Tiffany's (TIF) will report quarterly earnings Wednesday prior to the […]

The Bar Matters $FIVE $DLTR

As a weightlifter, I've always been fascinated by the challenge of adding more weight to the barbell. Each additional pound is a testament to strength, yet it also raises the stakes. In the gym, as in the financial markets, the more weight on the bar, the greater the expectation of strength and skill.

This analogy perfectly mirrors the situation facing Five Below (FIVE) as it approaches its earnings release. Just like a lifter psyching up to lift a heavily loaded barbell, FIVE is gearing up to meet and potentially exceed the substantial expectations set by the market.

And goodness knows the bar matters. We saw this a few weeks ago with Target (TGT) and Walmart (WMT). TGT shares popped on a not great but not horrible report (low bar) and WMT shares slumped on a good but not great report (high bar).

Thanks to Dollar Tree’s report and market reaction, we have a better understanding of where the bar sits for FIVE. Despite a struggling Family Dollar business and a trimmed annual forecast, DLTR shares are trading higher today, as predicted.

Five Below has a High Bar to Clear

So where is the bar for FIVE? A bit higher. DLTR shares were trading -22% lower YoY yesterday prior to reporting. FIVE shares are trading just over +4% higher YoY. Different expectations mean FIVE will need to put out a stronger report.

But thanks to LikeFolio consumer insights, we have a better understanding of if the company is prepared to clear it.

Here’s what we’re watching ahead of FIVE earnings:

1.LikeFolio data looks strong for Five Below.

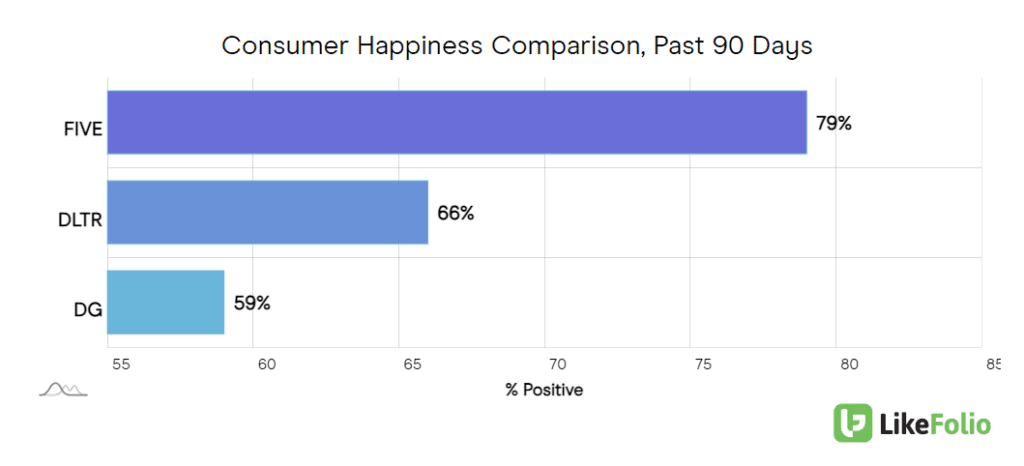

FIVE has a higher level of happiness than all other "dollar" stores, at 79% positive.

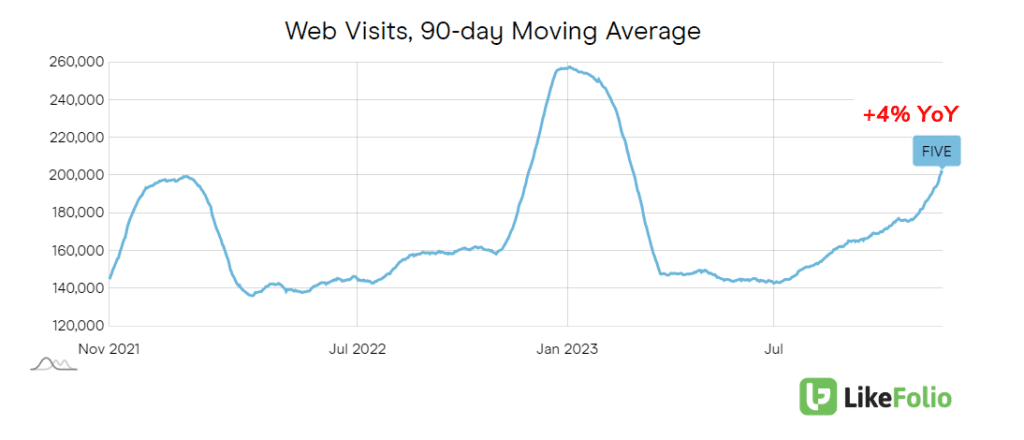

FIVE is also gaining traction on the web front, with a robust website (the competitors can't say this) and web visits up +4% YoY into a strong holiday season.

2. Low income consumers are struggling.

DLTR noted, "We experienced softening trends throughout the quarter, particularly in October as lower-income consumers responded to the accumulated impact of inflation and reduced government benefits." Digging deeper, DLTR noted this particularly impacted its Family Dollar brand, which caters to lower-income individuals. While that banner struggled to gain footing, its Dollar Tree brand actually expanded thanks to higher-earning individuals hunting deals.

3. FIVE may benefit from higher-earning consumers trading down.

Five Below may fare more like Dollar Tree in the example above, because it caters to individuals willing to pay a bit more than a dollar (or 5) for quality. On its last earnings call, the company noted comp transactions increased by +4.5%, driven by its Five Beyond conversion strategy (featuring stores with items that cost more than $5) and WOW offerings priced at higher dollar amounts but also providing higher quality. For example, a WiFi drone with camera or a tabletop light up air hockey game, both for $15.

Aside from these factors, Five Below has proven itself nimble, moving quickly to harness consumer trends.

For example, sourcing Barbie related items and enticing "Swifties" with friendship bracelets.

It is also expanding rapidly, eyeing 3,500 potential new locations across the U.S. Last quarter it opened 40 new stores in 24 states. Perhaps most importantly for its bottom line, its continuing its "Five Beyond" conversion strategy, completing 400 conversions through its last report, bringing its total converted stores to 600 in just over a year.

Bottom line

The bar is higher for FIVE heading into earnings. But thanks to its strong consumer metrics, strategic growth strategies and higher price points, we are playing this one to the upside (risk-defined, of course).