A Promising Public Offering: DUOL Duolingo, a provider of language […]

3 Positive Signs for Duolingo

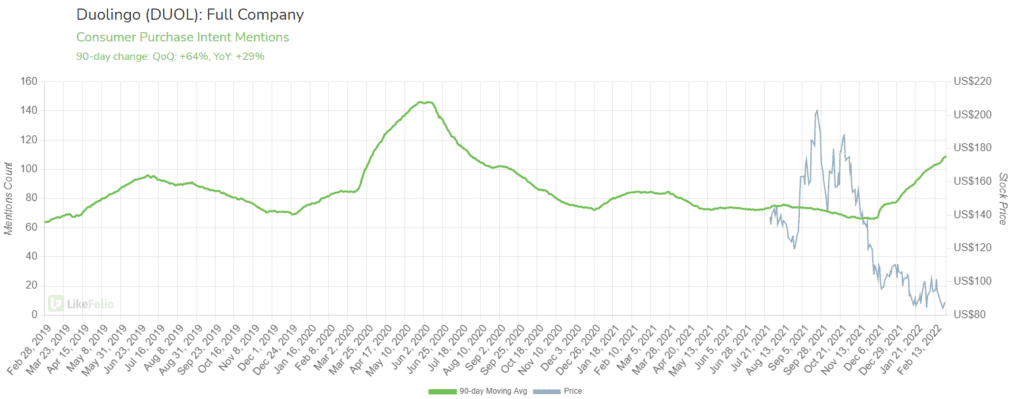

Duolingo shares are down significantly since their September 2021 highs.

Nevertheless, despite the decline, the company, which has a language-learning website and mobile app, could be in-line for a positive move, according to LikeFolio data.

Here are three reasons why:

1. Purchase Intent - Consumer Purchase Intent mentions are one of the first and most significant things we look at here at LikeFolio. Is the consumer demand for the business and its product high or moving higher?

When it comes to Duolingo, it most definitely is, with Consumer Purchase Intent Mentions trending +64% QoQ and +29% YoY.

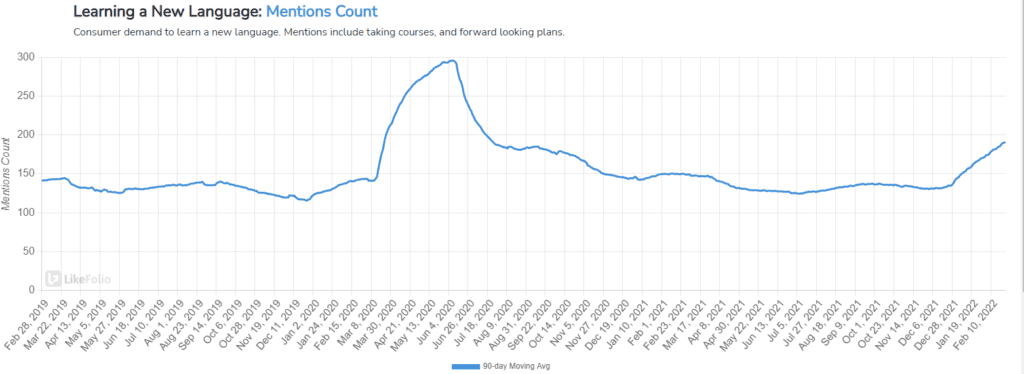

2. Learning a New Language - Talk of wanting to learn a new language is also rising both yearly and quarterly.

One thing you may notice is the Learning a New Language mentions chart looks almost identical to Duolingo’s purchase intent mentions.

Of course, the desire to learn a new language is where it all starts for Duolingo customers and will help fuel the company’s growth. LikeFolio data shows that consumermentions of Learning a New Language are up +46% QoQ and +27% YoY.

3. Paid Subscriber Growth -According to Statista, Duolingo had 900,000 paid subscribers in 2019, which grew to 1.6 million in 2020.

Fast forward to its latest earnings release which was for Q3 2021, and the company reported 2.2 million paid subscribers, an increase of 49% from the prior-year quarter.