Despite recent market volatility and some arguing for a bear […]

Individual Investors are coming back (SCHW, SOFI, HOOD)

The individual investor is back

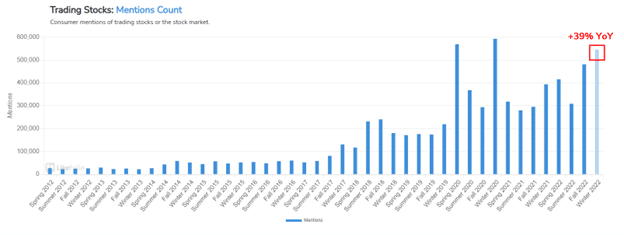

- Consumer mentions of trading stocks are up 39% year over year, and +21% over the past quarter.

- This is the third-highest quarter of individual interest in trading stocks recorded.

- Prior highs in individual investor interest (Spring 2020 and Winter 2020) were followed by significant market rallies.

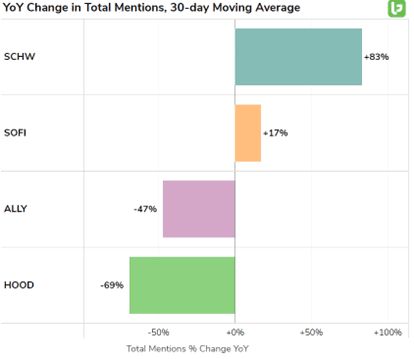

Charles Schwab (SCHW) and SoFi (SOFI) are pulling away from the pack

Schwab (SCHW) and SoFi (SOFI) are garnering the majority of mentions from individual investors.

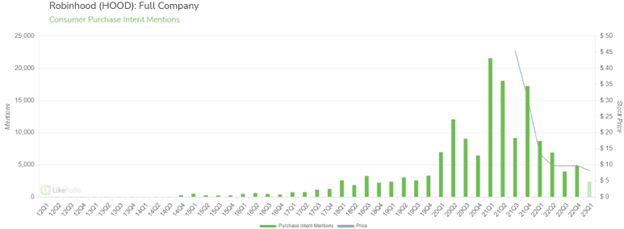

Is Robinhood (HOOD) coming up short?

Despite individual investor sector growth, “Learning to Trade” mentions are actually down quarter over quarter.

This suggests the bulk of individual investor interest is coming from existing account holders re-engaging in the stock market, rather than new traders entering the fray.

This doesn’t seem to be boding well for Robinhood (HOOD -- where we are seeing consumer demand levels for opening new accounts, downloading the app, etc), BELOW 2019 levels:

Looking ahead, we’ll continue to monitor the potential winners and losers of this shifting consumer behavior.

In the meantime, it’s a powerful sign to see trading activity build, as it speaks to growing consumer confidence in the overall market and economic state.