Airbnb (ABNB) AirbnB is set to report earnings for the […]

This meme has become reality…

The meme that's been making the rounds recently has hit the nail on the head.

It highlights the growing preference of travelers for the traditional hotel experience over the unpredictable service and exorbitant fees of Airbnb. Take, for instance, a recent price comparison conducted by a user:

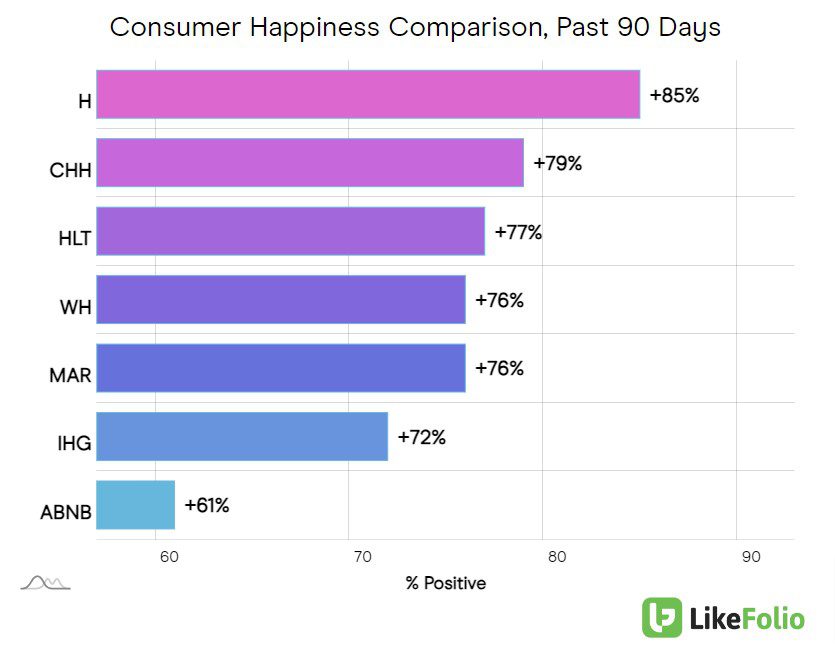

The difference between the pre-fee and post-fee booking costs of Airbnb properties in his locality is simply staggering. This could explain why Airbnb is lagging behind its competitors in terms of consumer satisfaction, as per LikeFolio's Consumer Happiness data.

While every hotel brand scores above 70%, Airbnb lags behind at 61%. This significant gap indicates that customers are less inclined to rebook with Airbnb as compared to hotels.

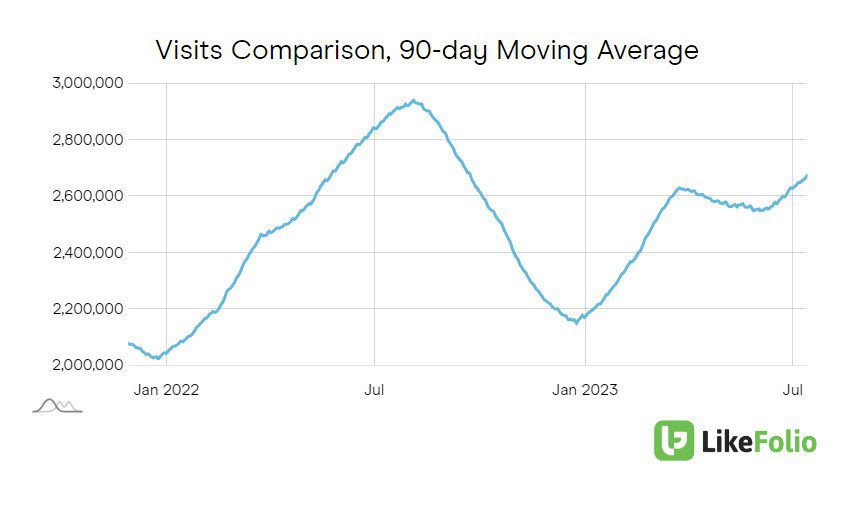

It seems the novelty of Airbnb has faded. Moreover, despite a recent uptick, visits to Airbnb.com are still lower than they were at the same time last year.

The key question that arises is how investors are viewing Airbnb. Are they comparing it to its past performance or considering it as a rival to traditional hotels? Regardless, it's hard to rationalize the 66% surge in Airbnb's stock this year. It's no surprise that investors have been cashing in over the past week, causing the stock to drop nearly 10% from its peak. This suggests that expectations have been tempered. Tonight, we'll see if Airbnb can outperform these reduced expectations.