Roku makes streaming devices that allow its customers to stream […]

Is the Bar too High for Amazon (AMZN)?

Strong results from Microsoft and Alphabet on Tuesday just set the bar really high for AMZN.

3 key themes drove momentum:

- Cloud Service Growth

- Artificial Intelligence Applications

- Cost Cutting Measures

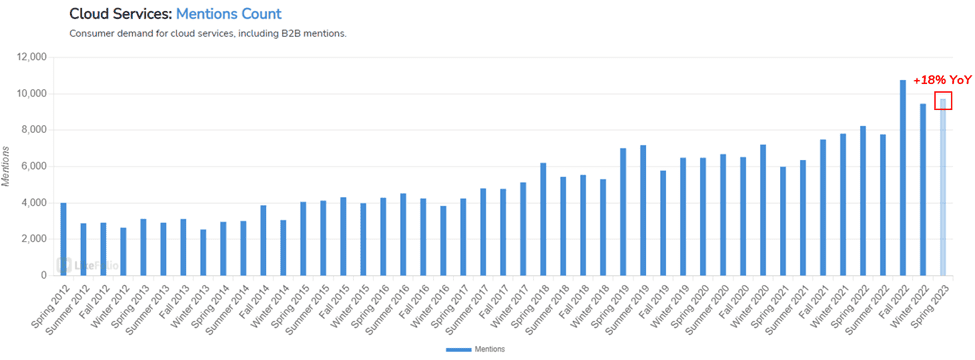

1) Cloud Services

- Microsoft’s cloud services powered the company’s growth, with segment revenue up +22% YoY, exceeding $28 billion for the quarter.

- Alphabet’s cloud services turned profitable for the first time, generating $7.45 billion in revenue in the first quarter.

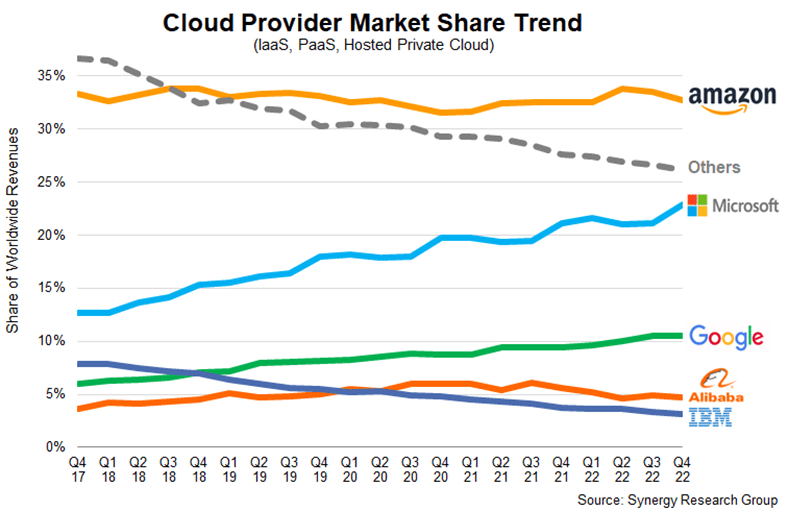

Last quarter Amazon was the market share leader in cloud services, commanding about a third of dollars spent.

But the company is losing ground.

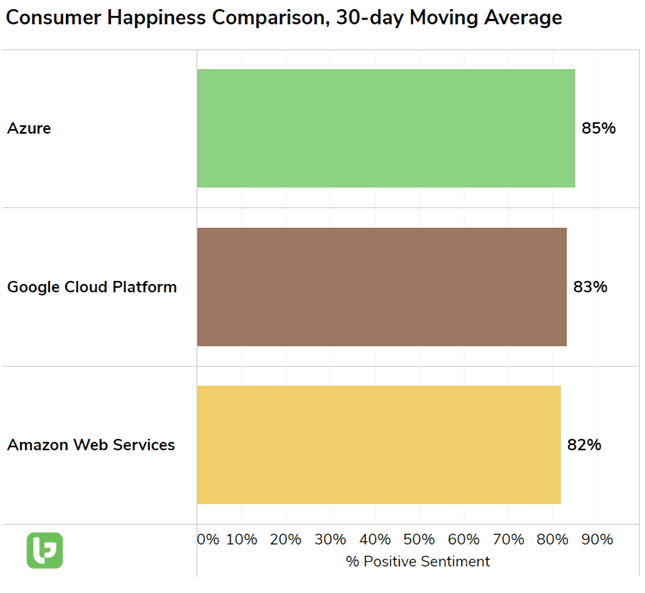

Not only are Microsoft (Azure) and Google Cloud users reporting a more positive experience, but both are outpacing on the demand front, critical signs of market share steal.

Consumer purchase intent mentions for Amazon Web Services rose by +23% YoY in 23Q1, but we do see some signs of slow down in April. AWS demand in Q2 is pacing for +14% YoY growth.

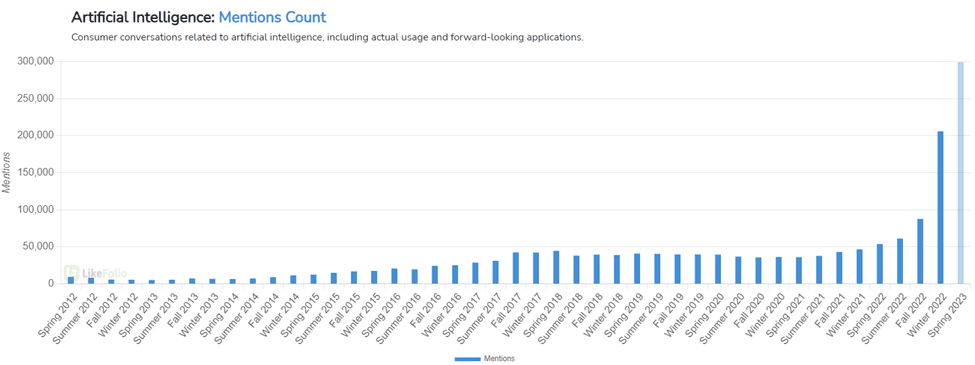

2) Artificial Intelligence

MSFT and GOOGL collectively mentioned AI 100 times on their earnings call.

- Microsoft is leveraging AI to connect advanced models (like ChatGPT) with its cloud enterprise capabilities. The company’s AI-powered Bing and Edge search tools are also recording significant usage and engagement upticks thanks to improved consumer experiences and new features.

- Alphabet touted AI large language model client adoption and search improvements, and also outlined Bard programming and software development progress… though consumer sentiment suggests Bard is seriously trailing the user experience of ChatGPT.

Amazon has leveraged AI for years now, from product recommendations to enabling Alexa to play a song based on a user voice request. But the future of AI at Amazon goes deeper…

- Amazon’s generative AI application, Bedrock, allows users to build and scale applications that can generate text, images, audio and synthetic data in response to prompts.

- Bedrock is Amazon’s direct response to OpenAI (controlled by Microsoft). The Bedrock service includes access to Amazon Titan foundational models, which are pre-trained on large datasets to democratize access for builders.

- Amazon is also trying to get ahead of software development applications by making CodeWhisperer (a coding companion for Amazon services), available to any user for free.

3) Cost Cutting

Tech companies got a bit ahead of themselves during Covid due to extreme demand growth, especially when it came to headcount.

- Amazon, Alphabet, and Microsoft have participated in significant workforce reductions in 2023.

- AMZN mass layoffs announced in March officially kicked off this week and included its AWS sector, spooking some investors.

We’ll be listening on Thursday to better understand if Amazon is in trouble, or if this is simply a strategic management decision to improve operational efficiency.

Key Takeaways ahead of AMZN Earnings

- Amazon is likely to benefit from consumer macro tailwinds and post strong cloud revenue in Q1. However, data supports cautious-to-weak guidance as competitors encroach on its dominant positioning and Microsoft gains momentum.

- Bedrock is Amazon’s answer to OpenAI (MSFT), but the service has some serious catching up to do. It’s too early to gauge success, but it is a rare example of Amazon dropping the technological ball. We’ll be closely monitoring for consumer adoption, but for now MSFT holds a significant edge.

- Investors want to understand the underlying cause of Amazon’s cloud layoffs, but reining in costs is likely to be well-received by investors…especially if Cloud growth is strong as data predicts.

- We’re officially neutral ahead of AMZN earnings. Aside from growing competition, Amazon’s retail demand appears weak.Long-term, Microsoft is garnering the most significant Bullish momentum.