New Coverage Addition, Upcoming IPO: ON Running Our coverage list […]

The Next Big Play on Luxury ONON

To become an “it brand”, performance and quality is paramount.

On Holding (ONON) is one of the most recent names in the LikeFolio universe to achieve that status.

The high-end footwear retailer has instantly recognizable branding and a hefty price tag – which consumers have been more than willing to pay…for comfort and status.

Last quarter, ONON achieved net sales of CHF 480.5 million, up nearly 50% YoY even as inflation soars.

The company has a “no discount policy” and is working toward global expansion.

This creates a unique long-term mindset in the LikeFolio universe (and why we are holding our bullish position from January 2023 that is up +60%).

Here’s what we are watching ahead of earnings:

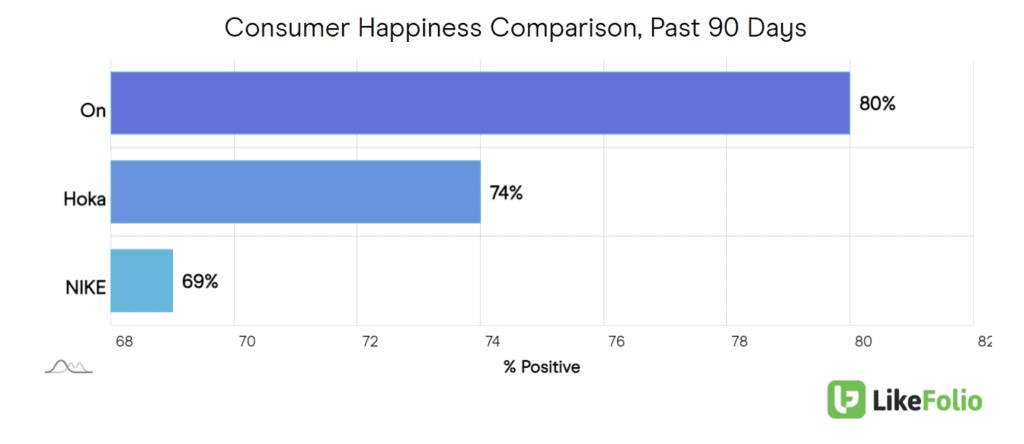

LikeFolio data looks solid. ONON leads peers in happiness at 80% positive.

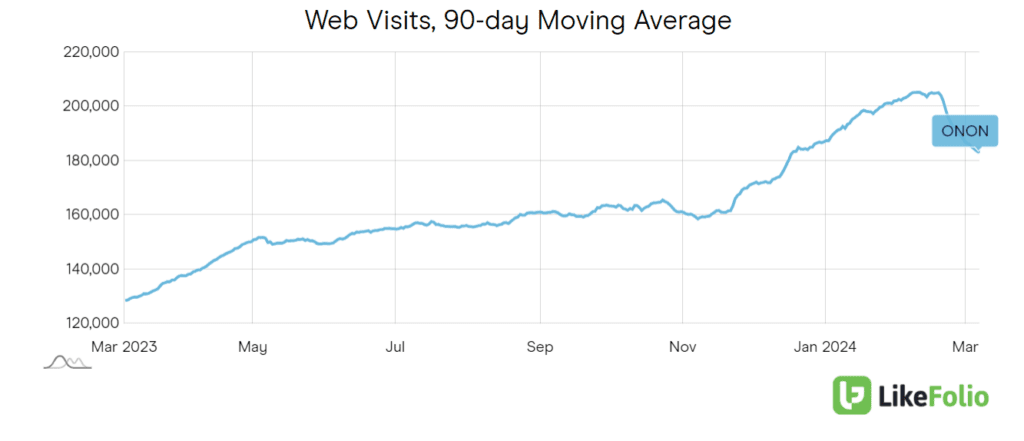

Web visits show a strong holiday season, with traffic up +43% YoY.

The only asterisk on our radar is related to guidance. On the chart above you can see a bit of a downturn following a strong end to 2023. This could be a sign of temporary pressure on the U.S. consumer.

However, the bullish thesis at large holds true:

- Increasing Brand Awareness with Proven Performances: On Holding is strategically enhancing its global brand visibility, leveraging high-profile wins by sponsored athletes, including victories in Boston and New York marathons, to bolster its reputation and ambition to become the top running brand. These efforts have significantly raised brand awareness, positioning On alongside long-established giants like Nike and Adidas.

- Premium Product Positioning: The company aspires to be the most premium sportswear brand, rooted in innovation, design, and sustainability. On's collaborations with luxury fashion houses, such as Loewe and JW Anderson, underscore its premium branding. Its commitment to maintaining high product standards and a full-price pricing policy, avoiding discounts, helps sustain this premium image.

- Rapid Expansion in China: On Holding plans to aggressively grow its presence in China, a key growth market. The company reported a remarkable 71.5% year-over-year sales growth in the Asia Pacific region in Q3, with even higher growth in China, especially during the Golden Week holiday. This expansion strategy, coupled with strong sales momentum and market share gains, underlines the brand's effective penetration and popularity in the Chinese market.

Our signal is cautiously bullish ahead of this report, and if we do see a pull back on temporary growing pains we are buyers of dips.

Andy talked about this in detail on the Shwab Network today: