Tiffany's (TIF) will report quarterly earnings Wednesday prior to the […]

Dollar Stores: From Kentucky Origins to Modern Value Retailing

The story of dollar stores began in 1955 in Springfield, Kentucky – about an hour South of LikeFolio offices, just past the Jim Beam Distillery – with the opening of the first Dollar General Store. Cal Turner's revolutionary concept, pricing every item at one dollar, was inspired by the “Dollar Days” promotions in retail department stores and quickly became a huge success.

In 1959, the dollar store narrative expanded when Leon Levine opened the first Family Dollar store in Charlotte, North Carolina, offering high-quality merchandise for under $2, setting another milestone in value retail.

Decades later, Dollar Tree STILL offers items for $1 while also incorporating products at higher price points, like $3 and $5, to provide a mix of value and quality. This approach is particularly resonant as the company heads into its next earnings announcement in a market driven by inflation and budget-conscious consumers.

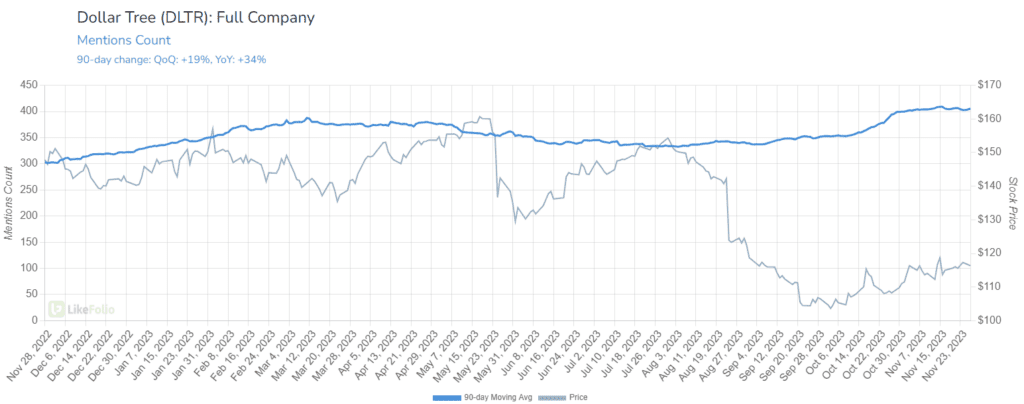

In fact, LikeFolio data suggests it’s just this mix that may position DLTR for a market surprise – check out the budding divergence below…

Here are the compelling insights we’re monitoring ahead of earnings:

- Consumer Demand Resurgence: Dollar Tree has seen a significant increase in consumer interest, with demand mentions hitting a 2-year high in Q3. This resurgence underscores the growing consumer trend towards value retail in times of economic constraint.

- Brand Strength and Consumer Sentiment: The Dollar Tree banner, in particular, has experienced a remarkable 46% year-over-year increase in buzz while Family Dollar remains relatively flat. This positive traction contrasts with the stock's 22% decline over the same period, highlighting a divergence opportunity.

- Adapting to Inflation and Shopping Trends: More than 75% of consumers are actively seeking discounts, as reported by PwC, aligning with Dollar Tree's strategic pricing. The company's ability to offer a range of products at different price points caters well to the current shopping behaviors driven by inflation.

- The bar is relatively low: Last quarter Dollar Tree reported an 8.2% increase in sales to $7,325 million in Q2 2023, buoyed by higher consumer traffic, but faced a stark 43% drop in profits and a 6% decline in its stock price, highlighting concerns about reduced consumer spending and ongoing challenges in sustaining profitability amid rising operational costs and shifting economic conditions.

Bottom Line

Our data indicates a positive outlook for Dollar Tree and justifies a bet to the upside on a strong report. Consumer spending at Dollar Tree is robust, particularly as shoppers actively seek deals, and its healthy mix of discretionary and staple items is checking off many shopping lists.