Tesla reports earnings after the bell on Wednesday. After last […]

Urgent: Q1 Earnings Season Preview

Some of 2023’s biggest trading opportunities are kicking off next week!

Admittedly, we get a bit giddy this time of year. There’s a nice crisp in the air. Resolutions are still holding strong (giving you the benefit of the doubt). NFL playoffs are underway.

Best of all, corporate earnings reports are about to come flooding in—and set the tone for what is sure to be an exciting year in the stock market.

Stocks tend to make some of their biggest moves in the wake of earnings reports. They can be positive or negative, and often spark an extended uptrend or downtrend.

Sales and profits relative to Wall Street estimates are always in focus and often dictate the market’s reaction.

In other cases, management’s outlook for future quarters steals the show.

And if you’re a betting man or woman – or as I call myself, a trader – then you’re drooling right now.

Here are a few examples from last season that showcase just how much earnings reports can move a stock:

- On Nov. 22, Burlington Stores (BURL) posted disappointing Q3 results but gave an upbeat outlook for Q4. The stock ran +24% over the next two days.

- Tesla (TSLA) fell short of Q3 revenue expectations on Oct. 19. It gapped down big on 2x the average daily volume en route to a -54% Q4 slide.

- On Nov. 3, Crocs (CROX) stomped consensus Q3 estimates and raised its full-year guidance. It climbed +27% in the next two days and finished the year at a 9-month high.

Why are corporate earnings releases such a big deal?

Companies reveal key financial results from the last few months and provide updated outlooks.

These revelations can have a huge (and often polarizing) impact on the market’s view.

A classic white paper by the Bureau of Economic Research hypothesized that the days leading up to and soon after earnings announcements tend to be characterized by above-normal volume and wider price swings.

This gives a soon-to-report stock an ‘earnings announcement premium’.

In layman’s terms, when many investors show up to the party to trade on valuable new information, things can get crazy!

Personally, I never show up to a party empty-handed -- and that goes for earnings season too.

On the famous LikeFolio Sunday Earnings Sheet, we boil all of our consumer sentiment data, along with macro trends, to deliver our proprietary LikeFolio Earnings Score – a simple -100 to +100 metric that lets us know if we should be bullish, bearish, or neutral heading into the earnings event.

You can think of it as a “cheat sheet” for the company’s report.

We then take it a step further, implementing bullish, bearish, or neutral options trading strategies.

We love using these strategies because they allow us to take on an appropriate, clearly defined amount of limited risk without having to go long or short on a stock.

The risk reward can be downright magical!

What’s In store for this quarter?

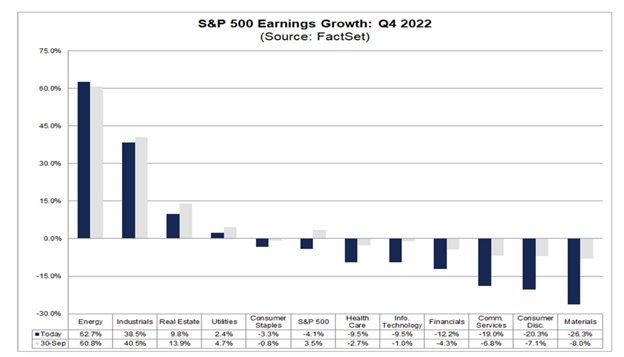

For 22Q4, S&P 500 companies are expected to report -4% lower profits compared to a year prior.

Inflation and rising interest rates are the main culprits, weakening consumer and business demand.

Supply chain snags, higher costs, and foreign currency effects are also at play here.

Remember, the -4% is just an average. There is significant disparity at the sector level.

For instance, companies in the Energy and Industrial sectors are expected to deliver strong YoY earnings growth. Materials and Consumer Discretionary names could struggle.

Overall, though, the expectations bar will be set pretty low.

Some 65 S&P companies have issued negative Q4 EPS guidance compared to only 35 positive.

This is consistent with what we’ve seen in the previous 3 quarters of 2022.

It seems dreary, but with low expectations often come big surprises—and vice versa.

This is what earnings season is all about. Making informed decisions about whether a company will surprise to the upside or downside, or simply meet expectations.

This is what makes these opportunities so potentially lucrative!

A key part of the earnings trade process is to learn from what went right. Repeat what worked well.

For the stuff that didn’t work in your favor, we make adjustments and avoid making the same mistakes.

With that in mind… let’s take a quick look at some critical trades we got right in the last earnings season:

Proof Pudding, if you will

These 3 winners from last earnings season demonstrate what the LikeFolio edge is all about.

We were able to leverage real-time consumer insights to pick companies that looked poised to shock the pants off Wall Street.

In each case, the wins bucked major market trends and expectations. We saw it coming a mile away….

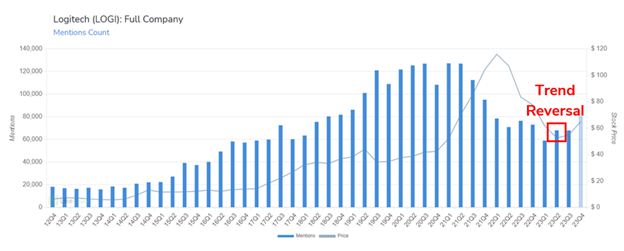

1. Logitech (LOGI): +52% gains

- Week 2 Earnings Sheet

- Earnings Score: +40

- Trader Strategy: Coin Flip Bullish

- Trade Result: +52%

LOGI soared on a report that shocked Wall Street – but not LikeFolio members. The computer peripherals maker showed an improvement in demand from its pandemic hangover and reaffirmed its full-year guidance.

LikeFolio data showed that mentions were rebounding from lows as the company rolled out new products for gaming, hybrid work environments, and digital content creation.

Gamers discussed buying Logitech G gear, PC/Mobile gaming trends were healthy, Q3 mentions were up +15% QoQ, and the stock was trading ~70% below its peak.

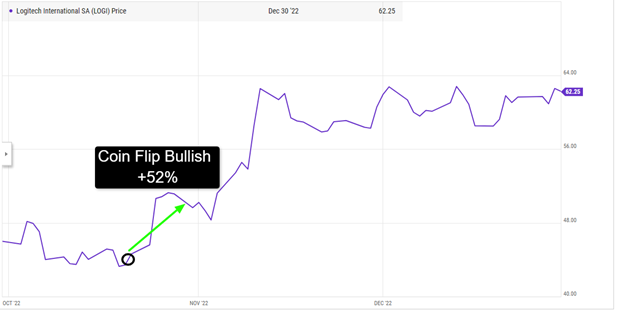

For the “Coin Flip Bullish” trade, we bought a slightly in-the-money call and sold a slightly out-of-the-money call on Monday morning when the stock traded around $45.

When we closed out the low-risk trade on Friday afternoon, the stock was up to $51, and we booked a 52% gain.

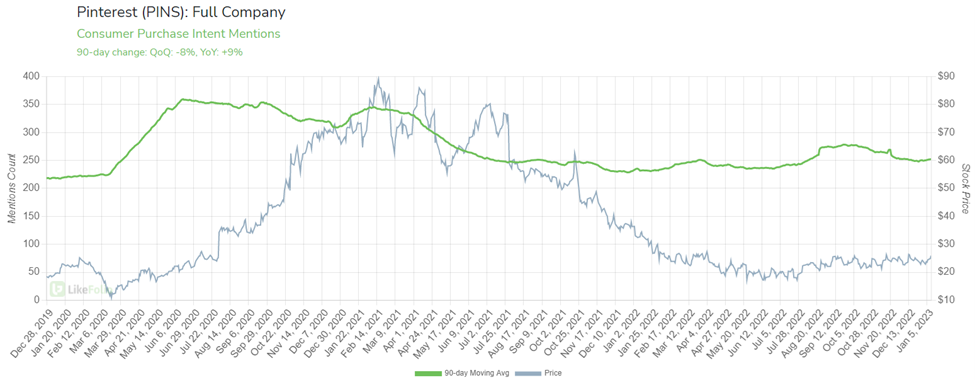

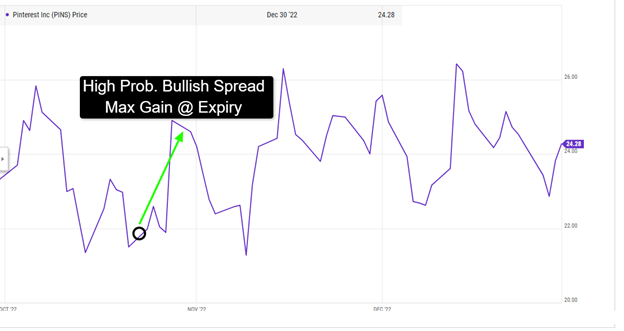

Pinterest (PINS): Max Gain @ Expiry (9%)

- Week 4 Earnings Sheet

- Earnings Score: +33

- Trader Strategy: High Probability Bullish Spread

- Trade Result: Max Gain @ Expiry (9%)

PINS jumped after beating Street revenue and earnings estimates.

The popular crafts and recipes platform operator returned to user growth and noted good progress with monetization efforts.

Purchase Intent Mentions were up 18% sequentially in Q3 and the options market was pricing in a big swing.

Based on our Earnings Score and the surprise success of the Collaborative Shuffles app, we anticipated a positive surprise.

PINS has run 14% since that Earnings Sheet was delivered and appears to have plenty of room to run.

We are seeing a long-term divergence between demand and stock price which could correct as secular tailwinds play out.

For the “High Probability Bullish” Spread, we were confident the stock wouldn’t drop significantly on earnings.

We bought a vertical spread on Monday morning when the stock was at $20.95.

When we closed out the very low-risk trade on Friday afternoon, the stock was up to $24.63, and we booked a max gain of $20 per contract, or 9%…. in just five days.

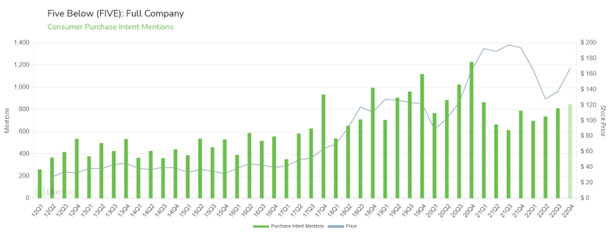

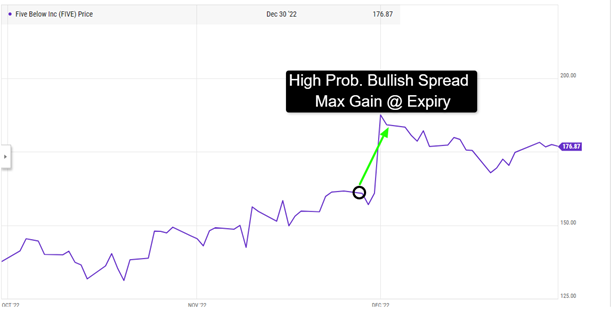

Five Below (FIVE): Max Gain @ Expiry (13%)

- Week 7 Earnings Sheet

- Earnings Score: +20

- Trader Strategy: High Probability Bullish Spread

- Trade Result: Max Gain @ Expiry (13%)

FIVE surged after its Q3 results easily bested market expectations and outperformed “discount peers” like DG and DLTR.

Both ticket and transaction data strengthened during the period and Five Below aggressively added to its store count despite the tough macro backdrop.

Comprehensive demand was up 37% YoY in Q3, and Consumer Happiness was a healthy 70%, so we weren’t surprised about the beat and management’s explanation.

Value-minded consumers continue to discuss shopping at Five Below and given the store’s relevance in an inflationary environment, the next few earnings reports could be good too.

For this High Probability Bullish Spread, we bought a significantly in-the-money call and sold another ITM call at a slightly higher strike on Monday morning when the stock traded around $164.

When we closed out the very low-risk trade on Friday afternoon, the stock was above $184, and we booked a max gain of $95 per contract, or 13%… again, in just five days!

But enough about last quarter – let’s get into the meat of what’s coming up.

And what better way to kick off a big earnings season than with the king of streaming, Netflix (NFLX)?

Earnings Sneak Peak – NFLX

Earnings season kicks off this week, with Netflix as the headliner.

Netflix shares have been on a tear.

And we’re asking ourselves the same question as everyone else: With the stock up over 100% since May 2022, are they too hot to touch as an earnings play?

Not for us…

Here’s what we’re watching:

In recent quarters, Netflix has benefited from management’s efforts to increase pricing, eliminate account sharing, and the addition of new revenue streams (namely advertising).

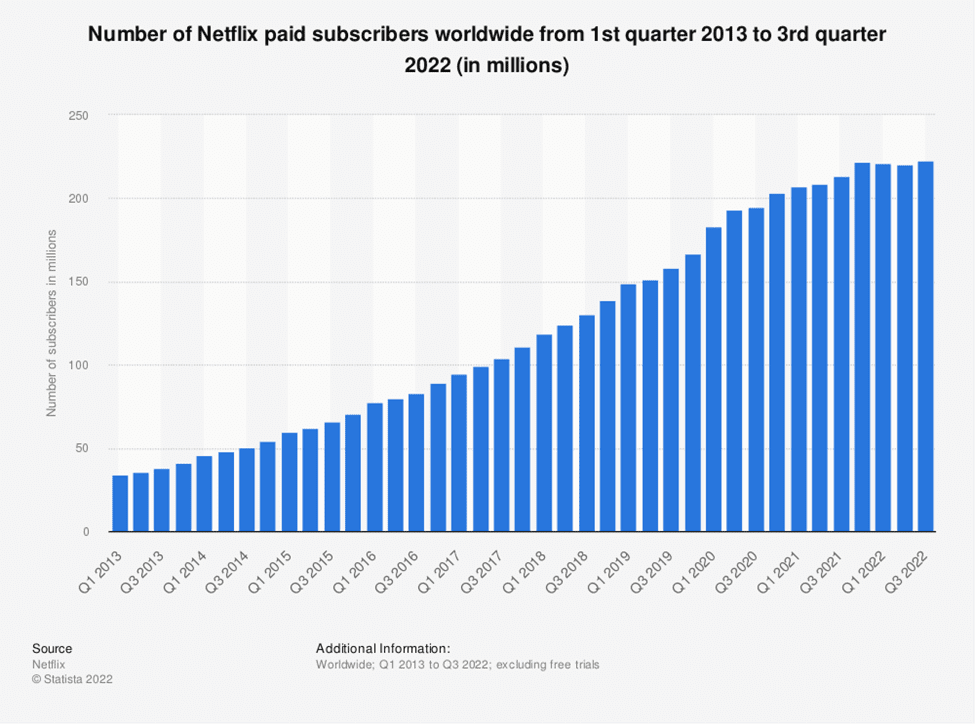

And the company has a large task at hand: solve its slowdown in user growth and prevent an embarrassing repeat of 6 months ago first subscriber loss in more than a decade.

In the chart above, note the plateau in paid subscribers over the last 4 quarters.

Yes, Netflix is still the market leader, but it’ll need to demonstrate growth to justify its still lofty valuation.

These are the 3 metrics we’re dialed into ahead of this week’s report:

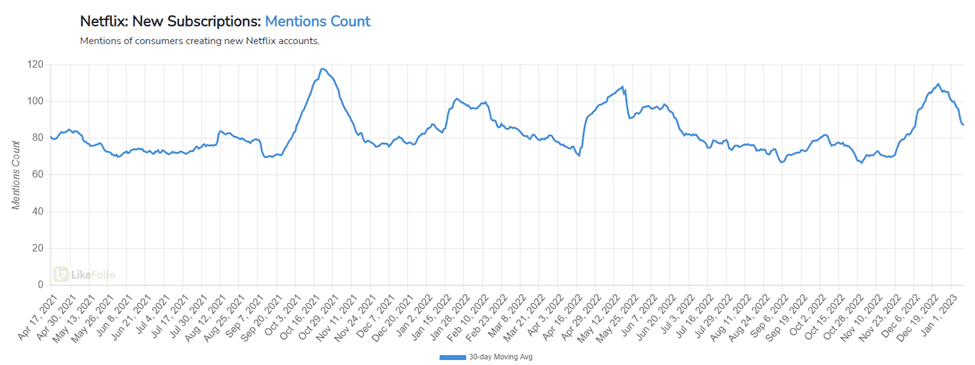

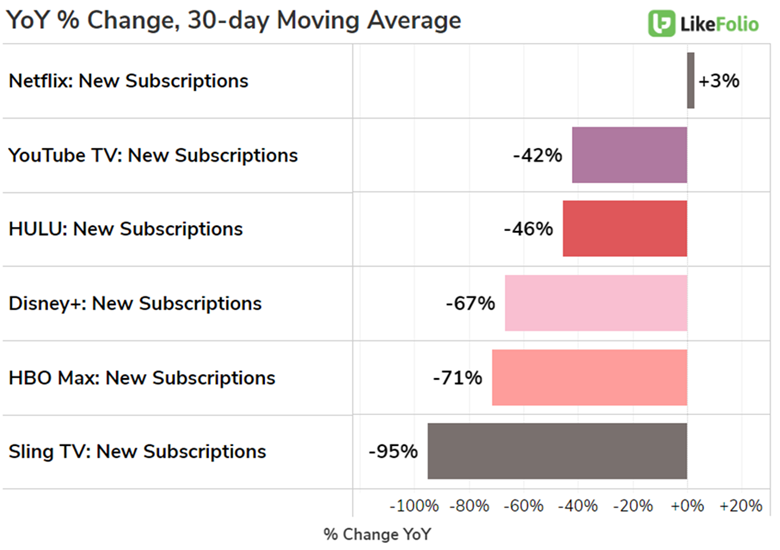

#1 Netflix New Subscribers: These are up YoY (and a green flag)

Netflix subscription mentions have improved among English speakers since the company’s launch of an ad-supported tier—a positive development.

New subscription mentions increased +3% YoY.

But the more striking takeaway: Netflix’s new subscriptions rate is much better than those of streaming peers like Disney+ and HBO Max which saw massive drop-offs in new subs (-67% YoY and -71% YoY, respectively).

We like this competitive edge…but will +3% be enough?

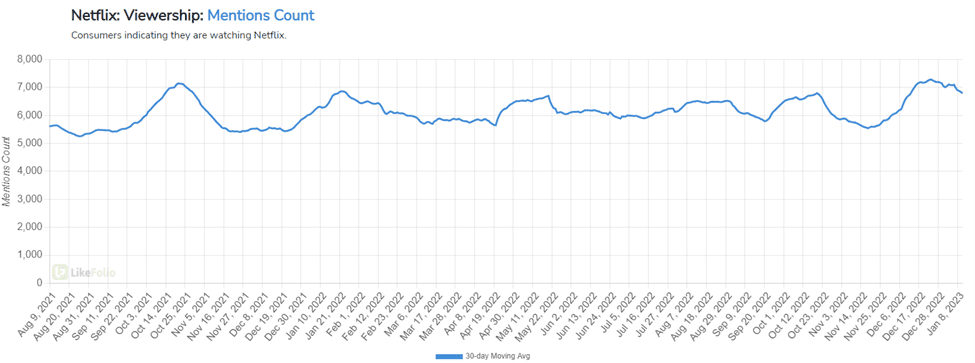

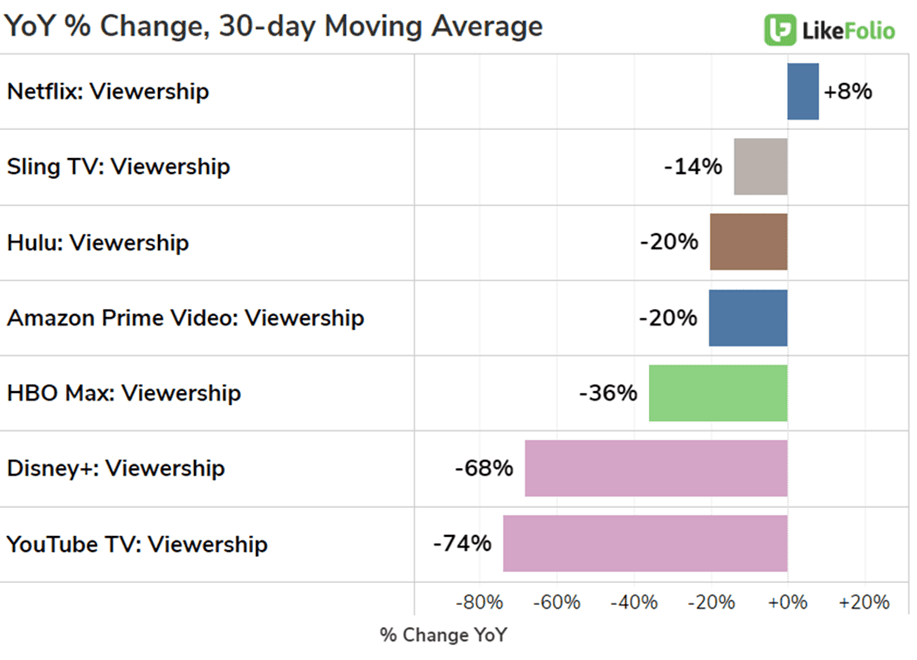

#2 Netflix Viewership: This is Rising YoY (another green flag)

The number of eyeballs on Netflix content is rising - currently up +8% YoY.

Better yet, the rise in Netflix Viewership is outpacing sorely lagging peers.

But a dive into the cancellation mentions to learn what’s driving the increase reveals a pair of interesting drivers:

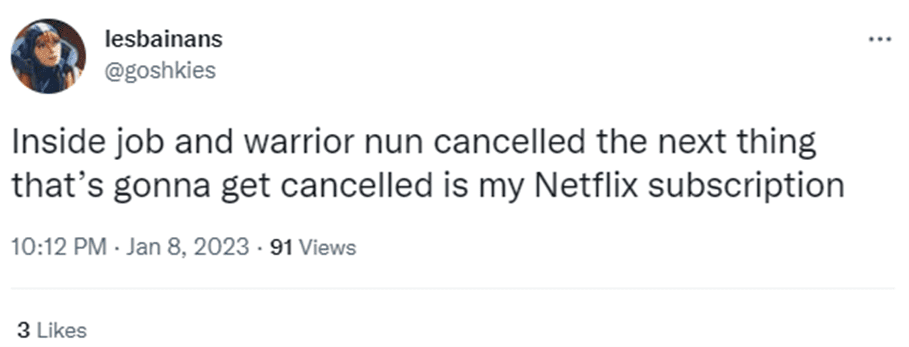

1) An army of Warrior Nun followers were very upset that Netflix canceled their beloved series. Blasphemy!

2) The Megan & Harry Documentary was extremely politicized. It became Netflix’s most-viewed documentary series ever, landing in the top 10 in 85 countries and racking up 28 million household views in the first week. But polarizing, nonetheless.

While these audiences were loud, our data analysis leads us to believe the cancellation trend is likely exaggerated… especially given Netflix’s clear outperformance among peers in terms of overall viewership and customer enthusiasm.

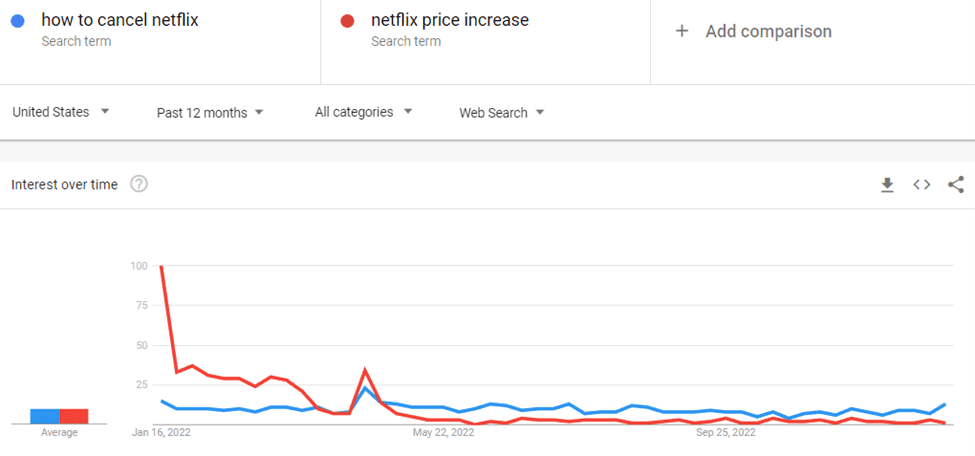

Google Trends also suggests a relatively flat cancellation season and low complaints from a Netflix pricing perspective.

So, while the streaming space is getting crowded, 2 of the 3 most important industry metrics show that Netflix is in the driver’s seat.

Bottom line: Much of Netflix’s recent success is built on investor speculation related to the potential upside to ads and the company’s success in generating and keeping subscribers.

Early indications show its ad tier and new content are attracting new viewers, while new content keeps existing users around, for now…but the bar is very high.

What should traders take from this?

As a trader, it’s important to define your risk well always but especially with NFLX—and especially as the shares hover near a critical support level.

This earnings report will likely send the stock much higher or much lower, depending on the financial results, user metrics, and expectations.

NFLX is a prime example of how earnings can whiplash a stock in one direction or the other.

A couple of potential ways to play the Q4 report:

- High Probability Bullish Spread - This takes a slightly bullish stance and lets you make money even if the stock moves against you in a “normal” range.

- Coin Flip Bullish – A bit more aggressive bullish trade that targets a risk-to-reward ratio of approximately 1:1…. If the stock goes higher, you’ll make a 100% return on your money… all while strictly defining the risk that you take to as little as $250.

Check out our Better Trading video series to learn more about how to implement these and other strategies this earnings season.

Key Points to Remember:

- Earnings season presents some amazing opportunities for both short-term traders and long-term investors.

- Sales and profits relative to expectations are often the biggest factors, but a stock’s post-earnings direction can stem from management’s comments, forward guidance, or any number of other company or industry factors.

- Being prepared with LikeFolio’s unique consumer sentiment data can enhance your chances of success.

Welcome to our Earnings Season party.

Happy Trading!