Tiffany's (TIF) will report quarterly earnings Wednesday prior to the […]

Dollar Tree Earnings are a Consumer Health Gut Check

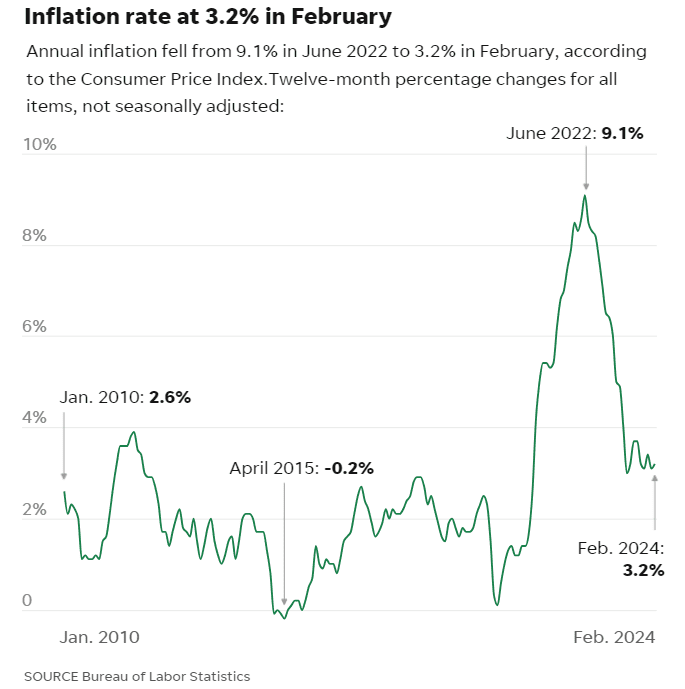

Inflation remained elevated in February, mainly driven by rising gasoline costs and rent, with overall prices increasing by 3.2% year-over-year.

This plays into the hands of companies like DLTR, positioned to help consumers score deals.

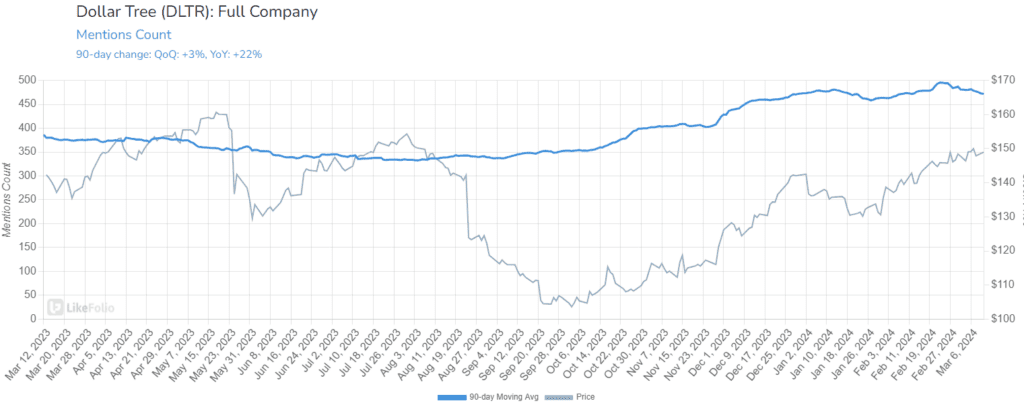

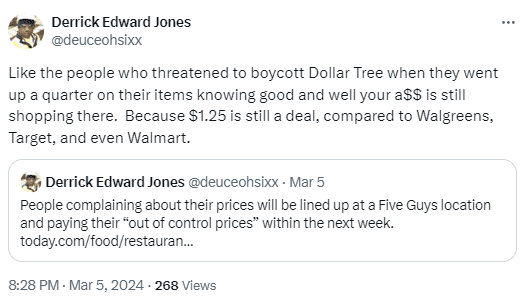

Dollar Tree mention buzz has risen by more than +20% YoY, driven by deal-seeking consumers like the one in the tweet pictured, who point out Dollar Tree is often more affordable than retailers like Walmart and Target and drugstores like Walgreens.

But the bullish thesis for DLTR from deal-hungry consumers is a bit murky -- because the persistent inflation previously mentioned is having a serious impact on low-income consumers who frequent dollar stores.

Last quarter, DLTR noted, "accumulating pressures of inflation, reduced government benefits, and depleted savings have negatively affected lower-income consumers." The reduced government benefits referenced include SNAP benefits, which were down -23% YoY in the third quarter of '23.

Overall investor confidence in Dollar Tree is optimistic. Last month, the company was upgraded by JP Morgan. The firm anticipates that a mix of the cost-of-living adjustment, gasoline prices, tax refunds, and student loans will collectively contribute an additional $70 billion to consumer spending in 2024.

However, we're not sold yet.

The company clearly has quality details to work out, as evidenced by Family Dollar's (under DLTR banner) rodent-infested warehouse resulting in a $41.6 million fine.

It also has failed to build any type of eCommerce presence, relying on foot traffic to drive sales. This contrasts with discount peers.

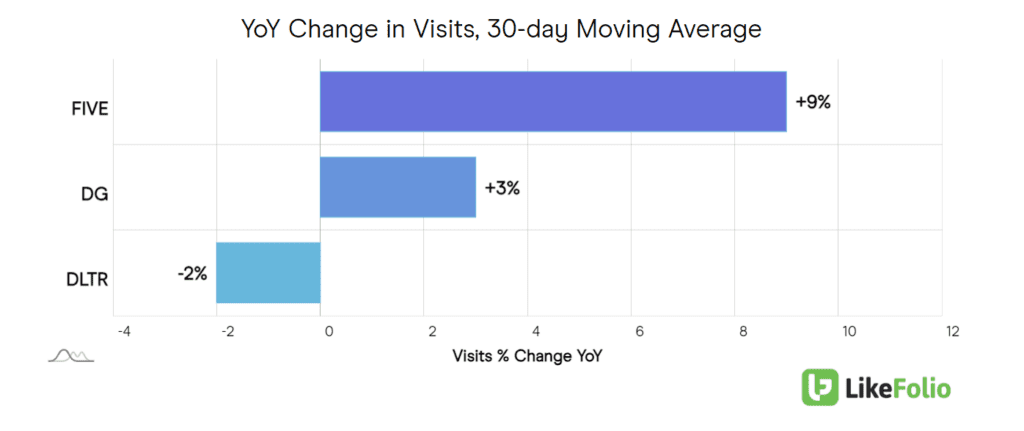

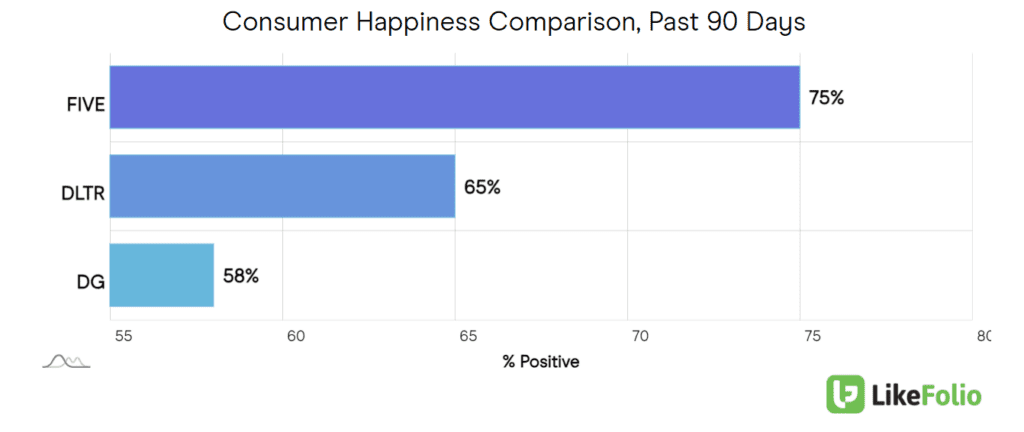

Lastly, its happiness level (though higher vs. Dollar General) is significantly lower vs. Five Below, which is a better non-essential peer comparison.

Bottom line: we're neutral ahead of this event, with data unconvincing of extreme bullish momentum. The better play may be retail peer Five Below (FIVE) who caters to a slightly higher-earning consumer and is undergoing rapid expansion.

Five Below reports March 20, and members can expect an official outlook ahead of its earnings release.