Tesla reports earnings after the bell on Wednesday. After last […]

The Bullish Case for Tesla (TSLA)

The street has turned against the EV giant, with some pondering if the company may lose money at some point in 2024.

Shares are down nearly -30% YTD.

Tesla's Q4 earnings missed Wall Street expectations and the company projected slower automotive sales growth for 2024, leading to a significant 12% drop in its stock price—the worst single-day performance in over a year.

Despite Tesla's ongoing efforts to ramp up production, such as the Cybertruck launch, increased costs and vague future sales guidance have resulted in lowered analyst price targets and concerns over future profitability and market performance.

Additional fears include tepid EV demand, strong hybrid momentum, and large dumps from fleets like Hertz.

Adding fuel to the fire, Rivian (RIVN) just released new R3 and R3X crossovers (and priced its R2 at $45k -- when it finally hits the road in 2026).

But we say TSLA is playing the long game. Here's why:

Tesla's price cuts have wounded the competition.

Ford appears to be taking a page from Tesla's book, slashing the price of its Mustang Mach-E by more than $8k to drum up demand (sales dropped significantly in January). This places the cost of its vehicle around $48k. Tesla's comparable vehicle, the Model Y, starts at $42k AND qualifies for the federal tax credits that the Mach-E does not due to its reliance on Chinese suppliers.

Tesla continues to captivate consumer interest.

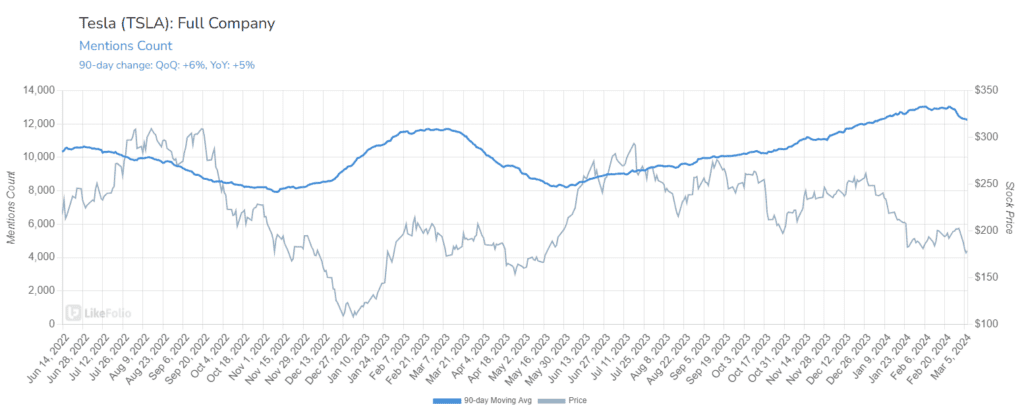

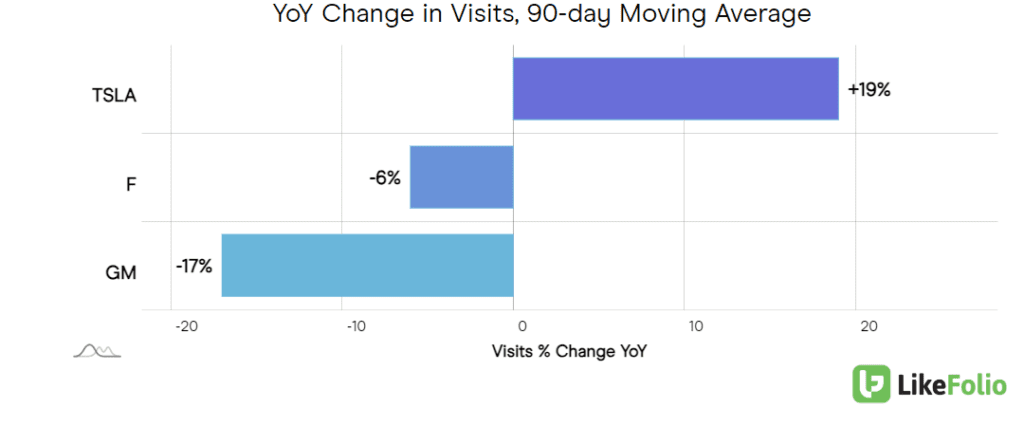

Mention buzz is up +5% YoY and web visits have increased at an even larger clip: +19% YoY. This greatly contrasts with other major players like Ford with declining traffic and buzz (F mention volume is down -16% YoY). These are both positive indicators of future demand, especially as happiness levels hold steady near 60% positive.

The cybertuck is generating significant buzz (+266% YoY) and tweets look positive. Check out this one with a metallic wrap -- out of this world. Users are also putting the truck to the test vs. other big daddies like the Chevy Silverado 2500 -- and it's not even close.

Bottom line -- the company has proven it can produce the highest quality vehicles around when it comes to comfort and performance.

While EV demand may be cooling as gas prices are forced lower during election season, we actually see Tesla as the big winner when it comes to all vehicle manufacturers, not just EVs.

We are big buyers of dips -- this is one of our favorite long positions.