Tesla reports earnings after the bell on Wednesday. After last […]

Tesla Set to Defy Odds…Again

From Bold Prediction to Market Reality

In 2018, LikeFolio made a bullish call on Tesla, a stance that might have seemed overly optimistic to some at the time. Fast forward to today, and the data-driven foresight has proven not only accurate but prescient.

TSLA stock is currently trading more than 1000% higher than it was 5 years.

But recently, the market’s bearish sentiment and media headlines are giving us déjà vu.

Is Tesla poised to beat market expectations yet again?

We think so.

Here’s why…

Impressive Web Traffic, Strategic Pricing, and Cybertruck Buzz

With a 7% year-over-year increase in Tesla mentions, primarily driven by the Model X, Model Y, and the surging interest in the Cybertruck, Tesla's market position is stronger than ever.

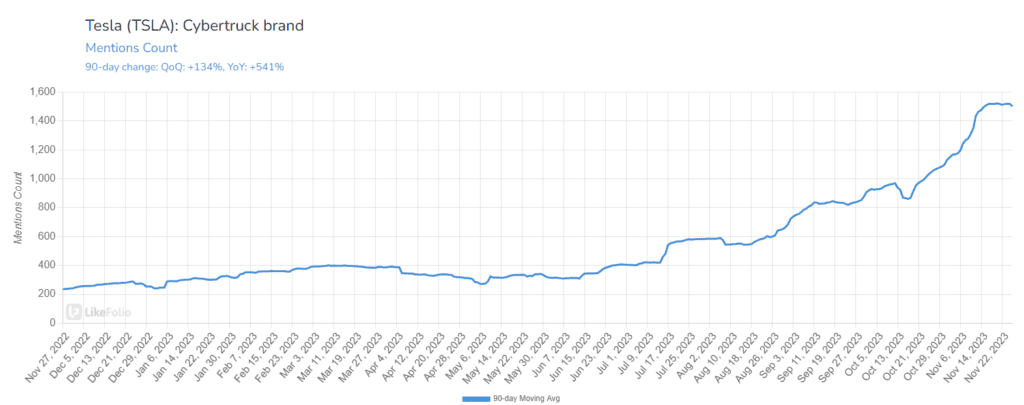

Tesla is set to deliver the first 10 Cybertrucks at an upcoming delivery event on Nov. 30, marking the start of the long-awaited electric pickup's journey to customers. This initial batch aligns with Tesla's typical approach for product launches, as the company anticipates ramping up production to reach a target of 5,000 units per week by 2025. The event and subsequent production increase come after years of anticipation and development for the Cybertruck.

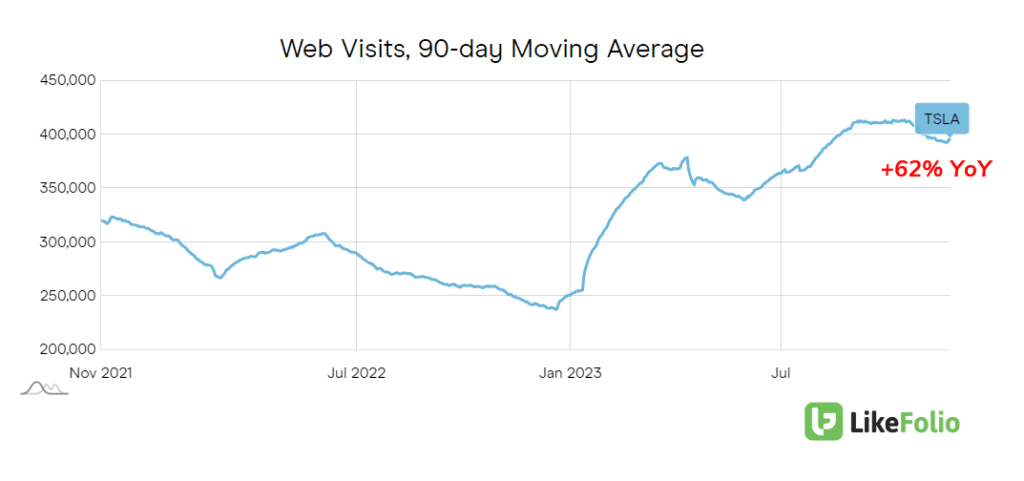

Tesla's digital footprint has expanded significantly, with web visits showing a staggering 62% year-over-year increase.

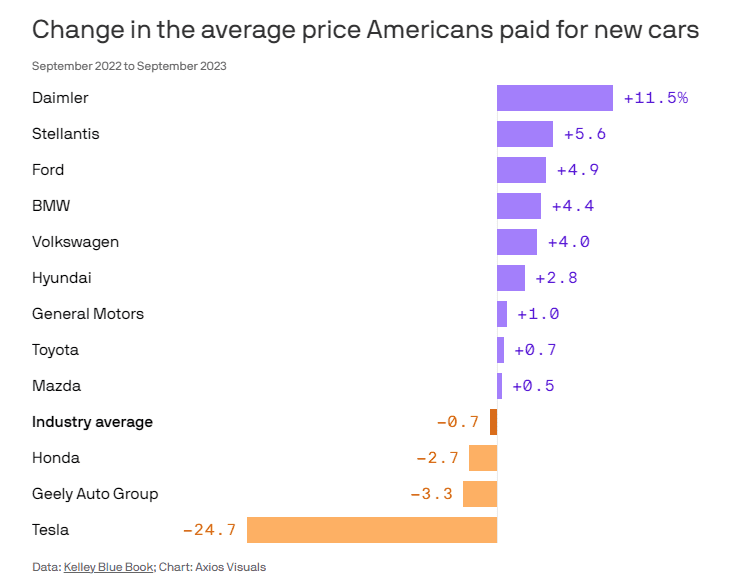

This growth goes hand-in-hand with Tesla's dynamic pricing strategy. Despite reducing prices by nearly 25% compared to September 2022, Tesla has managed to sustain a healthy 18% margin, showcasing the company's ability to balance affordability and profitability.

The Three Pillars Driving Tesla's Path Higher

Our continued bullish outlook on Tesla is anchored in three key areas:

- EV Price Parity: Tesla's strategic pricing adjustments have enabled its electric vehicles to directly compete with traditional internal combustion engine vehicles in terms of affordability and appeal. The Model 3, priced at a competitive $28,000, is particularly noteworthy, offering an attractive option that rivals the cost of mainstream ICE models.

- Supercharger Network Expansion: Tesla's Supercharger network, utilizing the North American Charging Standard (NACS), is a significant differentiator in the EV market. The adoption of NACS by other major automakers, slated for 2025, will further elevate Tesla's charging infrastructure, enhancing its convenience and accessibility.

- New Product Excitement: The Cybertruck has generated a wave of excitement, with mentions increasing by over 500% year-over-year. This enthusiasm points to a potential new growth avenue for Tesla, further solidifying its market position.

Navigating Challenges: Recognizing Opportunities Amidst 'Noise'

Despite these growth engines, Tesla and its leader, Musk, have been in headlines recently for different reasons:

- Legal Action in Sweden: Tesla's lawsuit against the Swedish Transport Agency, a move to streamline new-car registrations, is a response to logistical challenges and labor disputes in Sweden.

- Labor Dispute: The ongoing labor dispute involving Tesla mechanics in Sweden, revolving around a collective bargaining agreement, affects around 130 employees across seven facilities. This situation demands careful management to ensure continued operational efficiency.

- Twitter Drama and Musk's Visibility: Elon Musk's recent visit to Israel and the ensuing controversy underscore the challenges of managing public perception, especially given Musk's high visibility and his association with Tesla. This situation has a nuanced impact on Tesla's brand sentiment, with TSLA happiness registering at 57% positive, a 4% drop year-over-year. However, this contrasts with the actual user sentiment ratings for the Model 3 and Model Y, at 66% and 67% respectively.

But any negative backlash for headlines like these may serve as opportunity fodder for long-term investors who believe in Musk’s vision.

Bottom Line

Tesla's journey from a bold LikeFolio prediction to a market leader exemplifies the power of data-driven insight and strategic agility. Tesla continues to navigate market dynamics and external challenges, transforming them into opportunities for sustained growth and innovation. The company's ability to adapt and evolve makes it a compelling case for investors and industry watchers alike.