“You know it's time to sell when shoeshine boys give […]

MSTR Continues to Outperform Bitcoin (as promised)

Institutional investors are supposed to be the smartest players in the room.

But even the pros can fall into the trap of an “easy” trade. Kerrisdale Capital made such a move by shorting MicroStrategy (MSTR) while buying Bitcoin (BTC) as a pair trade, betting that MSTR would underperform its massive Bitcoin holdings. They thought they’d spotted an obvious opportunity that the market was missing.

But the data paints a different picture.

What Kerrisdale failed to recognize is that MicroStrategy (MSTR) is far more than a simple Bitcoin proxy. Thanks to its flywheel strategy of continuously leveraging debt to buy more Bitcoin, MSTR has significantly outpaced Bitcoin’s price movements.

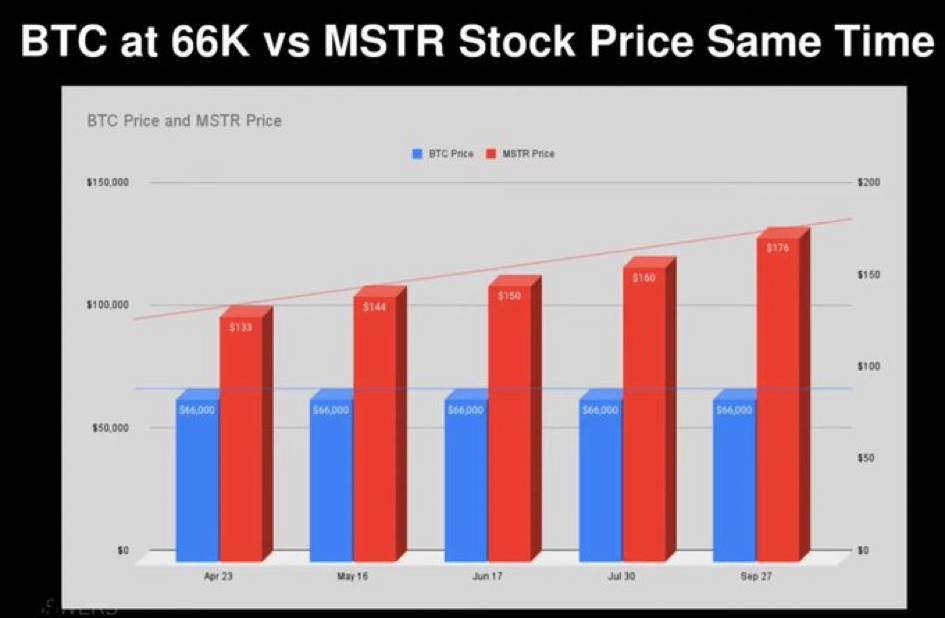

While Bitcoin has remained stable around $66,000 over the past several months, MSTR’s stock has surged from $133 to $195.

The MicroStrategy Flywheel: More Than a Bitcoin Proxy

MicroStrategy’s unique flywheel effect comes from its ability to acquire Bitcoin using debt, amplifying its returns. Each time Bitcoin rises, MSTR not only benefits from the underlying appreciation of its holdings, but also from the leverage it has taken on to buy more. This creates a multiplicative effect that allows MSTR to outperform Bitcoin during bull runs.

What institutional investors like Kerrisdale missed is that this leverage turns MSTR into a speculative vehicle that can soar well beyond Bitcoin’s price appreciation.

As LikeFolio has pointed out in our detailed analysis, MicroStrategy is actually a better bet than Bitcoin for investors seeking exponential returns.

The Future: $750,000 Bitcoin and 20-30x Potential for MSTR

At LikeFolio, we see Bitcoin’s potential to reach $750,000 in the long term, which would represent roughly a 12x increase from current levels. But due to MicroStrategy’s strategic use of leverage and the flywheel effect, we project that MSTR could rise by 20-30x in the same timeframe. That’s the beauty of this strategy: MSTR has become a supercharged bet on Bitcoin, not just a passive Bitcoin holder.

Kerrisdale’s hedge may have seemed safe on paper, but the real story here is the long-term potential of MicroStrategy’s unique playbook. As Bitcoin climbs, MSTR is set to fly even higher.

MicroStrategy isn’t just riding Bitcoin’s wave. It’s positioned to outpace the cryptocurrency by a wide margin. Don’t miss out on the opportunity to capitalize on this game-changing strategy.