Black Friday and Cyber Monday -- this upcoming weekend is […]

A Warning Sign from Consumers

October 25, 2022

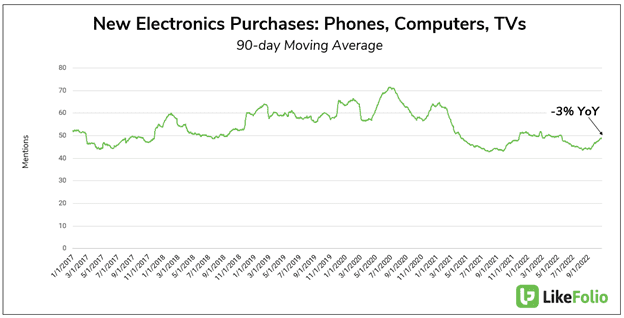

| We like it when the stars align – not in the astrological sense. But when consumer macro trends begin to cool off or explode alongside company demand in related sectors, we know we’re on to something. Essentially, consumers are shifting their behavior…and this action is having a direct impact on company sales. In light of record-breaking inflation, we’re watching to see HOW consumer behaviors may begin changing. We’ve already hit on the “trade-down” effect, where some industries are recording a downgrade in consumer buying power. But two sectors on our radar may be experiencing a pause in purchasing altogether: Electronics and Appliances. Electronics Demand is Cooling as Consumers Wait for Promotions Electronics sales are dominated by three devices on the consumer front: Phones, Computers, and TVs. Consumer mentions of purchasing one of the three items above have slipped slightly over the last month, currently pacing -3% lower than they were last year. |

| The kicker? Many of these mentions are from consumers who are pouncing on (likely needed) discounting and promotional activity. |

| A win for consumers, but a big ding for company margins. You can see this cool-down in real-time by looking at Best Buy (BBY) shopping mentions. |

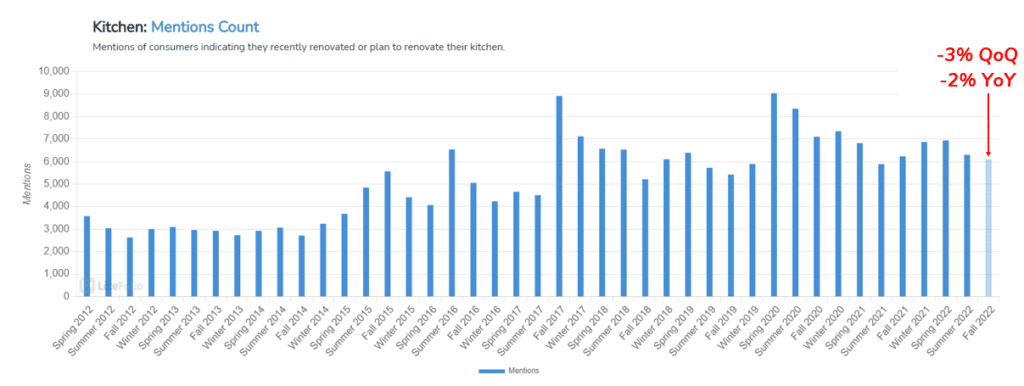

| Purchase Intent has slipped by -24% YoY – nearly in lockstep with BBY’s share price. Last quarter Best Buy posted a -12% drop in comp sales as consumers spent less on its computer and home electronics products. The company noted tough competition for consumer spend in areas like travel…and an unexpected hit from competition for basic human needs…like food. “…we expected to see some impact to our business as customers broadly shifted their wallet spend back into experience areas, such as travel and entertainment. We did not expect and compounding these impacts is a changing macro environment where consumers are dealing with sustained and record-high levels of inflation in some of the most fundamental parts of their daily lives, like food.” Ouch. Unfortunately for Best Buy, it also operates in a second segment where LikeFolio is recording a cool down: Appliances. Consumers Holding off on Non-Essential Appliance Upgrades Home renovations surged over the last two years following consumers moving into a new home OR upgrading their current digs because of the amount of time spent inside. This surge continues to cool – especially in the kitchen. |

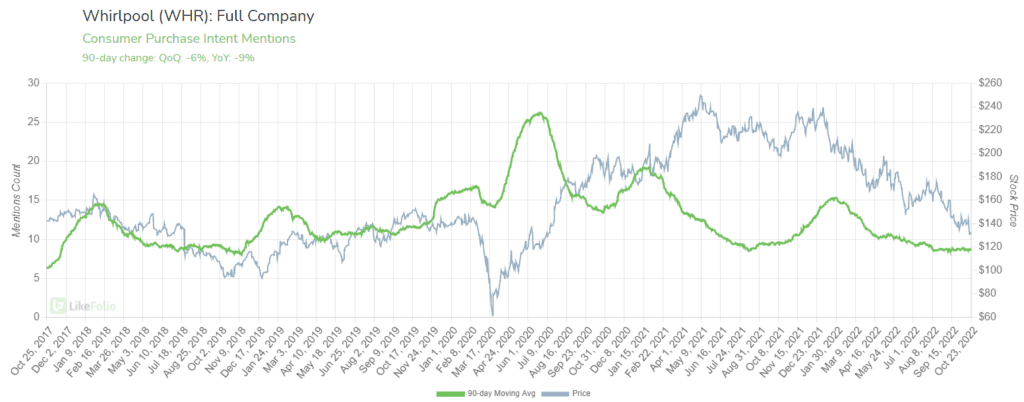

| Consumer mentions of renovating their kitchens (including appliance upgrades) are losing steam, currently pacing -2% lower YoY and -3% lower QoQ. This home reno segment differs from other areas of the home. For example, consumer mentions backyard renovation projects are exploding this fall, up nearly 100%. What’s happening? Kitchens were one of the first areas consumers hit – there was a lot of at-home cooking during the pandemic. But now they’re set and moving on to other areas of the house…er yard…and skipping unnecessary upgrades. You can see the impact of this behavior change (and pull-forward effect) on the demand chart for Whirlpool (WHR) below. |

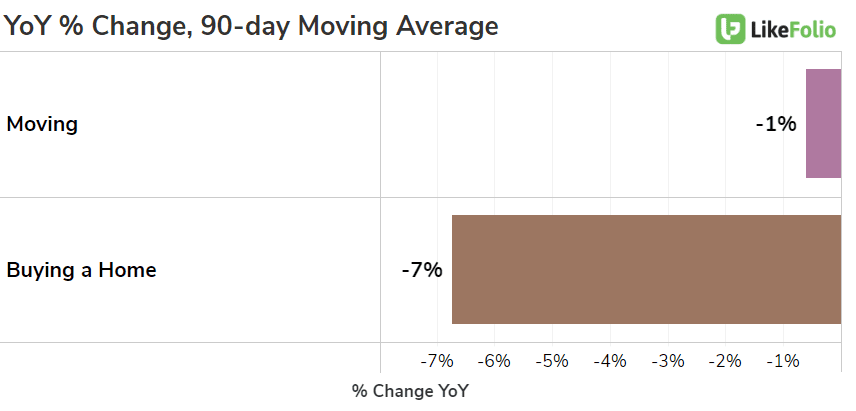

| Purchase Intent has dropped -9% YoY, dipping to levels we haven’t recorded since before the pandemic. Just last week Whirlpool cut its earnings outlook citing weak demand alongside rising inflation. Whirlpool also called attention to another important trend correlation to watch moving forward: new home sales. The company sees a strong correlation between existing home sales and overall appliance demand. “Obviously, existing home sales declined sharply in 2022, reflecting the mortgage rate shock, keeping both new buyers away from the market as well as keeping prospective sellers from selling due to existing fixed mortgage rates, which are significantly lower than current mortgage rates.” Consumer mentions of moving and buying a home continue to slip on a YoY basis. |

Bottom line: Although consumers ARE still spending, where they’re spending has changed.

And this has serious implications for companies…especially those on the losing side.

We’ll be monitoring consumer macro trends and related companies to understand when this bleeding stops. Until then, we’re avoiding major bets in “big” areas of discretionary spend on goods like electronics and appliances.