Peloton is Making Moves to Expand its Userbase, Monetize Addicted Users

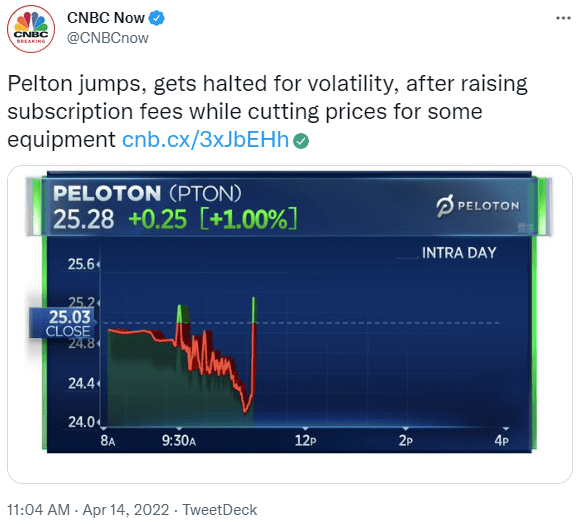

Peloton shares were halted from trading earlier this morning after the company announced it was cutting the cost of its Bike, Bike+, and Treadmill, and raising the cost of its monthly subscription by ~$5 for all-access users.

This move makes sense.

The company has struggled to maintain its pandemic-driven momentum, slashed its financial outlook for the year, and replaced its CEO. Shares have shed more than -77% in value over the last year.

LikeFolio data shows that Purchase Intent Mentions for Peloton machines have been falling for some time, currently pacing -56% lower on a YoY basis.

A lower equipment price may position Peloton as a deal vs. competitors, and remove barriers to entry for consumers sitting on the fence.

And Peloton is betting that once users take a class, they're hooked. And this could translate to more (and more consistent) revenue on the backend.

Peloton maintains some of the highest consumer happiness ratings in the LikeFolio universe, just above 84% positive.

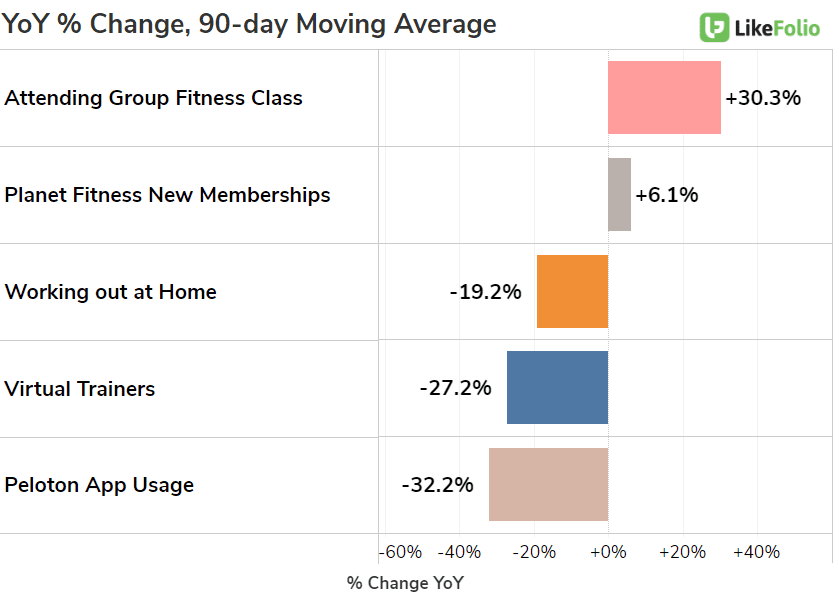

The company is facing stiff headwinds as consumers return to the gym and in-person group fitness classes.

Looking ahead, keep a close eye on Peloton Purchase Intent volume to see if new pricing moves the needle.