PayPal (PYPL) Last week we touched on a huge crypto […]

Big Week Ahead…. Inflation, PYPL, TPX, HRB, FVRR and Unity (U)

With mixed earnings expectations and the much-anticipated release of the Consumer Price Index (CPI) on Wednesday, we're gearing up for a potentially volatile trading week.

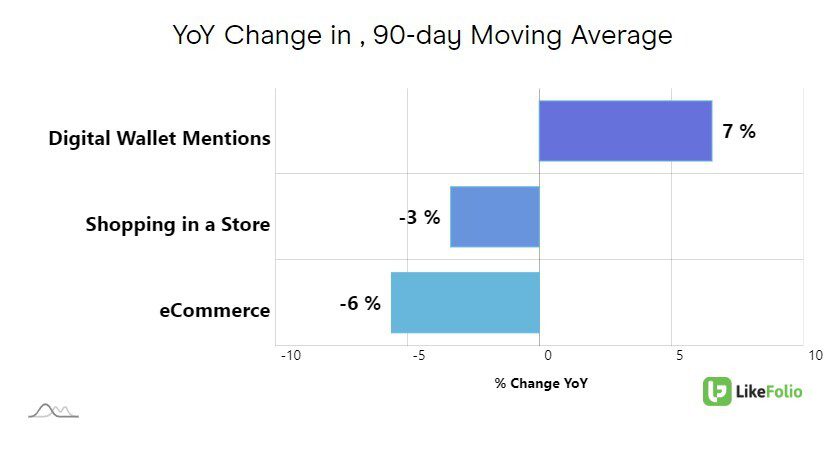

Monday after market close, PayPal (PYPL) is set to announce its earnings, with a LikeFolio earnings score of -47. Demand for the digital payment giant has fallen 19% YoY. Venmo's purchase intent is at a 5-year low, and digital payment volumes have been hurt by macro weakness. To top it off, a data breach class action lawsuit looms over the company, and its stock is struggling to regain key trend lines.

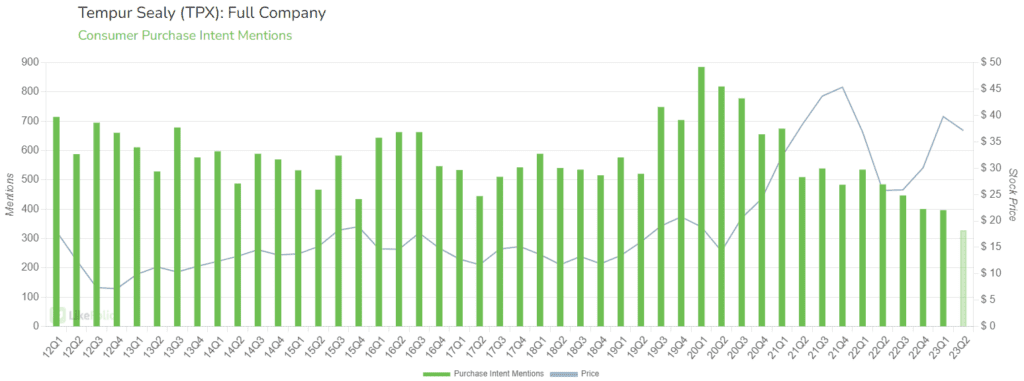

Tuesday before the market opens, Tempur Sealy (TPX) will announce its earnings. Its LikeFolio earnings score stands at -48, with predictive happiness trending lower and total mentions hitting an all-time low in Q1. The soft housing market is impacting demand, and there's a significant demand/stock price disconnect, as LikeFolio demand indicators show a -25% drop, while the stock is up 22% YoY.

H&R Block (HRB) will report earnings on Tuesday after the market closes. The company's earnings score of -78 reflects a 41% YoY drop in demand mentions. Negative mentions have prevailed during the key tax season, and tech and operational investments are weighing on margins. The stock has been on a long, slow descent from $50, and the IRS is reportedly considering offering free e-filing for all Americans.

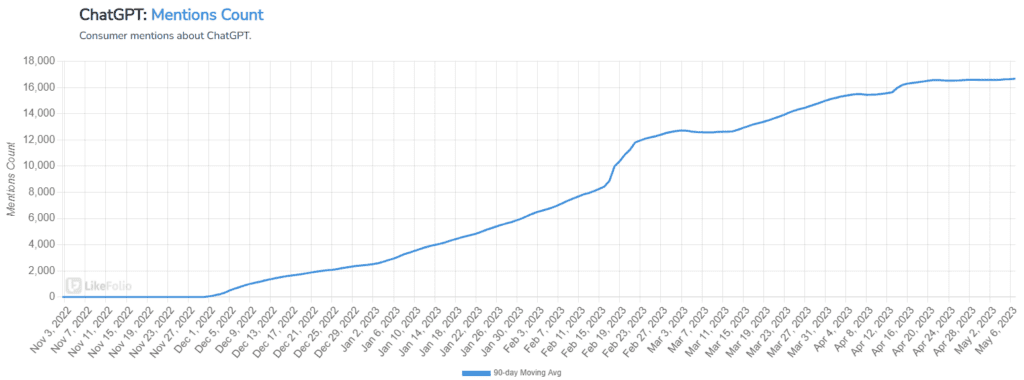

Thursday before the market opens, Fiverr (FVRR) is set to announce earnings. With an earnings score of -73, the company may face a Chegg-like effect as ChatGPT could lure customers away. Total mentions are down from peak Q4 levels, and mentions of working as a freelancer have also decreased YoY. The stock is limping into earnings at a new 52-week low.

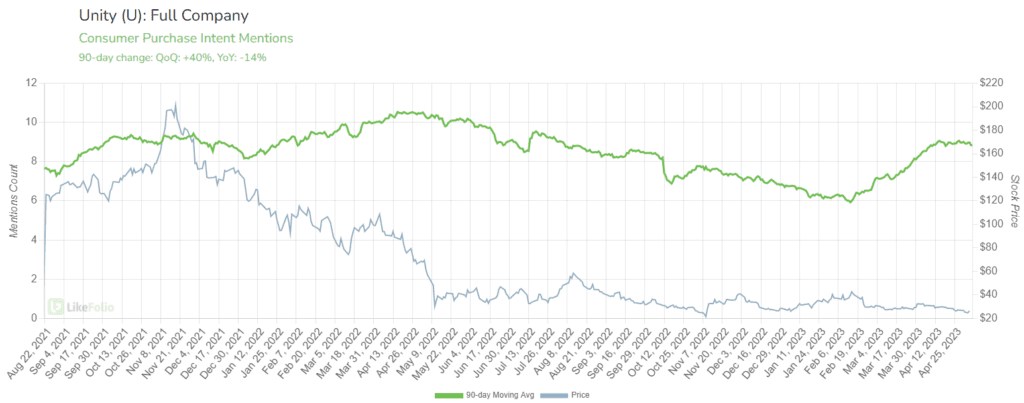

On a brighter note, Unity (U) will report earnings on Wednesday after the market closes. With an earnings score of +62, social media buzz for the company is up 18% YoY. Customer happiness is up sharply from a year ago, and online video game mentions are up 35% YoY. Technicals point to oversold conditions, and short covering could add to a potential rally, with short interest at 15%.

Investors should also keep an eye on the CPI data release on Wednesday morning. The market is expecting a 5% YoY increase, and this key data point will be crucial for the Federal Reserve as it considers the need for further interest rate hikes. With mixed earnings reports and the looming CPI announcement, the week ahead promises to be eventful and potentially volatile.