Ulta is Making Strategic Moves ULTA is gaining momentum in […]

Will Cosmetics Demand Propel ULTA Higher?

Last year we noted an unsurprising shift: consumers wore (and bought) less makeup when they were stuck at home and avoiding social activities. In 20Q3, Ulta net sales fell nearly -8% YoY and its Ultamate rewards member growth fell -6% YoY. While the skincare segment grew, it wasn't enough to offset traditional cosmetic and beauty services' weaknesses. Now things have shifted.

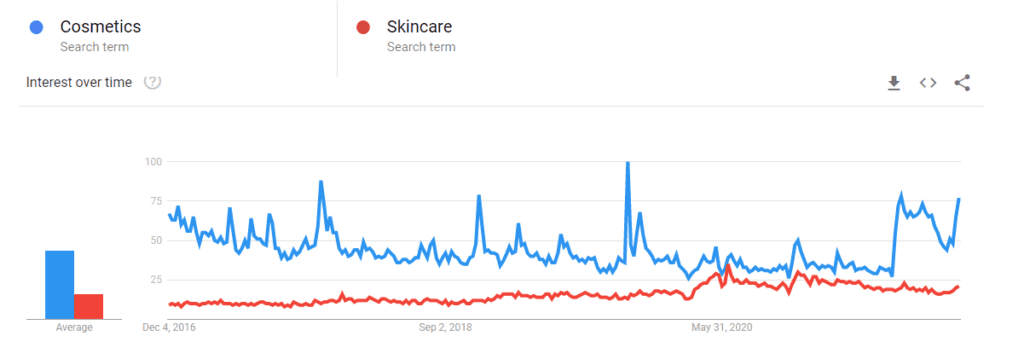

Note the resurgence in consumer searches for cosmetics. While skincare searches remain higher vs. 2019, the priority for consumers is clearly swinging back the other way.

We can see this reflected in near-term momentum for many trends in the LikeFolio universe.

- Store Traffic is Increasing: Mentions of visiting an Ulta store have increased +22% QoQ.

- Digital Demand shows Stickiness: Ulta digital purchase intent mentions remain +11% higher vs. 2019

- Ulta Makeup Demand is Coming Back: Mentions of purchasing Ulta cosmetic products have increased +12% QoQ

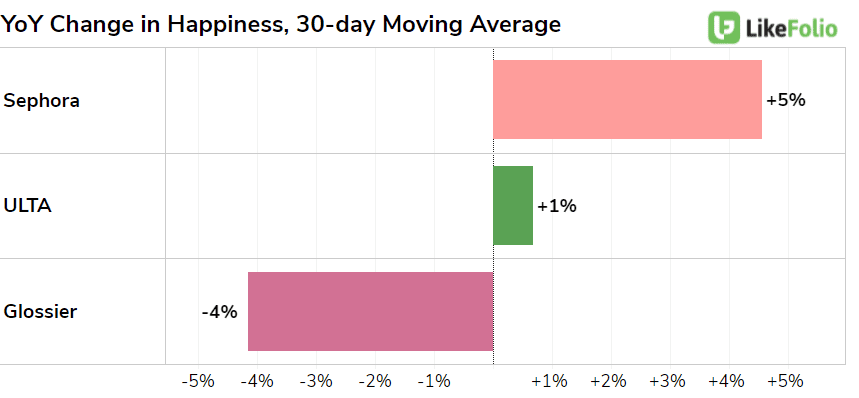

In fact, Ulta and Sephora are recording a Happiness boost vs. digital-only peer Glossier as consumers return to stores.

While Sephora's happiness is boosted by rising consumer demand for Fenty beauty products, app store downloads show Ulta remains the top downloaded app in the beauty space. Long-term, we'll be watching for the success of Ulta's partnership with Target, digital acceleration via same-day delivery, as well as continued product expansion (including Olaplex products). ULTA reports 21Q3 results Dec. 2 after the bell.