Tesla reports earnings after the bell on Wednesday. After last […]

Can Tesla Stock Reach a new ATH this Week? $TSLA

Can Tesla Stock Reach a new ATH this Week? $TSLA

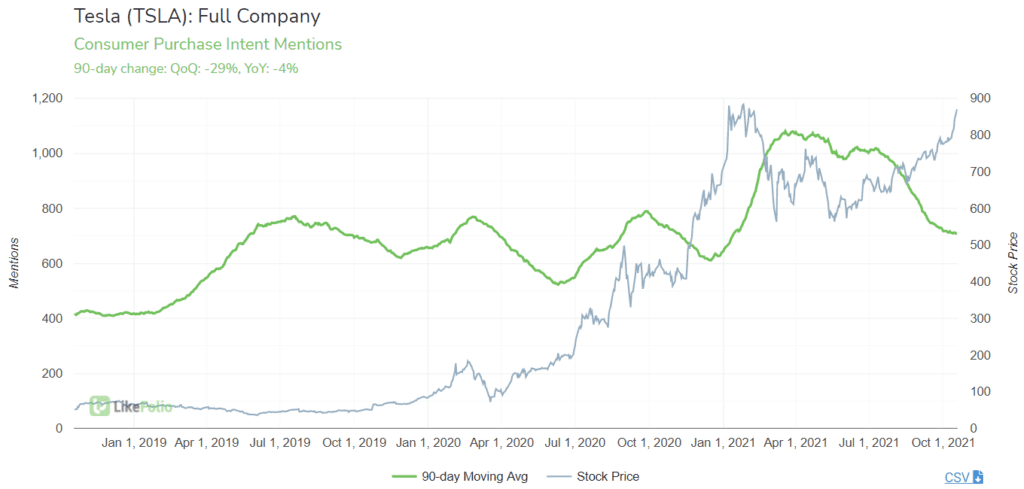

Earlier this year, we put out a bullish alert on Tesla ($TSLA), noting an all-time high level of Purchase Intent Mentions backed by surging electric vehicle demand. Shares of TSLA have gained by +36% since then, currently trading near an all-time high… Will the upcoming earnings report be enough to send the stock above $900?

Underlying Purchase Intent Mentions suggest a cautious near-term outlook: -29% QoQ and -4% YoY (90d MA).

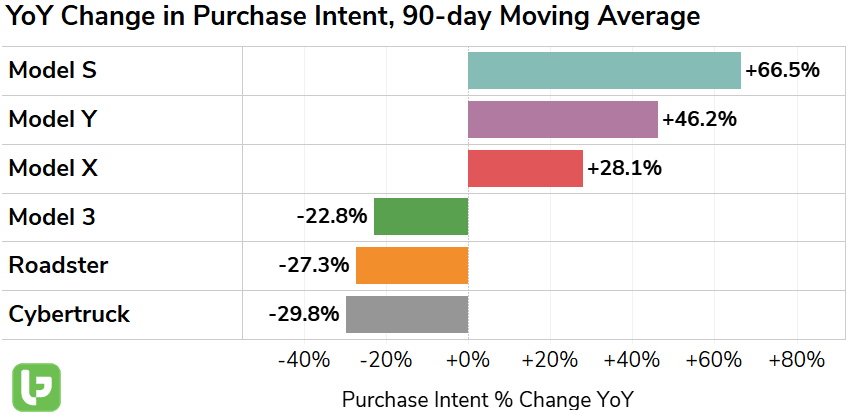

A brand-level analysis reveals the crux of the recent slowdown in consumer Demand growth: Model 3 and Cybertruck.

CyberTruck Hype is dying down. And, the pullback In PI volume comes as Tesla continues to obfuscate details regarding the electric pickup’s release date.

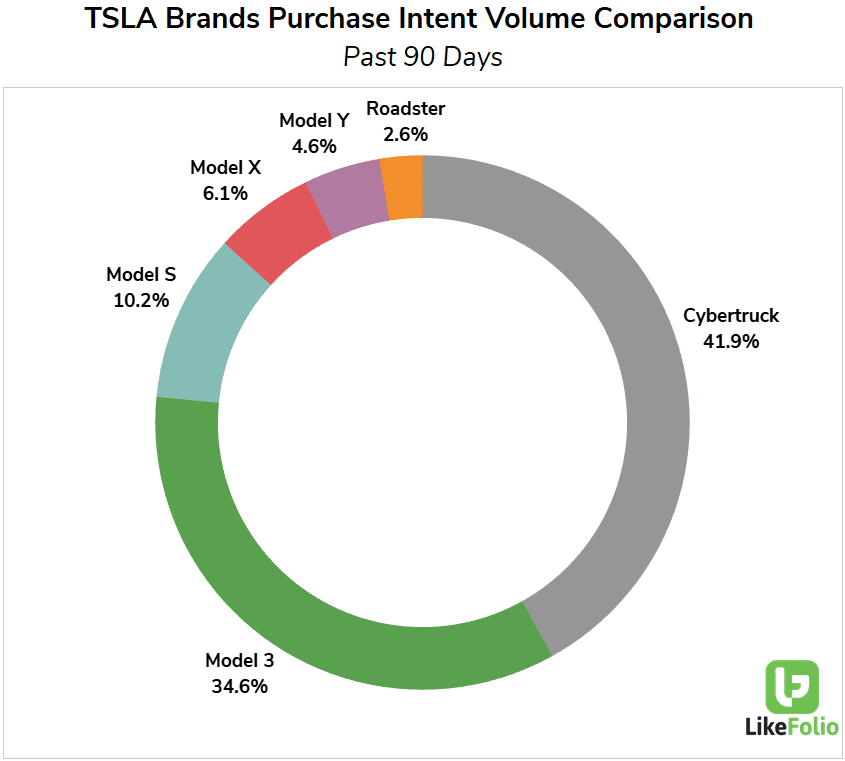

Of greater import, The Model 3, which Tesla boasted as the best-selling premium vehicle in the world last year, has started to lose momentum in terms of consumer demand. Although the company claims the Model Y will eventually exceed the Model 3 in terms of sales, a comparison of Mention volume suggests that the Model Y has a long way to go:

Despite the weakness seen in these key brands, there’s still plenty of reasons to remain bullish on TSLA long-term.

It’s undeniable that general Demand for electric vehicles (EVs) is on the rise. Global semiconductor shortages and port congestion haven’t had a material impact on Tesla’s growth thus far. BUT, any inkling of supply chain problems could trigger a significant bearish reaction.