When social-data and stock price are moving sharply in opposite […]

Is the Tech Rally Over? $NVDA $NFLX $TSLA

When we featured mega-cap tech players (like Nvidia and Netflix) as some of our favorite names to watch --

In September of last year --

Many people thought we were crazy.

This is what the headlines looked like:

Yet we were Bullish.

Why?

Because thanks to LikeFolio data, we had a cheat tool in our back pocket: real-time consumer insights derived from social media mentions.

Our hypothesis (as stated in the report):

“Many Mega Cap Tech stocks have shed significant value or stagnated in the past 9 months alongside the market rejection of tech names. However, LikeFolio data shows that many of these companies are holding high levels of consumer demand and happiness.

Could the companies in this report be poised for a rebound as the macro headwinds ease?”

Yes.

Since the report was published, we’ve logged massive gains, most notably from Netflix (shares +46%) and NVDA (shares +67%).

We recently added another “tech” name to this group on our list: Tesla.

So now it’s time to ask ourselves: are we still in this? Does consumer data support continued growth for these already-big-winners?

From a consumer-perspective: Yes.

Here’s why…

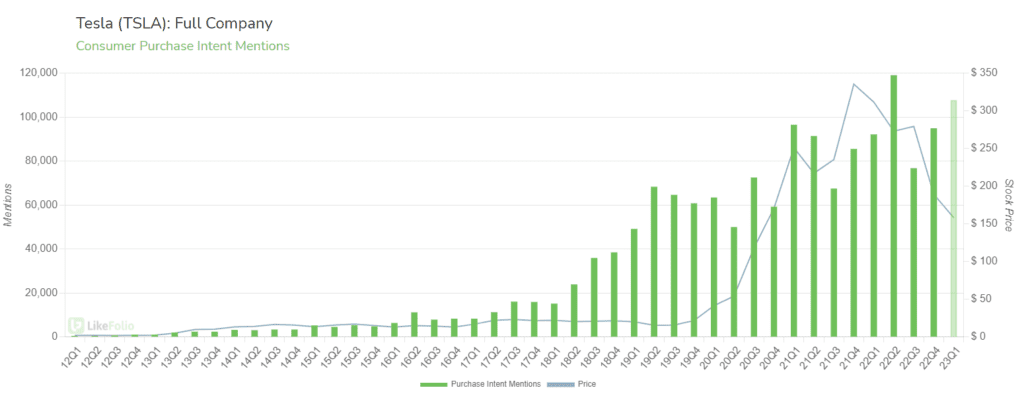

Tesla Price Cuts are Driving Demand Higher

In January, Tesla slashed its prices across the board, making its high-tech electric vehicles available to an even larger audience pool – and undercutting its competition at the same time.

LikeFolio logged an immediate consumer response to these cuts.

Demand in the first quarter (the shaded bar on the right) accelerated, currently pacing +17% higher YoY.

This would be the second-largest quarter for Tesla demand in LikeFolio history.

Doesn’t feel like a slow-down to us.

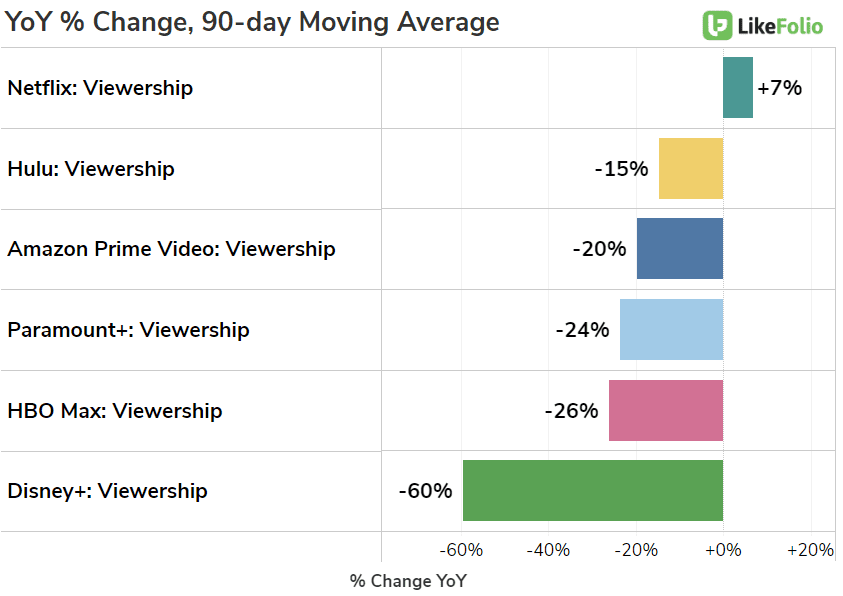

Netflix is Dominating Streaming Peers

Streaming growth tempered post-pandemic. This isn’t news.

But what IS interesting is how Netflix responded.

The company amped up original content, added an ad-supported, low-cost tier, and is exploring ways to lock down password sharing.

But it’s working.

Netflix viewership is surpassing streaming peers by a landslide.

The company still has some kinks to work out – its plans to crack down on password sharing generated a lot of noise from consumers.

But if the streaming giant can figure out how to execute this effectively, it will reap massive benefits long-term.

We’ll be watching consumer response very closely. But for now, we like the trajectory.

Megan joined the TD Ameritrade Network today to discuss LikeFolio's data on Netflix and Tesla...

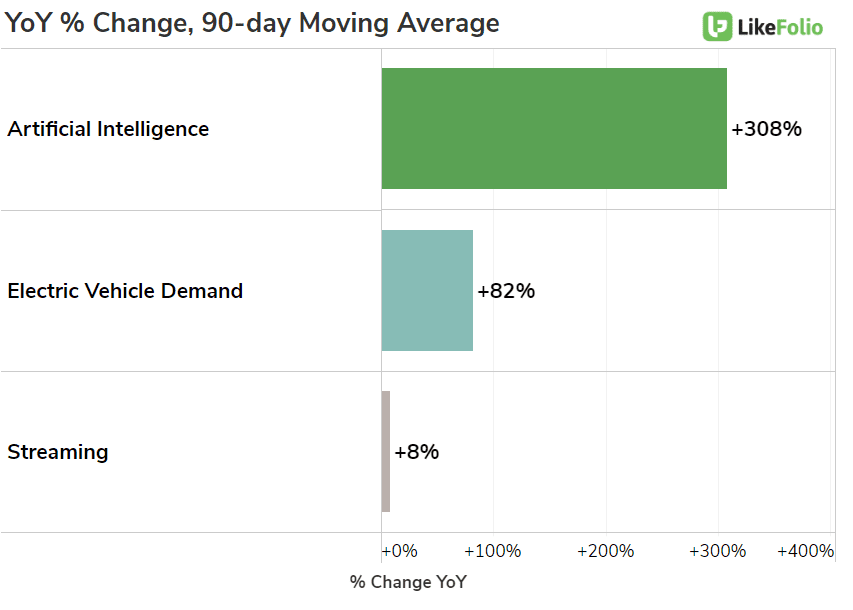

Nvidia is Being Propelled by Massive Trend Tailwinds

Nvidia has often fallen victim to its own success.

We saw its stock come back to earth after massive gaming and crypto booms over the last 3 years.

But the key moving forward:

- Nvidia is best of breed when it comes to chip technology

- Nvidia is powering major developments in critical consumer trends – from high-tech vehicles to artificial intelligence

Artificial intelligence is one of the fastest-growing trends in the LikeFolio universe.

We expect this to serve as a major tailwind for the company for years to come.

Bottom line: we were able to get ahead of massive rallies in tech thanks to forward-looking LikeFolio data. And the data suggest it’s probably not over yet, though some of the gas is certainly out of the tank.

Like always, we’ll be monitoring for any changes.