iRobot (IRBT) Last quarter, iRobot posted strong results: revenue increased +43% […]

Is Zillow’s resurgence a case of Fool’s Gold?

The housing market has been on a tear throughout the pandemic…

In 2021, the average sale price of a home was $346,900, representing a 16.9% increase from 2020.

But are we starting to see this pace slow down?

It’s not a stretch to state that the rate of price increases we’ve seen over the last few years is not sustainable.

Mortgage rates spiked the most in 9 years in December. Furthermore, the Fed is expected to raise interest rates, with predictions ranging from 3 to 7 rate hikes in 2022.

At the moment, the housing market in many areas is experiencing surging demand with little inventory.

It is one of the reasons why Homie, the Utah real estate market disruptor, ran into some trouble and recently announced a reduction of around 28% of its workforce.

So, we have a housing market with limited supply and extremely high demand, and the Fed is set to raise rates multiple times this year — what happens next?

The Case Against Zillow (Z)

Well, as you may have already guessed, rising interest rates and corresponding mortgage rates should start to dampen buyer demand. It could also result in a slowdown in other aspects of the housing market, such as housing construction and investment spending.

A limited supply and, more importantly, a demand reduction could seriously cool down the housing market...

This isn’t great news if you’re a company profiting off the buying and selling of real estate, like digital-based firm Zillow.

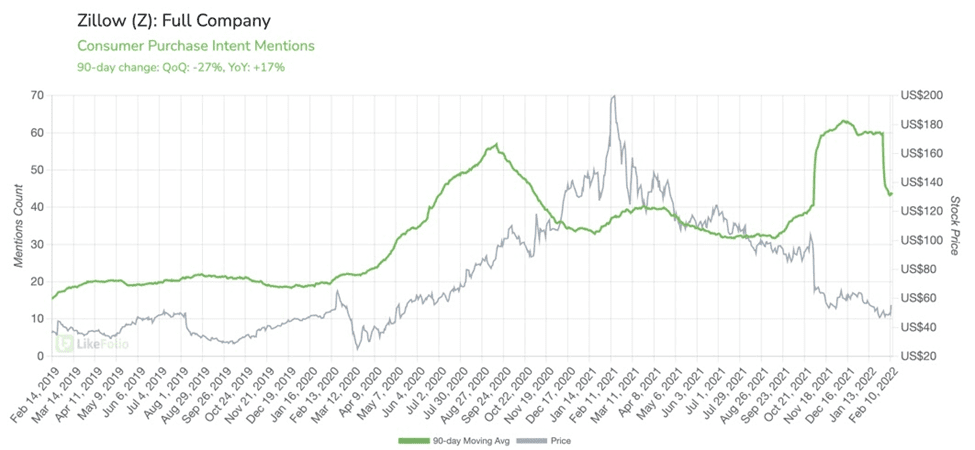

Likefolio data reveals the company’s Purchase Intent mentions have experienced a -26% decline quarter over quarter.

Now, you may think this is just a decline in Zillow’s business, and house buyers and sellers are utilizing other platforms.

However, there are other factors at play.

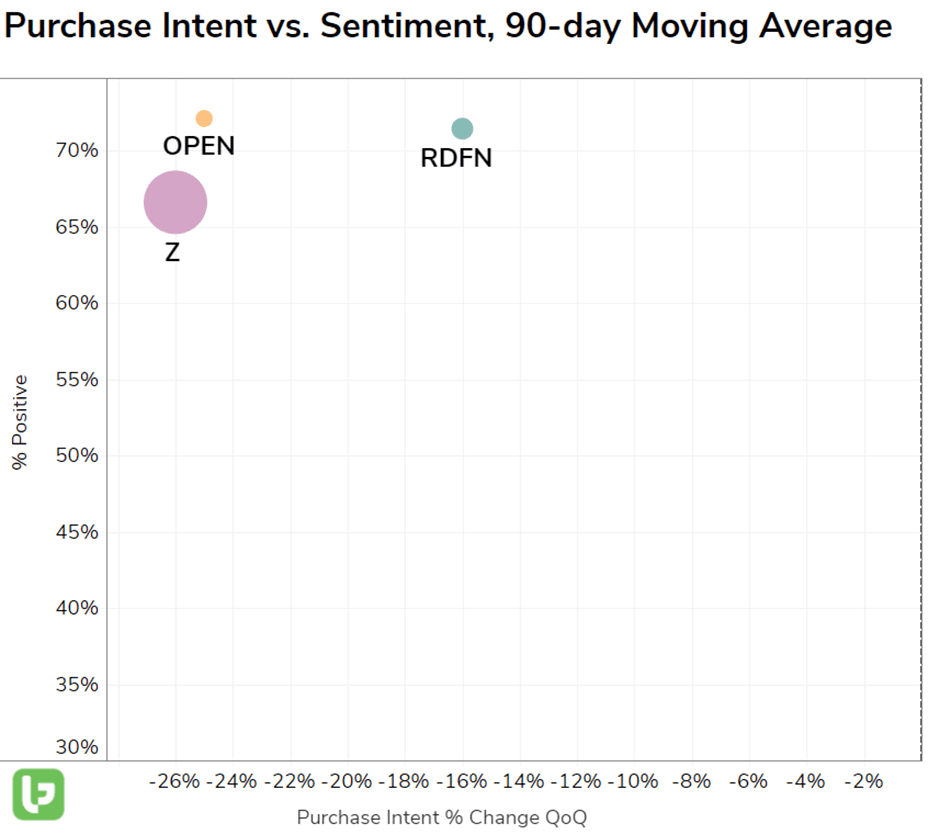

First, take a look at Zillow against its peers…

Comparing the company to Opendoor Technologies (OPEN) and Redfin (RDFN), Zillow is in last place for both Purchase Intent growth and Consumer Happiness.

This creates an interesting scenario.

After Zillow’s most recent earnings release, the company saw its shares jump as much as 20%.

Why?

Because it is getting out of the home-flipping business more quickly and economically than it had previously expected.

But this doesn’t change the fact that Zillow’s underlying business is underperforming peers.

OK, so the stats on Zillow aren’t great.

But did you notice that Opendoor Technologies and Redfin consumer Purchase Intent mentions are also on the slide?

This is an industry-wide shift.

Redfin’s consumer Purchase Intent mentions have dropped -20% QoQ, and Opendoor’s Purchase Intent mentions have declined -23% QoQ.

According to Redfin itself, “if mortgage interest rates were to rise to 3.9%, a homebuyer with a $2,000 monthly housing budget could afford a $382,250 home.”

While that may seem minor at first glance, it is down from the $396,000 home a buyer with the same budget can afford with a 3.5% rate, which is roughly where mortgage rates stand today.

If mortgage rates rise alongside interest rates, as expected, consumer buying power will likely decrease in 2022.

What Do Real Estate Macro Trends Reveal?

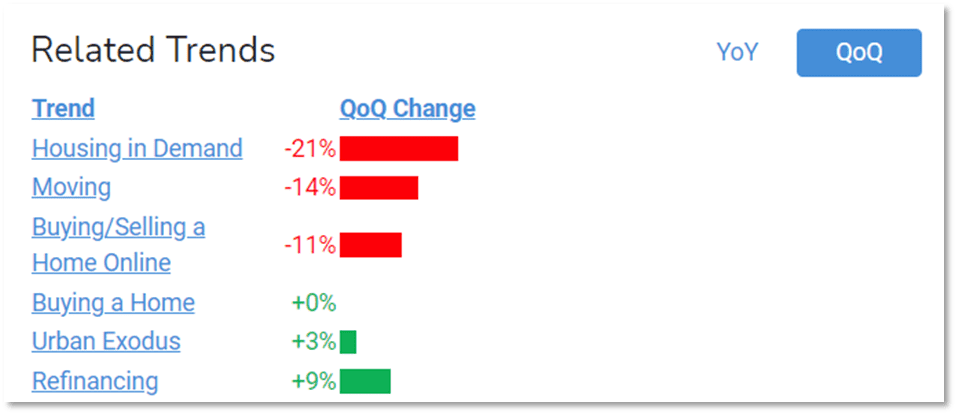

LikeFolio data suggests many consumers who planned to move, made the move over the last 2 years.

Mentions of moving and housing demand are cooling off, both recording double-digit drops on a quarter-over-quarter basis.

Meanwhile, many consumers are opting to refinance and take advantage of rates while they’re low. Perhaps to re-invest in their existing home.