LikeFolio's Consumer Happiness data on Papa John's has been incredible […]

Can Taco Bell keep propping up YUM?

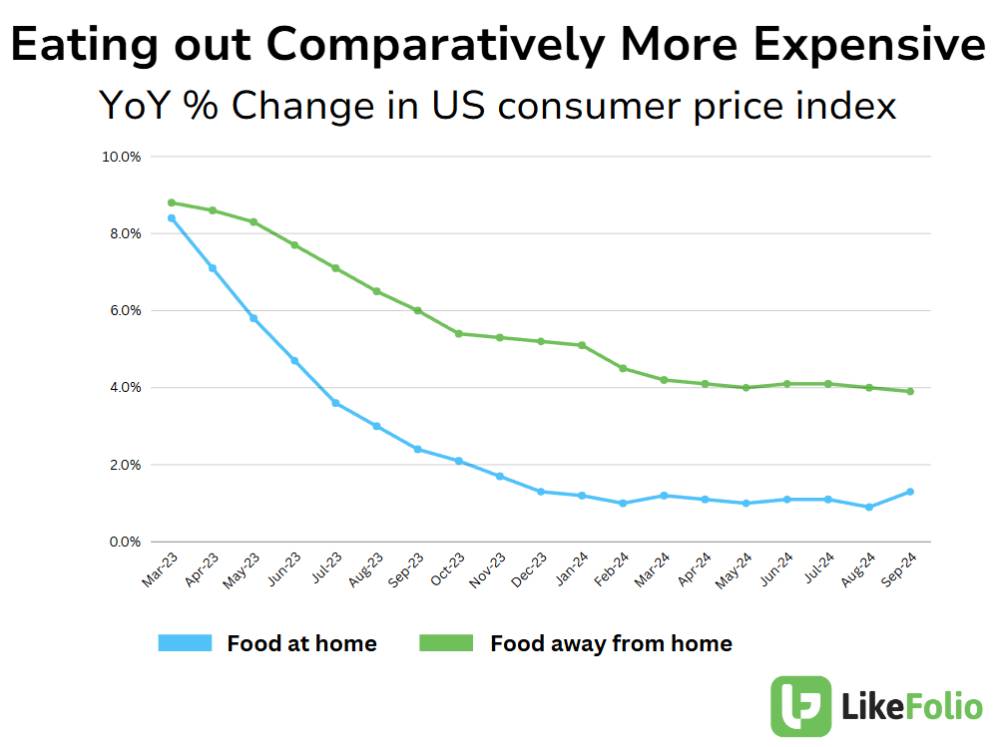

Yum Brands reports Q3 earnings on November 5, and the economic picture remains challenging for fast food. The CPI data shows food away from home up 3.9% year-over-year in September, while food at home rose just 1.3%.

This gap pressures low-income consumers to cook more at home, squeezing the fast-food segment.

Fast-food chains like Yum’s KFC and Taco Bell have rolled out new value menus to hold onto these customers.

In Q2, Yum's earnings topped expectations, but revenue missed, with net income slipping to $367 million from $418 million last year. Taco Bell led the portfolio with a 5% increase in same-store sales, driven by popular, low-cost items on its “Decades Menu.” Taco Bell also saw a 30% year-over-year boost in app usage in August, showing strong digital engagement. KFC and Pizza Hut, however, posted 3% declines in same-store sales, and app traffic across Yum brands has slowed since earlier this year.

Consumers also seem to be turning away from fast food due to perceived value, according to social media mentions.

Diners increasingly question why they should pay fast-food prices when, for a similar cost, they can enjoy sit-down options like Olive Garden, where unlimited breadsticks add a perception of better value.

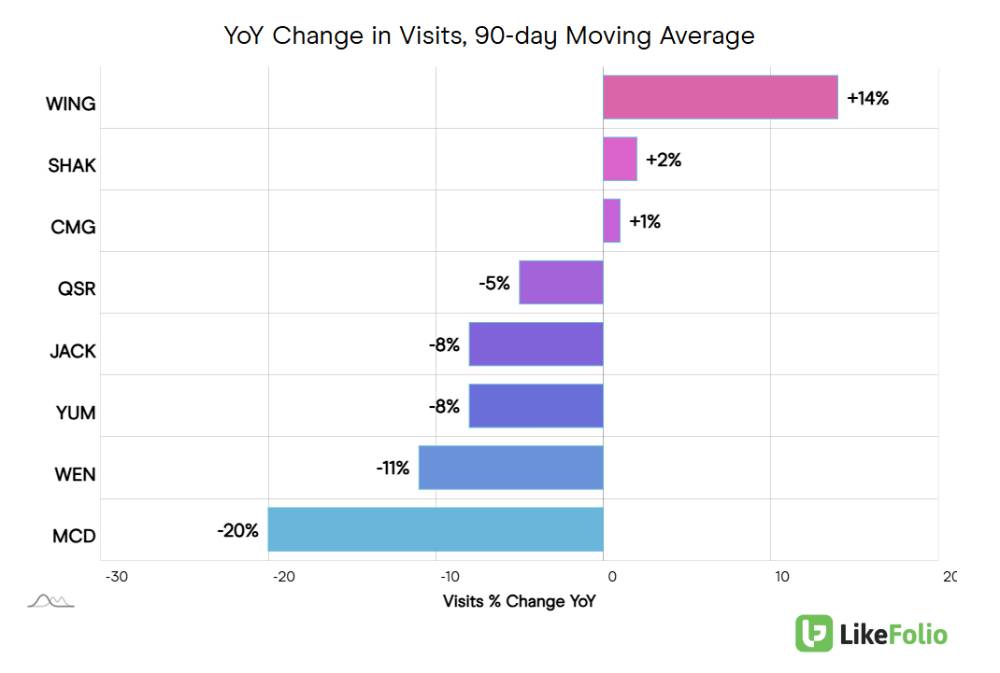

You can see a clear divide when it comes to fast food vs. fast-casual chains as well, which tend to offer higher quality and in many cases higher portion sizes vs. quick-service peers a step below.

Here's the bright side for YUM...