ON Running is a popular athletic shoe and performance sportswear […]

Segment Spotlight: Athleisure and what we learned from ONON

Right now consumers are more price-sensitive and value-oriented, impacting spending on athletic apparel and footwear.

Brands that manage costs effectively, provide high quality apparel/footwear, and adapt to changing preferences are better positioned to succeed.

We're breaking down ONON's earnings report to see what we can learn and how peers are likely to stack up.

Check it out:

ONON (On Holding AG)

ONON shares surged as much as 20% today thanks mostly to its leadership's ability to streamline operations. Effective cost-cutting measures and operational efficiencies, such as a higher mix of direct-to-consumer (DTC) sales and leaner inventory management, resulted in earnings of 36 cents per share, more than double the 17 cents reported last year, despite a fifth consecutive quarter of slowing sales.

This earnings performance surprised us, but does check a core competency box that we will consider moving forward in its management's ability to navigate a tightening economic environment.

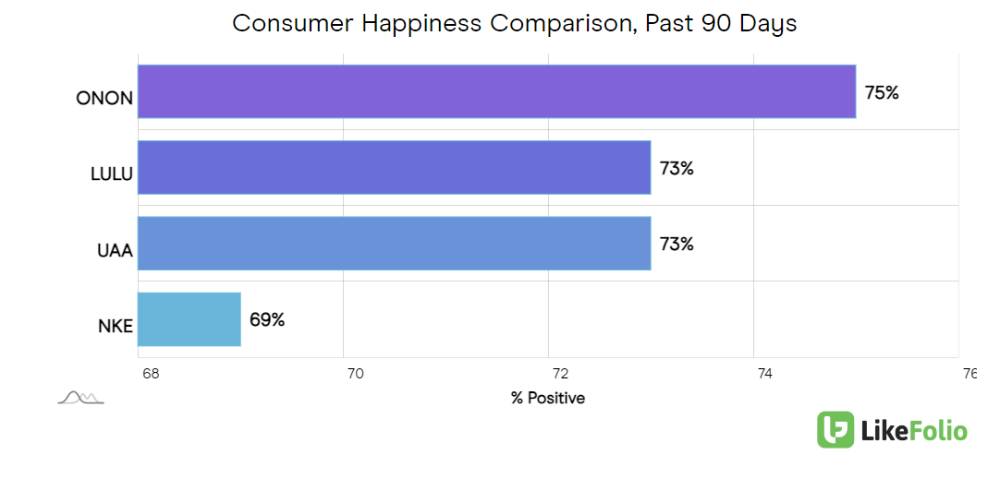

The company's sentiment levels are at the top of the pack vs. peers. Keep an eye on this -- any changes may signal trouble in holding value amid cost cutting measures.

ONON Investor Considerations from here:

- Positive: Strong earnings growth and efficient cost management.

- Caution: Continued sales slowdown could temper future gains.

Here is how we see UAA, LULU and NKE in this context...

This section is restricted to LikeFolio Pro Members only.