iRobot (IRBT) Last quarter, iRobot posted strong results: revenue increased +43% […]

Zillow Group Stock has been Struggling...Is it still a buy? ($Z)

Zillow Group Stock has been Struggling...Is it still a buy? ($Z)

As the undisputed leader in digital real estate, Zillow Group ($Z) stock exploded higher alongside the red-hot housing market last year…However, it’s pulled back significantly YTD, down nearly -60% from the February 2021 ATH.

Although a pullback was warranted after the +900% run from the March 2020 lows, LikeFolio data suggests this industry titan has become oversold at the current level.

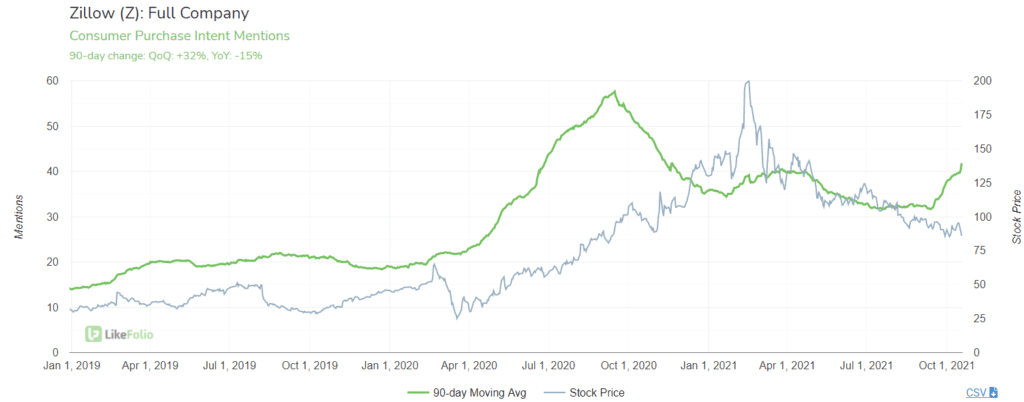

Zillow Purchase Intent Mentions are showing near-term strength, trending +32% QoQ (90d MA).

Furthermore, consumer Demand remains elevated relative to pre-COVID levels: +99% vs. 2019 on the same trendline.

Zillow has managed to meet or beat analysts’ EPS/revenue expectations in the past 10 quarters...So why are shares trading lower this week?

Earlier this week, Zillow announced that it would cease “iBuyer” home purchases, due to labor and supply constraints.

This decision corresponds with the recently-released September housing start numbers, which also suffered due to supply chain issues.

Zillow is taking a step back to address the backlog of purchased properties in its inventory – Meanwhile, its website and mobile app traffic has continued to rise – The company reported a 5% YoY increase in average monthly unique users last quarter.