Roku makes streaming devices that allow its customers to stream […]

Amazon is Threatening DoorDash Dominance ($AMZN, $DASH)

July 7, 2022

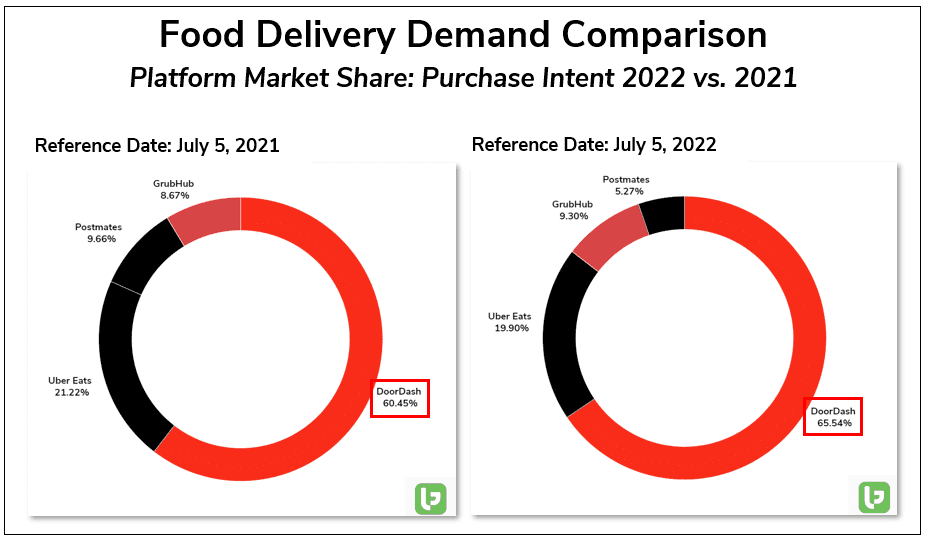

| In the LikeFolio office, food delivery is part of our company culture. What started during the pandemic cemented into an office ritual. Every Friday we pick a location and have lunch Door-Dashed in for the team. It’s so commonplace that “Door-Dashed” has become a verb. Almost like “Ubering” downtown to a concert. And if you’ve been following along over the last couple of years, it shouldn’t be a surprise that DoorDash is the verb of choice here. Not Uber. Not Postmates. And not Grubhub…. Yet, that is. DoorDash Commands Overwhelming Market Share in Food Delivery We analyzed the total market share of demand mentions for the top 4 players in the food delivery scene over the last 5 years. And what DoorDash has accomplished is nothing short of remarkable. In 2017, DoorDash held less than 10% of food delivery mentions, trailing Uber Eats AND Postmates when it came down to consumer conversations. But since then, the platform’s popularity has exploded. In fact, DoorDash has continued to grow its piece of the food delivery pie each year since, expanding its majority of demand mentions by +5 points over the last year to nearly 66% of food delivery demand mentions. |

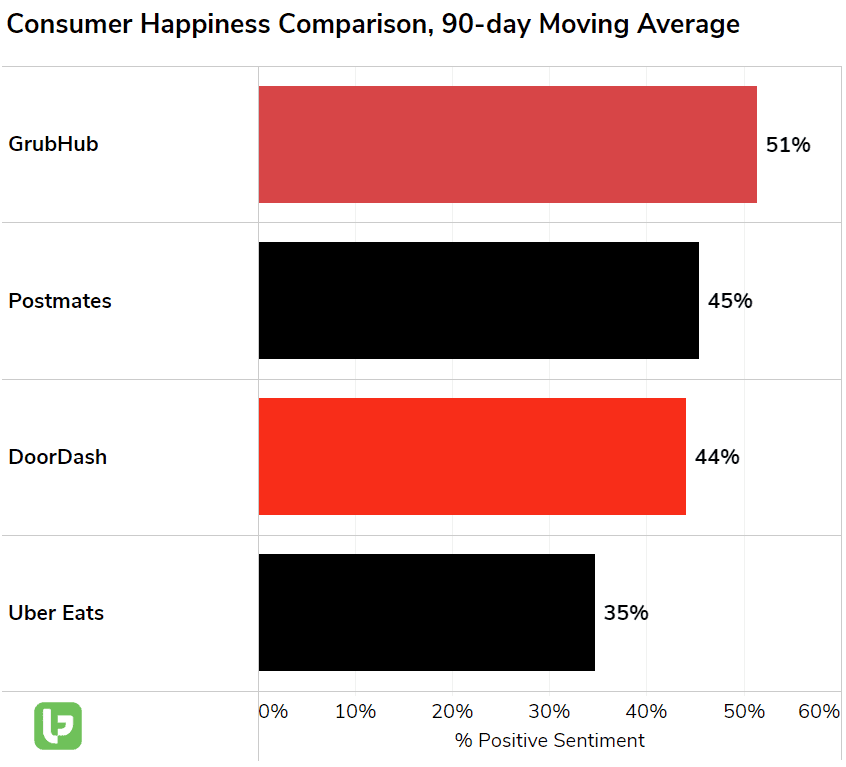

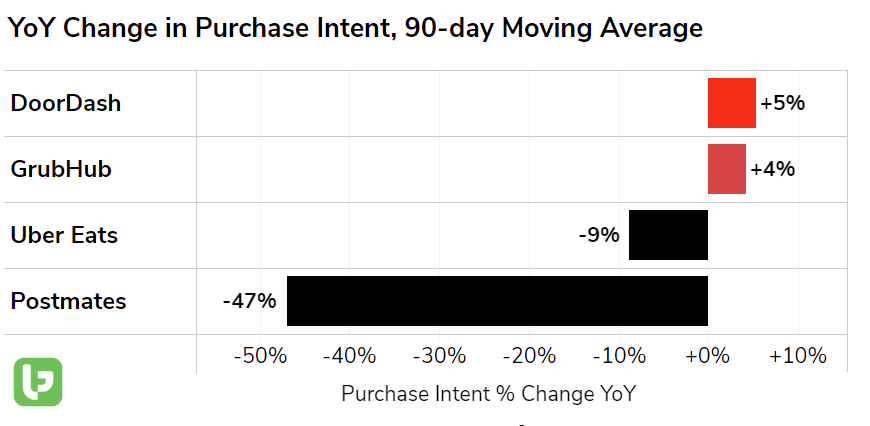

| But recent news may threaten DoorDash’s path to total domination. Amazon's Backing of Grubhub is a Major Offensive move for the eCommerce Giant Earlier this week, Amazon announced a 2% stake in DoorDash competitor, Grubhub… conveniently just ahead of the company’s annual Prime day(s) shopping frenzy. Amazon Prime members will now get Grubhub+ (typically $10/mo) for free. This means, if you have an Amazon Prime account, you now can use it to access free food delivery. (Don’t get too excited, you still have to pay for the food). But this move seriously threatens an area in which DoorDash thrives: its DashPass subscription. Last quarter, DoorDash noted all-time highs in its DashPass subscription base. But will users stick around if they get the same service as part of their Prime Membership? Yikes. It’s something we will be tracking very closely. In addition, Amazon’s interest in Grubhub specifically makes sense. Uber already scooped up Postmates via acquisition in 2020. According to LikeFolio data, Grubhub holds the highest consumer happiness vs. all other food delivery players. |

| Grubhub was the only platform other than DoorDash to record YoY demand growth: +4% YoY. But speaking of Uber… Uber Seriously Dropped the Ball Not only does Uber Eats hold the lowest level of consumer happiness, but Uber Eats and Postmates are recording significant declines in consumer demand over the last year. |

Looking ahead, we’ll be keeping a close eye on all of the major platforms in this field.

Revenue in the online food delivery segment is projected to reach $343.8 billion in 2022.

And the take rate may be seriously shaken up for the players involved….