Nike reported an awesome quarter Tuesday evening. The stock is […]

Who is the next big brand in athletic streetwear?

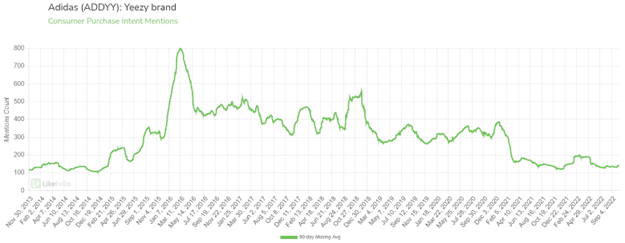

| For years Nike has dominated the athleticwear market…specifically when it comes to shoes. The last time we saw serious competition was peak-Yeezy, circa 2016. |

| Now, another name in athletic streetwear is clawing its way to the top, at least in the hearts of consumers: Puma. |

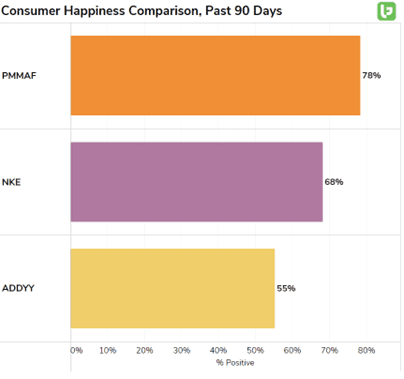

Although Puma has a lower level of Consumer Mention volume in comparison to Nike and Adidas, it boasts the highest levels of consumer happiness. And demand is growing rapidly.

Here’s why we think Puma is setting itself up for major growth:

Consumer Demand is Climbing…Quickly

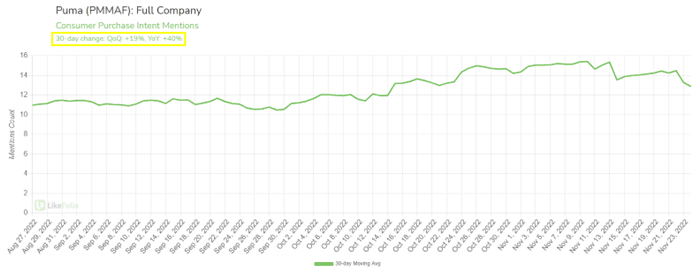

| Consumer mentions of purchasing Puma are rebounding off last year’s pandemic low, currently trending +40% higher YoY. Conversely, Puma’s stock is down more than 50% over the last 12 months. |

What’s driving this demand growth?

- The World Cup is ushering in fresh attention. Puma is a kit sponsor for 6 countries in the world cup (Ghana, Morocco, Senegal, Serbia, Switzerland, and Uruguay). For reference, the next largest sponsor, Adidas is kitting 7 countries, with Nike leading at 13.

- Puma is producing specialty shows for high-performance athletes. The Nitro brand is popular among track & field athletes while the Lamelo Ball basketball shoes sell out fast. The rollout of sports-based NFTs and Roblox games are expanding Puma’s audience.

Puma is Generating Positive DTC, Retail Sentiment

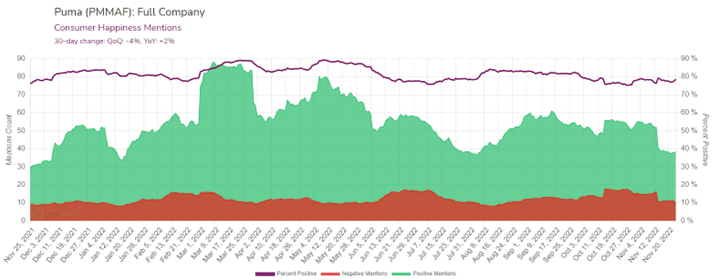

| Over the past month, Puma’s consumer happiness level was 79% positive, up +2% on a year-over-year basis. |

| Much of this can be attributed to the brand’s eCommerce fulfillment standards. E-commerce customers love Puma’s product quality, fast delivery, and customer service. The Puma app that recently launched in the U.S. has a 4.9-star rating in the App Store. Brick & mortar retailers such as Foot Locker and Famous Footwear are providing positive feedback and driving a strong order book. |

Sports Participation is on the Rise

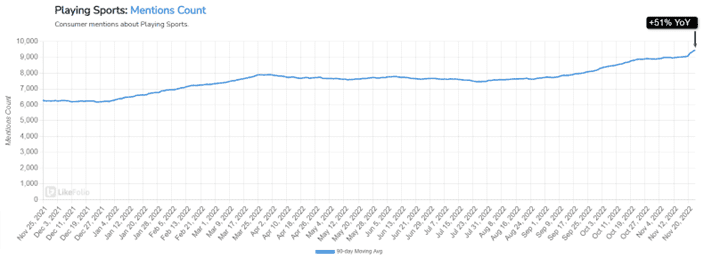

| Consumer mentions of playing sports are up +22% QoQ and +51% YoY on a 90-day moving average. |

Global health and wellness trends and the need for social interaction post-Covid are drawing people to team and individual sports.

In addition, increased social acceptance of ‘comfortable style’ is driving demand for casual athletic attire…athlete or not.

The Bottom Line

- The crossover of sports and fashion is a powerful apparel industry trend. World-famous athletes are increasingly taking to social media to showcase the latest footwear and clothing of their favorite brands. This combined with a pandemic-led shift towards casual, comfortable clothing is expanding the market for fashionable athleisure wear among athletes and non-athletes alike.

- Germany-based Puma is at the intersection of sports and pop culture. Its high-performance products are becoming increasingly popular among soccer, running, basketball, golf, and motorsports athletes as well as consumers interested in sport-inspired lifestyle gear. The 5 billion+ viewers expected to tune in for the 2022 World Cup should increase soccer cleat and jersey demand and could create a ‘halo effect’ that improves sales of other merchandise. Puma’s sustainability strategy focused on recycled materials stands to appeal to Gen-Z shoppers and further broaden its customer base.

- Puma posts solid sales and profit growth despite the tough macro backdrop. Sales were up 17% in 3Q22 led by strong sneaker sales — and despite a sharp slowdown in China. Higher raw materials costs and freight rates limited profit growth to 2%, but these issues are expected to improve over time. Supported by healthy demand trends, management backed its full-year outlook for currency-adjusted ‘mid-teens’ percentage sales growth.

Like other athletic apparel retailers, Puma continues to be challenged by supply chain constraints which, along with commodity inflation and higher freight costs, are expected to limit profitability. Industry players are also working through an inventory glut and markdowns that will likely weigh on near-term results.

But it looks like the company is gaining momentum…

This could be a big win for long-term investors.