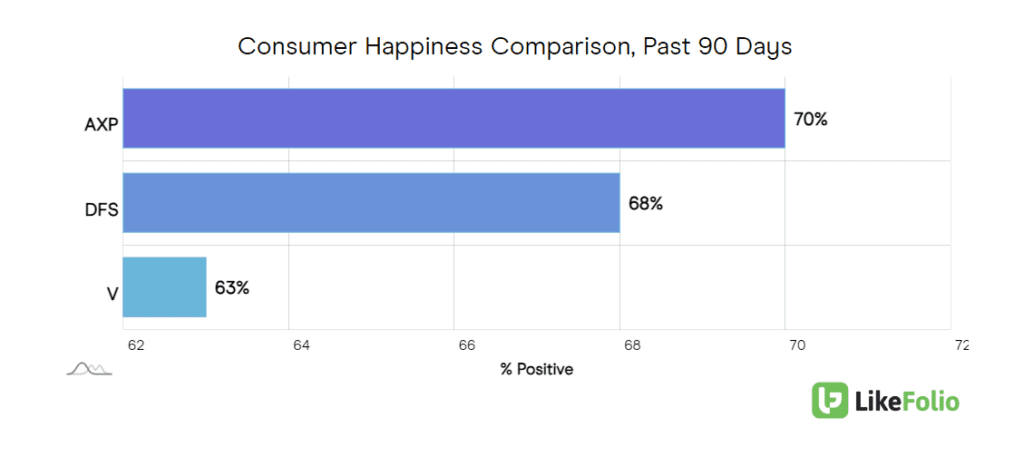

- Consumer Happiness Outshines Peers: At a 70% positive rating, AXP's consumer happiness is not only impressive on its own but also stands +2 points higher than Discover and a substantial +7 points higher than Visa.

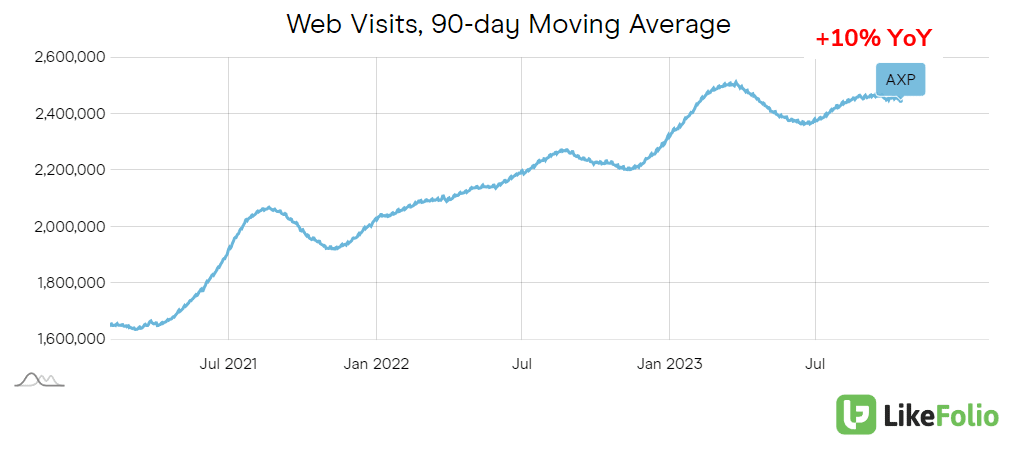

- Web Traffic Building: In a digital age where online presence is everything, American Express is killing it. Their web traffic is up by 10% year-over-year and a staggering +25% on a two-year stack.

Q2 Performance and Forward-Looking Insights

American Express isn't just a credit card; it's a lifestyle, and the Q2 2023 earnings prove it.

The company smashed expectations with a record revenue of $15.1 billion, up 12% from the previous year. This success is directly tied to their affluent cardmembers, an 8% hike in card spending, and a significant uptick in travel and entertainment spending.

What's more exciting for long-term investors is the traction AXP is gaining with millennials and Gen Z. These younger demographics made up the fastest-growing segment last quarter, with U.S. billings up by +21%.

The Power of Partnerships and a Unique Business Model

AXP's recent 10-year extension with Hilton underscores the power and longevity of its partnerships, a cornerstone of its business strategy.

This, coupled with a business model heavily focused on fee-based premium products, sets AXP apart in the financial services landscape.

Navigating Headwinds with Grace

Sure, there's been chatter about the changes to the Delta/Amex branded cards, particularly around Delta Sky Club access. But let's flip the script: Could the Sky Clubs be brimming because of high Amex adoption and perk utilization? That's a quality problem, indicating brand strength and customer engagement. And guess what? Even with these tweaks, Amex's happiness metric still reigns supreme in the LikeFolio universe.

Stock Performance and What's Next

AXP shares have seen an approximate 11% downturn over the past three months. But here's the deal: with a lowered bar, we might just be on the precipice of a pleasant surprise. It seems the market has already accounted for prevailing uncertainties.

Final Thoughts

American Express is more than a financial services company; it's a global symbol of affluence, luxury, and premium service.

The company's strategic moves, backed by LikeFolio's positive consumer insights, suggest that any current market hurdles are just that — temporary hurdles. The long-term outlook for AXP looks promising, especially as it continues to resonate with the luxury preferences of younger, affluent consumers.

So, is AXP a tried and true luxury play? All signs point to a resounding yes!