Lululemon (LULU) As we prepped this chart for send today […]

Do Gamers Still Love GameStop (GME)?

GameStop (GME): A Fading Star in a Changing Landscape

"The only constant is change," said Heraclitus, the ancient Greek philosopher. This rings true for GameStop (GME), a company once celebrated as a meme-stock darling but now grappling with a rapidly evolving gaming industry and shifting consumer behavior. Let's delve into why GameStop's future looks increasingly uncertain as it prepares to announce its earnings.

The Digital Dilemma

GameStop's allure has always been about the experience. The tangible satisfaction of holding a physical game, the knowledgeable staff, exclusive game bundles, and the ability to trade-in games. For many, it's not just about buying a game; it's about being part of a community. But with the rise of digital downloads and direct-to-consumer sales, GameStop's traditional business model is under siege.

Online retailers and direct sales from game publishers have eaten into GameStop's market share. The company has been striving to transform its business, but the question remains: Has it done enough?

The Earnings Cliff

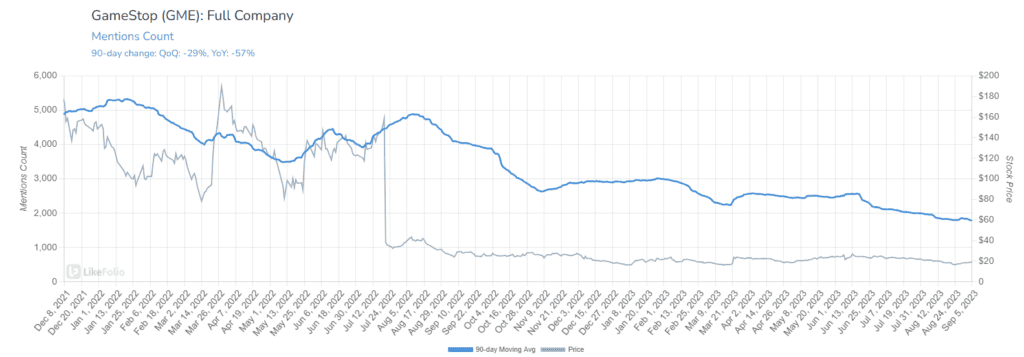

GameStop's buzz—and its share price—have plummeted over the last year and have yet to recover. Mentions have dropped by a staggering -57% YoY, and the stock is trading well below levels from two years ago.

Last quarter, the company reported weak earnings, coupled with the surprise firing of its CEO. European sales showed promise, up +26% YoY, but U.S. sales declined by -16%, resulting in a revenue shortfall of $240 million compared to the same quarter last year.

The Ryan Cohen Factor

This quarter marks the first full period with Ryan Cohen as Executive Chairman, steering the company's business decisions. While Cohen brings a fresh perspective, it remains to be seen if his leadership can turn the tide for GameStop. And for that matter, it may be unlikely to happen this quarter, when demand is seasonally low across the gaming industry.

The Silver Lining: Low Expectations

The good news for GameStop is that investor expectations are already low. Shares are down nearly -80% from all-time highs, and Wall Street is merely expecting narrowing losses. Any positive surprise could be well-received.

The Bottom Line

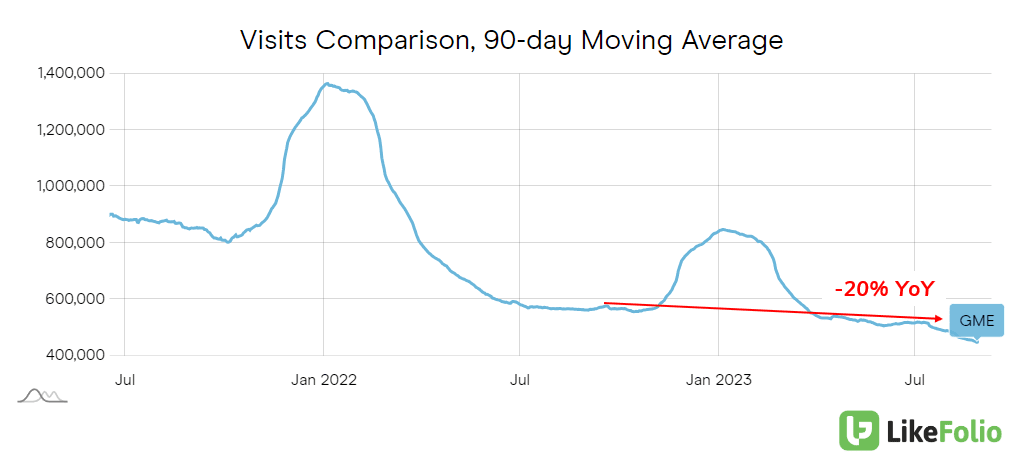

Despite the low bar set for GameStop, any negative news could further depress the stock. LikeFolio data paints a grim picture: mentions and web visits have declined by -57% YoY and -20% YoY, respectively.

While we can't predict the impact of management decisions or surprise profitability, the underlying metrics don't support a bullish outlook for this quarter.

In a world where consumer preferences are shifting and digital transformation is accelerating, GameStop faces an uphill battle. The data doesn't lie, and it doesn't offer much room for optimism.