JetBlue (JBLU) Enters the Bookings Space JetBlue Airways (JBLU) made […]

These airlines are best of breed, according to consumers...

Travel Update: Airline Earnings

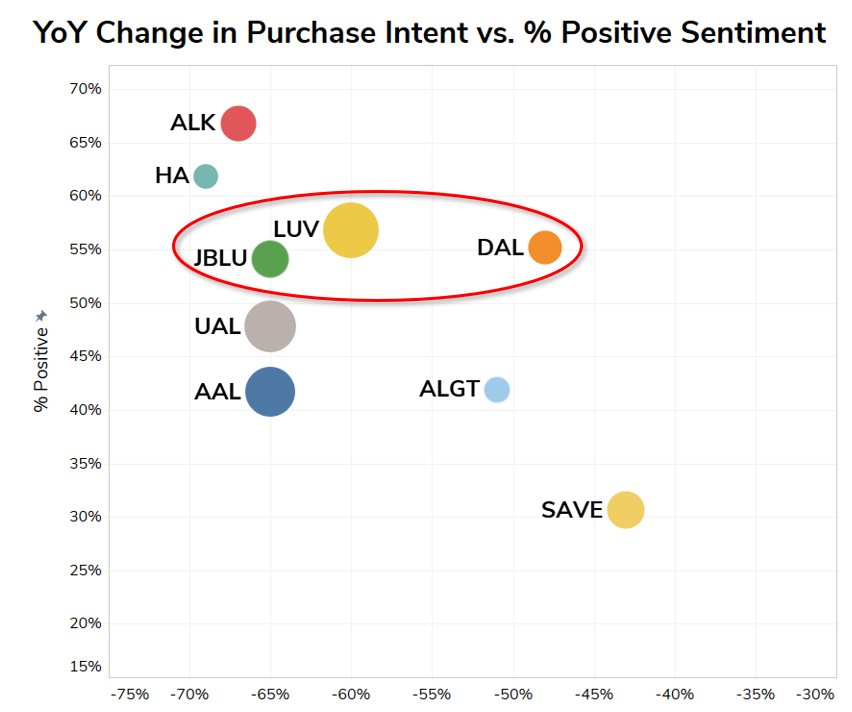

It's time for the airline industry to report 20Q4 earnings, and Delta is the first on deck. As an investor, how do you approach the uncertainty of Airlines? One strategy is to separate best of breed from the rest of the pack. The chart below is the view we're monitoring, because it captures 3 key elements: Purchase Intent Growth, Consumer Happiness, and how each airline stacks up.

What are our takeaways? 1. Flight demand remains lower YoY across the board...demand in every airline we track decreased by at least double digits in the last quarter. TSA confirmed this: during the last two weeks of 2020, TSA screened > 1 million passengers per day on average a -57% YoY decrease, but better than July 4: -73% YoY. 2. When considering Purchase Intent decline AND sentiment, a "sweet spot" emerges. These names aren't experiencing the highest amount of demand decline, and happiness is relatively elevated. These are circled on the chart, and are top performers, comparatively. 3. Avoid the losers. Some names have consumer sentiment so low, or demand drops so high that we wouldn't want to bet on them in the immediate future. We're looking at you AAL. The bright spot? Pent-up travel demand is palpable. As factors outside of airline control (lockdowns, vaccine updates, etc.) begin to fade, we've got our watch list ready.

Dropbox (DBX)

Last month, we noted that Dropbox (DBX) was starting to show some year-over-year PI weakness towards the end of the 20Q4 fiscal quarter (ended 12/31/20)…Things aren’t looking better in 2021.

Purchase Intent volume in 20Q4 fell -21% from the prior year, and the rate of decline is accelerating. Purchase Intent Mentions are trending -35% YoY in the current quarter.

DBX shares are trading lower today, following news that the company will be cutting 11% of its workforce.

Now, LikeFolio data suggests...