United Parcel Service (UPS) After two quarters of explosive demand […]

Will UPS Be Impacted By Rising Fuel Prices?

UPS is set to report earnings before the bell on Tuesday, April 26th.

The shipping & receiving and supply chain management firm has already benefitted tremendously from the pandemic, with lockdowns resulting in more deliveries and extensive demand for companies like UPS.

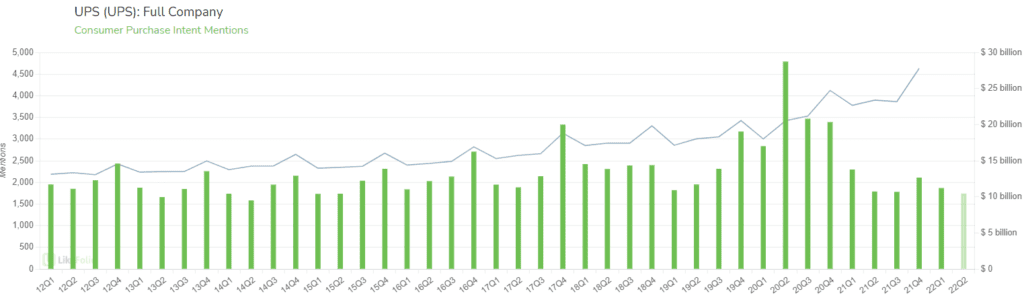

In the LikeFolio universe, 20Q2 was the best recorded quarter for UPS Consumer Purchase Intent.

However, things haven’t exactly been smooth sailing since…

Purchase Intent has faltered lately, closing the first quarter at -12% QoQ and -19% YoY.

Historically, UPS’ revenue (represented by the blue line in the chart above) tends to spike in the fourth quarter due to the holiday season, and last quarter was no different.

However, all LikeFolio metrics for the current quarter are about flat.

The company beat earnings and revenue expectations last quarter, and its shares are now trading lower.

Even though more people are inclined to purchase goods online due to behaviors learned during the pandemic, the company is now facing headwinds in the form of rising fuel prices and inflation.

This caused UPS to hike its fuel surcharge recently.

Investors will need to consider how much those headwinds, along with declining demand, impacted the company’s Q1.