United Parcel Service (UPS) After two quarters of explosive demand […]

Why are Precious Metals are Selling Off Today?

Why are Precious Metals are Selling Off Today?

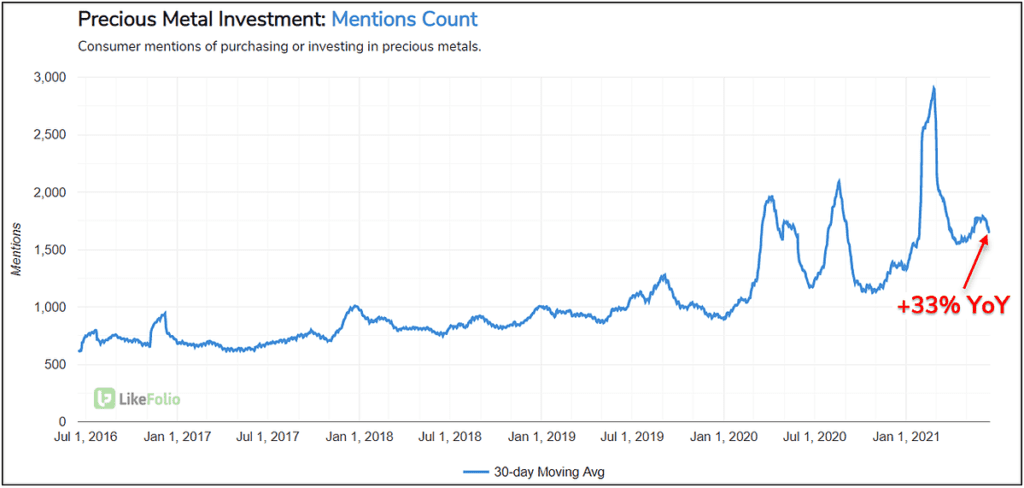

Since 2 p.m. yesterday, Gold and Silver Futures have plummeted lower, -4.8% and -6.8% respectively…So, what prompted the move lower? In short, the results of the Fed’s FOMC meeting yesterday, but that’s not the full story. Retail traders have been showing elevated investment demand for precious metals since early 2020– Now, Mentions of purchasing and investing in gold/silver/platinum are holding steady at a higher level, up +33% YoY on a 30-day moving average.

Interest in hard assets, like PMs, has been rising largely due to inflation concerns, and those fears are at an all-time high level according to LikeFolio data. However, the recent move was not prompted by retail traders. In the 30 minutes between the end of the FOMC meeting yesterday and the start of Chairman Powell’s speech, ~18,000 silver contracts and ~50,000 gold contracts were sold on the COMEX -- That amount of metal represents a significant portion of an entire year’s mining supply (5-10% for both). Such reckless sell volume is a hallmark of the small pool of banks who control the precious metals market (by virtue of holding the most metal on the exchange), and they had their own fears soothed by the Fed's assurances yesterday.