“You know it's time to sell when shoeshine boys give […]

Is there More Crypto Carnage to Come?

June 14, 2022

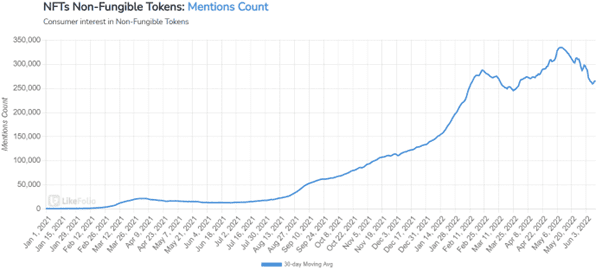

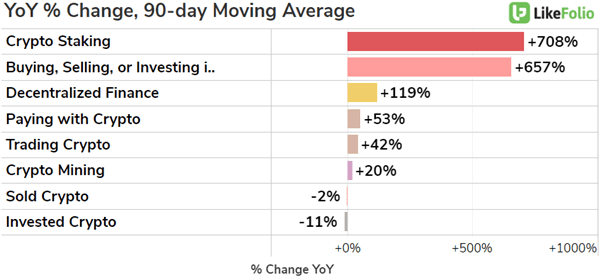

| It's a troubling time for digital assets with crypto prices plunging. Bitcoin is down more than 48% this year, currently trading around the $23,500 mark, while Ethereum is at $1,250, down almost 66% in 2022. There has also been the collapse of Luna/UST, and troubling news that Celsius Network has frozen withdrawals. Not good. Inflation and rising rates have played a significant part. As previously mentioned, its digital assets in general — not just cryptocurrencies — that are worrying investors. NFT’s have also been affected, although consumer interest in non-fungible tokens is has been outperforming relative to other cryptocurrency trends: +3% QoQ and +1900% YoY (30d MA). |

| Still, the chart above provides an important message, one that can also be applied to the crypto space as a whole. That is, while it's difficult to look beyond the current downturn, it’s important to maintain a sense of perspective. Bitcoin was last trading near the $23,000 mark in December 2020… up nearly 4x from the 2020 lows. Crypto moves are exaggerated in both directions. To clarify, this isn’t a positive spin on the current plunge — definitely not. Just a reminder that there’s still a long way to go, in either direction. Timelines matter. So, with a long-term perspective in mind, here is what we are watching when it comes to crypto markets: Consumers Investing in Crypto |

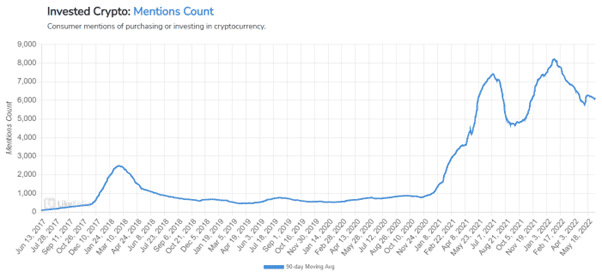

| Consumer mentions of investing in cryptocurrencies are decelerating, trending -12% QoQ and -11% YoY. It's obvious why. Liquidity has dried up with central banks hiking rates, resulting in trading activity (and investors risk appetite) falling alongside asset prices. However, focusing on the overall chart, not just the recent decline, we can see mentions are still significantly above pre-pandemic levels. We will be watching this trend to see how it plays out over the next few weeks. Crypto Trading Mentions |

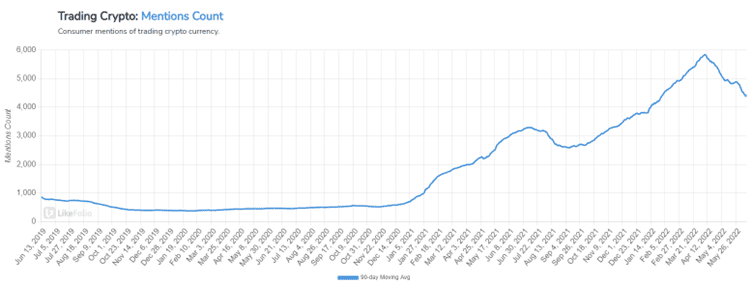

| While consumer mentions of investing in crypto are decelerating, so too are the number of people talking about trading digital assets. It’s only natural, given the current macro environment. Mentions of trading cryptocurrencies are pacing -18% QoQ. However, the bigger picture provides a more rounded view, and on a YoY basis, mentions of trading cryptocurrencies are up +42%. We track various crypto trends to provide a comprehensive view of the current market conditions. |

While there’s been a significant decline in consumers’ demand and interest in crypto…it’s not Armageddon.

Regardless, we’re bullish on BTC long-term. And keeping track of consumer activity and market sentiment could be key to predicting if there’s still more carnage to come.

Want FULL Access? Click Here for LikeFolio Pro

Tags: