Tesla reports earnings after the bell on Wednesday. After last […]

Tesla's $25K Market Shake-Up

In the current environment, it should be tough to talk about consumers buying new cars.

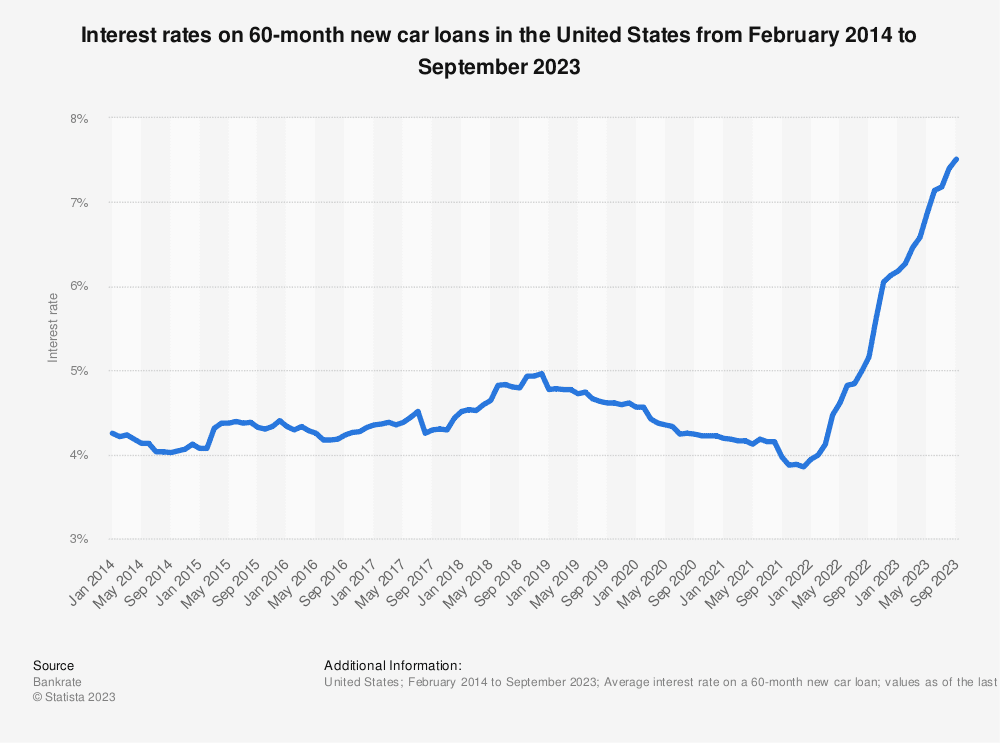

Federal reserve rate hikes have pushed interest rates on new car loans in the U.S. to decade-highs.

Meanwhile, ongoing labor strikes have dented production for several auto leaders.

The UAW's strike against GM concluded with a tentative deal at the end of October that promises a 25% wage hike, faster wage progression, and the right to strike, ending a six-week standoff that cost Detroit automakers billions in lost production.

But at LikeFolio, we see a distinct shift in the consumer psyche when it comes to forward-looking interest in a new vehicle.

For those of you who have been around for a while, this shift is reminiscent of the digital wallet ‘line in the sand’ we noted back in 2021.

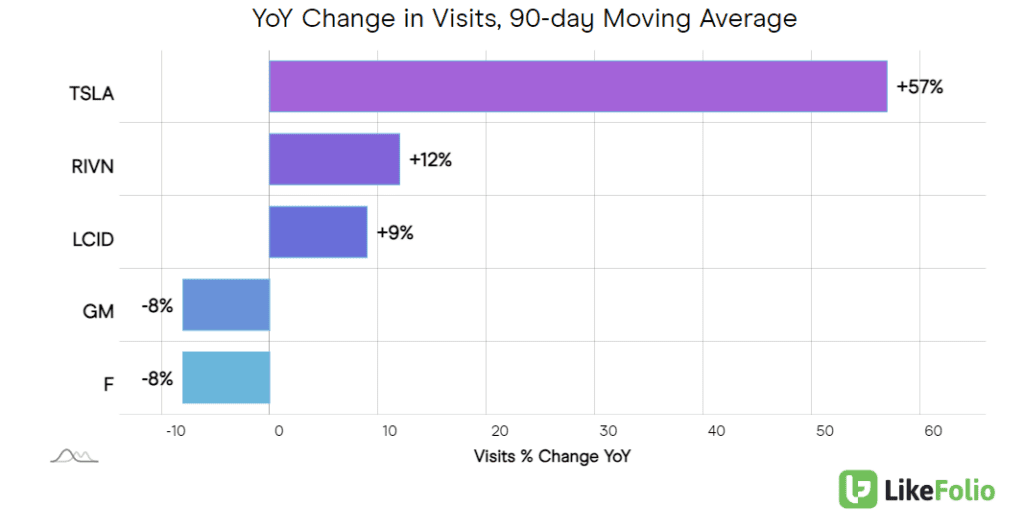

Just look at this chart:

While forward-looking consumer interest for two of the largest traditional auto manufacturers in North America slides (looking at you GM and Ford), consumer interest in electric vehicles is on the rise.

We’ve hammered home that consumers have already passed the tipping point -- EVs no longer seem novel and risky.

But the chart above also reveals another key takeaway...

This is Tesla’s (TSLA) game to lose

TSLA shares dropped after it reported earnings in mid-October.

What can investors learn from the golden standard ahead of RIVN and LCID reports?

- Expect Near-term Macro Hurdles: Tesla's performance, with lower-than-expected earnings and a sharp decline in operating margin, suggests short-term cooling in the EV market potentially impacted by economic headwinds and consumer sensitivity to rising interest rates.

- Pricing Matters: Musk's emphasis on making Tesla cars more affordable points to a broader necessity for cost competitiveness in the EV sector, as high prices may deter consumers in a high-interest rate economy.

- Profitability takes time: The cautious outlook from Tesla on the Cybertruck's profitability timeline indicates that new EV models may face longer periods before becoming financially beneficial, reflecting the challenges of scaling production and achieving cost efficiencies in the current economic environment.

EV peers Rivian and Lucid are playing catch up here, and also have much more room for improvement vs. proven executer, Tesla.

Rivian reported a narrower-than-expected loss in Q2 and raised its 2023 production outlook to 52,000 vehicles, signaling confidence in its manufacturing ramp-up and demand for its EVs.

The company's cost reduction efforts are yielding results, with significant decreases in per-unit vehicle costs and a projected positive gross profit by 2024, reflecting improved operational efficiency.

With $10.2 billion in cash and a reduction in capital expenditure forecasts for the year, Rivian is taking strategic steps to manage its finances, including staff reductions and delayed product launches to conserve cash.

This seems positive, right?

Sure -- but TSLA is a fierce competitor.

Last Friday Tesla told workers in Germany it would be building a cheap, mass produced EV...priced at 25,000 Euros, or about $26,800.

Investors have called deemed iteration the "Model Q" or "Model 2".

Tesla's potential introduction of an EV priced around $25,000 could significantly disrupt the current market dynamics, particularly for companies like Rivian, whose entry-level R1T electric truck starts at over $74,000.

Similarly, Lucid may find it challenging to maintain its premium pricing for the Lucid Air sedans, which can reach up to $115,000. This price point disparity becomes even more pronounced as Lucid has recently implemented price reductions of $7,500 to $10,000 on some models, yet the starting price post-reduction is still nearly triple that of the anticipated Tesla model.

We are sidelined for LCID and RIVN this week, and have our eyes fixed on a Bullish Tesla Horizon.

Musk isn't backing down -- expect some speedbumps along the way, but data confirms TSLA is in the drivers seat.