Drinker’s tastes and priorities are shifting in a major way. […]

The big winner of the Bud Light meltdown

Have you moved on from the Bud Light advertising controversy that had everyone talking?

No?

You’re not alone.

We at LikeFolio have been keeping our ears to the ground, listening to consumers and analyzing the data to understand the real impact on purchasing behavior.

The Bud Light Backlash

A quick refresher: Bud Light faced a significant backlash after a controversial ad campaign featuring a trans influencer, leading many loyal BUD drinkers to reconsider their choices. We previously highlighted how Coors Light (TAP) seemed to be the primary beneficiary of this controversy. But what's the situation now, a few months down the line?

The Sentiment Shift

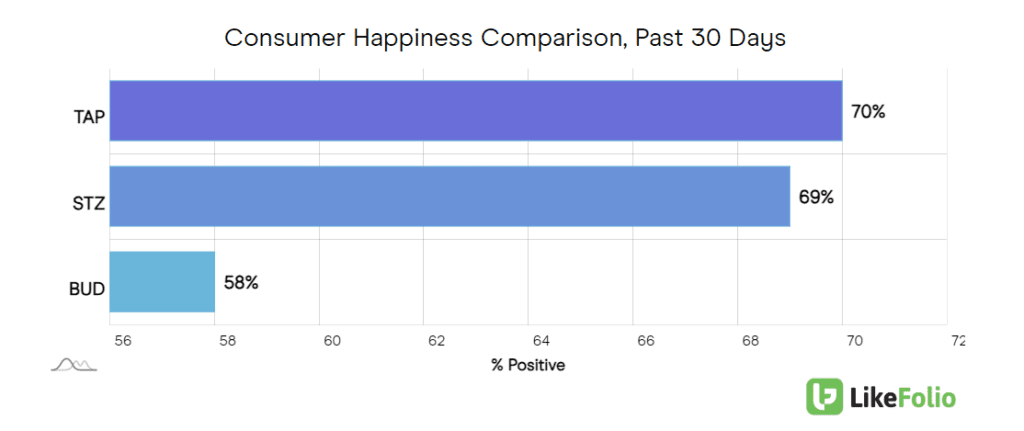

Our latest chart [sentiment] paints a clear picture. BUD's happiness rating has plummeted to a dismal 58% positive, a significant drop from its pre-controversy high of 76%. This is historically low for an alcohol brand, and it's evident that the controversy has left a lasting mark.

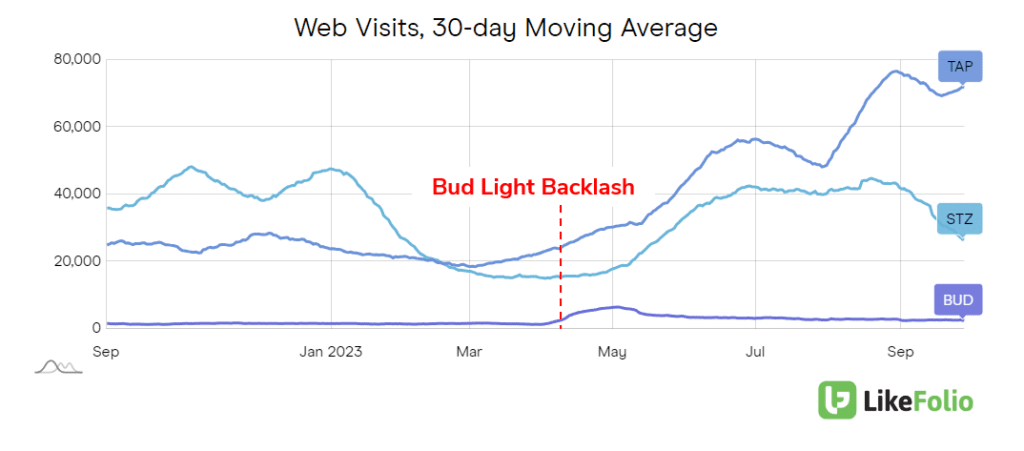

Interestingly, web visits indicate a massive shift towards TAP, specifically Coors. While both STZ and TAP saw an initial bump post-controversy, TAP's momentum is undeniable.

The company’s web visits have skyrocketed by over +130% YoY. This surge, combined with a high happiness rating, suggests that many consumers have permanently switched allegiances.

Breaking Down the Brands

So -- how are we playing each of these names from here? We broke it down nicely for you. Each name is ranked according to consumer momentum. Unsurprisingly, we'll kick off with Molson Coors...

- TAP (Molson Coors Beverage Company): Bullish

- Overview: TAP is a major multinational brewer, slightly smaller than BUD. They offer a mix of traditional and modern beverages.

- Top Brands: Coors Light, Miller Lite, Blue Moon Belgian White, and more.

- Growth Drivers: Significant growth in core brands, especially Coors Light and Miller Lite. Their "Made to Chill" campaign and a diversified marketing approach have been game-changers.

- LikeFolio Take: TAP has a golden opportunity to capture a significant portion of lite beer drinkers. Our data supports a bullish outlook for the brand.

- STZ (Constellation Brands): Neutral

- Overview: STZ is known for its premium beer and wine brands and has diversified by investing in the cannabis industry.

- Top Brands: Corona Extra, Modelo Especial, Pacifico, and more.

- Growth Drivers: Strong growth in their beer business, with a focus on high-end Mexican beer brands.

- LikeFolio Take: While Mexican beer is trending, our metrics suggest a slowdown in growth for STZ.

- BUD (Anheuser-Busch InBev): Neutral

- Overview: BUD is the world's largest brewer with a vast portfolio and a global expansion strategy.

- Top Brands: Budweiser, Bud Light, Stella Artois, and more.

- Growth Drivers: Strength of its brand portfolio, global footprint, and a focus on long-term investment.

- LikeFolio Take: BUD has a long road to recovery. However, its global presence and recent financial performance indicate potential for a comeback.

The Final Pour

In conclusion, while BUD and STZ are under the microscope, TAP is the one to watch. The market might be underestimating its potential, and we're excited to see how this beer battle unfolds. Cheers! 🍻