Polaris (PII) Polaris has reported greater-than-anticipated demand for its powersports products (ORVs, Snowmobiles, […]

Spotting a Reopening Winner and Loser: CROX, PII

Spotting a Reopening Winner and Loser: CROX, PII

As consumer behaviors shift in a reopened society, it's time to see which companies are benefitting and which companies are struggling.

By analyzing macro trends and consumer demand, a reopening Winner and Loser have emerged...and no, we aren't biased -- the data tells all.

CROX is a Reopening Winner: Demand is rising into a critical Back-to-School season.

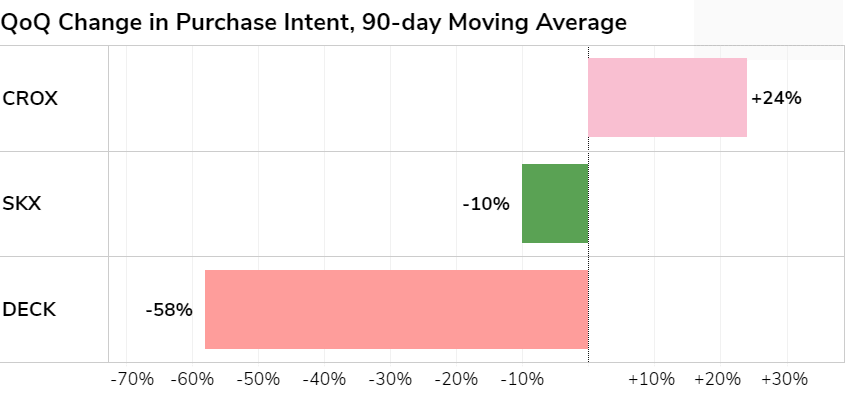

Crocs Purchase Intent is outperforming peers, with Purchase Intent rising +24% QoQ.

New Drops continue to drive demand, including collabs with Balenciaga, Diplo, and Disney/PIXAR's Lightning McQueen.

We expect demand growth to continue, especially as students (and teachers) return to school.

Last year's Back-to-School shopping peak was ~64% lower vs. 2019...so pent-up demand is looming.

PII is a Reopening Loser: Demand is dipping below pre-covid levels.

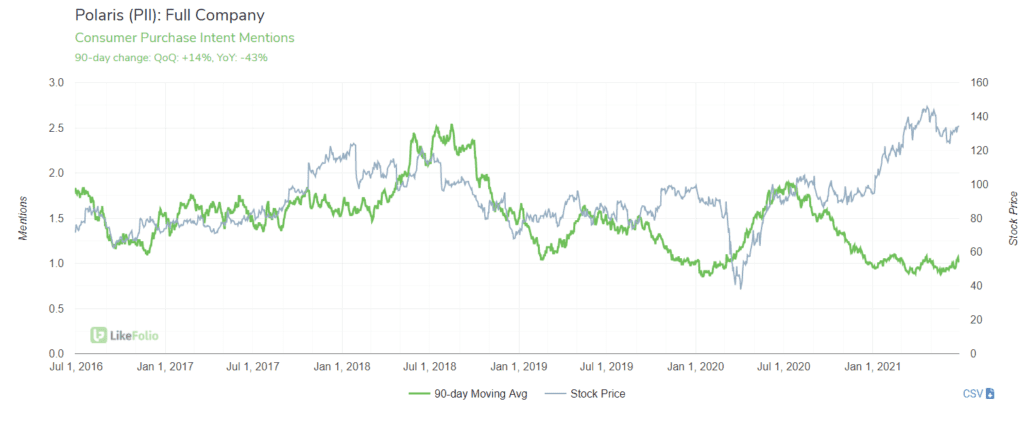

We touted Polaris strength last Summer, and again after a strong holiday season

Shares have traded +50% higher since our first note, currently +39% since last July.

Now, consumer demand for new Polaris vehicles is waning.

Purchase Intent has fallen: -43% YoY, and -35% vs. 2019. Even though we are recording an expected seasonal ramp, demand remains much lower vs. the prior 2 years.

In addition, ORV (off-road vehicle) usage mention growth has normalized: -2% YoY.

As stimulus checks dry up and entertainment options reopen, can PII growth continue at its recent pace?