Nordstrom is the biggest gainer in the S&P 500 today -- here's how LikeFolio data predicted the move.

Does Discount Apparel Mean Discounted Share Prices?

COVID-19, like many previous American hardships, hit us in the pocketbook, once again shifting consumer shopping behavior in new directions. Much remains in flux, but one thing seems sure: Consumers really want to go shopping again and they want to do it at shopping centers and malls.

Despite this pent-up demand, they don’t want to drop a ton of cash, often because they don’t have much left for discretionary purchases due to job loss or job uncertainty.

All this creates opportunity for off-price and discount stores ranging from TJ Maxx (TJX) to Nordstrom Rack (JWN), which could be spearheading a movement from indoor shopping centers and malls into off-mall locations where they’re typically located.

Consumers Want More Bang for their Buck

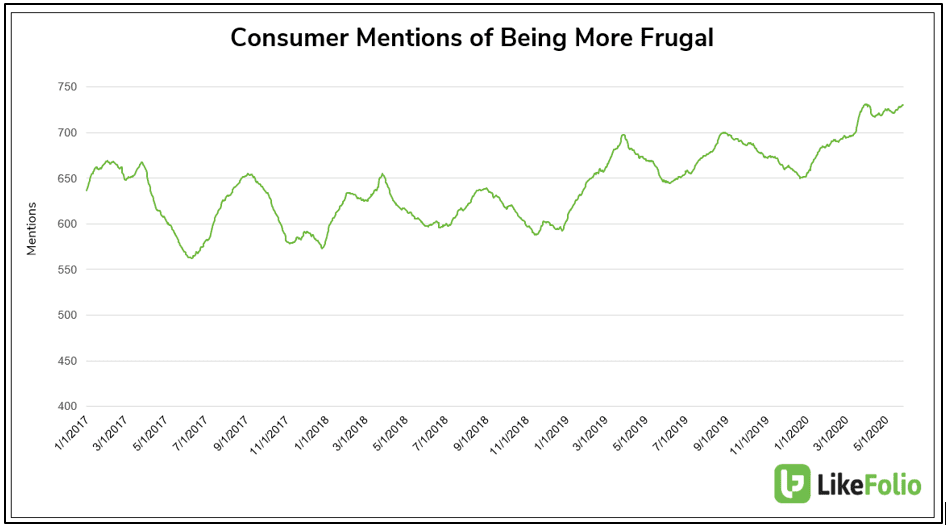

Let’s look at consumer spending first. LikeFolio has logged consumer social-media mentions of “trying to save money,” “spending less money,” and “being more frugal” on a bumpy, but mostly ascending chart for some time.

From September 2019 to January 2020—when much of the world was feeling financially cocky—the frugality meter was trending down. Holiday spending was robust and 2020 looked like it was going to be another year for the record books.

Then coronavirus hit and all bets were off. Consumers have been tightening their purse strings and sharing frugal messages since then, with LikeFolio plotting a 13% year-over-year upswing in frugality mentions over the last 90 days. (See chart below).

No real surprises here considering unemployment is at an astounding 14.7% and expected to rise again in the U.S. Couple that with the uncertainty of another potential COVID-19 spike and those who are working are now hoarding cash, according to the Bureau of Economic Analysis. The personal savings rate stood at 8.2% in February. By April, the latest statistics available, it had vaulted to 33%— a nearly 4-decade high.

That underscores how Nordstrom Rack and JWN’s e-commerce site have been able to contribute 60% to 2019 sales while the mall-based full-line Nordstrom stores supplied just 38%, according to its latest earnings report.

And it gives weight to how this “need breed” of shoppers might look as they turn to off-price retailers to scratch the new apparel yen that’s been itching.

And the Winners Are….

Mostly calling off-mall centers home, TJ Maxx, Nordstrom Rack and other off-price discounters—like the traditional mall retailers—didn’t sell food and weren’t considered “essential” to the daily needs of quarantined consumers (though certainly people needed underwear and so-called “computer wear” that’s comfy from the waist down).

When states and cities across the country issued stay-at-home mandates and ordered people-gathering locales like shopping centers, restaurants, bars, fitness centers, salons and the like to temporarily shut down, mall and off-mall retailers’ sales were devastated too. That has come to light in Q1 earnings that tell a tale of lost sales.

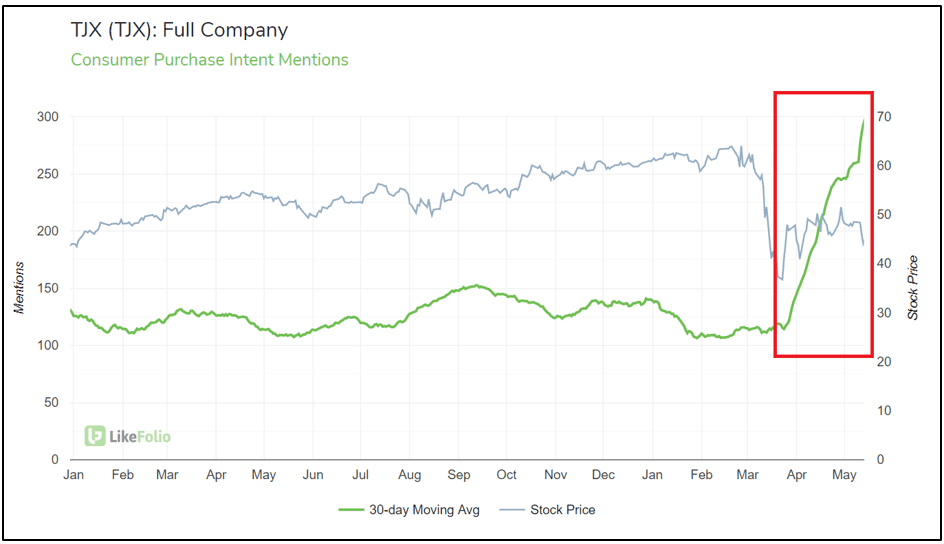

The share prices were wrecked, as well, and have been much slower to recover than most other equities. TJX, for example, hit a 52-week high in late February and plummeted 43% when the stock market took its first pandemic plunge. It’s still nearly 20% below that peak while the S&P 500 is only off its high by a few percentage points as of June 4, 2020 (see chart below).

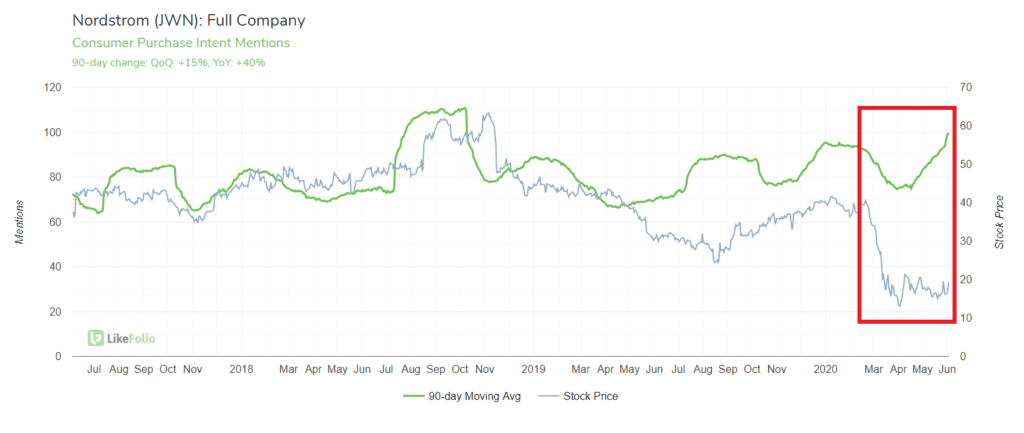

But investors might have missed the underlying opportunities in building consumer demand. LikeFolio also kept notes on where consumers said they were longing to shop as the quarantine dragged. Purchase Intent charts (figures 3 and 4 below) offer up some insight into what’s rattling around in the consumer head before the shopping begins.

Even long before the parent of TJ Maxx, Marshalls and Home Goods began unlocking its doors, LikeFolio’s 30-day Purchase Intent moving average surged a jaw-dropping 1,331% in May at a time when TJX shares were hovering in the $45 range.

Ditto on JWN’s 30-day Purchase Intent moving average, which soared while its stock price languished and is still more than 50% off its one-year high. (See chart below)

And as shoppers get back to off-mall stores, their spending is on fire too. In the first week that many states and malls reopened in mid-May, droves of shoppers stopped market watchers in their tracks, according to retail consultant Jan Kniffen, chief executive of Jan Rogers Kniffen World Wide.

He had expected off-mall store volumes would log in at about 65% to 70% of year-ago volumes. The dip hasn’t been quite that severe, which has him believing a V-shaped recovery could be in the making for many retailers.

“If the first week is any indication, it seems that off-mall openings are running at about 85% of last year's volume,” he said. “That has surprised the landlords and surprised the retailers and surprised me.”

Moreover, some stores are “opening at 110% of last year's volume when they had only been running at a rate 105% of last year's volume pre-COVID,” he added. Again, these results were when fewer than 50% of U.S. states and even fewer cities had given the greenlight to reopen.

Inventory Sitting Pretty, but We Lost an Entire Season

Sure everyone wants to shop, but what are they going to find when they get there? At this point, it looks like it might be a lot of the same, so to speak. Apparel inventory when the country started closing down in mid-March was just bringing out early spring fashions and limited summer fashions for the spring-break crowds.

Guess what? Much of that merchandise is still sitting on shelves and racks. Many retailers had to halt summer orders because there simply weren’t enough revenues to cover the costs. Of course, some are moving forward with fresh merchandise, but many have to cycle through what’s there first.

“They have inventory that was essentially trapped there for a couple of months and now they need to move it out,” said Jefferies analyst Janine Stichter.

Shoppers can expect big bargains almost anywhere as retailers look to unload huge reams of inventory, and that’s a big get for the TJ Maxxes of the world.

“The marketplace is loaded with inventory, and I am convinced we will have access to plenty of high-quality branded merchandise to offer consumers in the categories they want when they shop us,” Ernie Herrman, TJX’s chief executive said on an earnings call late last month, adding there’s “incredible availability” already in the market.

JWN was able to keep its inventories mostly in line, the company said recently, because Nordstrom Rack and e-commerce sales were relatively strong, and the company was able to tap on merchandise in the full-line stores to fulfill customer demand.

Nordstrom Rack has another arrow in its quiver for JWN, whose mall leases tend to be very long-term and costly to break. Besides being profitable, Rack stores have more flexible lease terms, which also allow for relocation if necessary, the company said.

“As retail continues to evolve, our flexible model supports a continued shift from what was predominantly a mall-based business toward a more diversified model that includes digital and off price,” Chief Executive Erik Nordstrom said on the recent earnings call.

Indeed, the trend is still evolving, which might favor nimbleness and flexibility. “We’ll continue to adjust and refine our approach as we learn more about this new environment,” he added, sounding a clarion call that investors might want to heed.

The short answer: The bargain racks look to be filling up with the good stuff, and consumers are licking their chops in anticipation.