Nike reported an awesome quarter Tuesday evening. The stock is […]

All Eyes on Nike (NKE)

All Eyes on Nike (NKE)

Nike (NKE) ended its 2021 fiscal year on a high note.

Not only did its 21Q4 report smash expectations for both EPS and revenue, but it also validated the company’s aggressive development of its DTC sales channels.

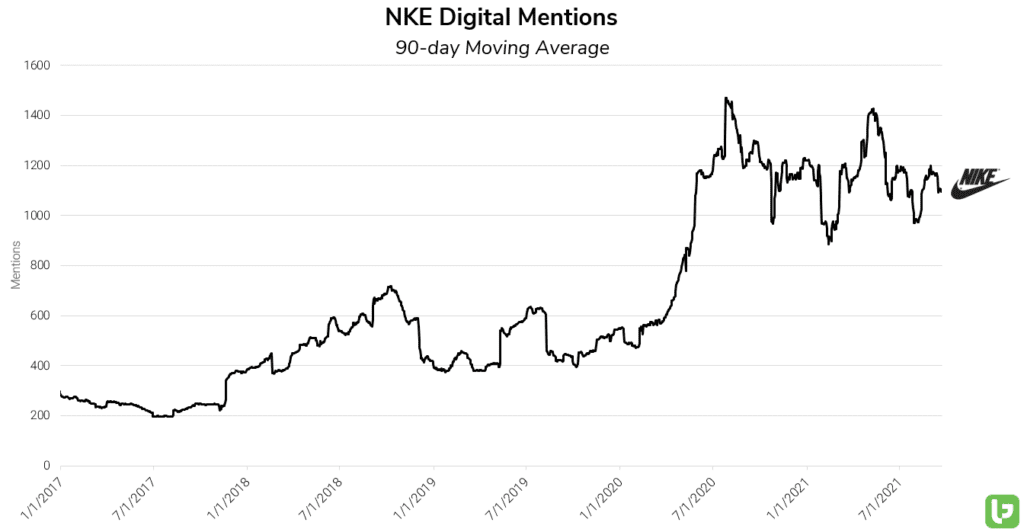

Reported revenue for 21Q4 rose +96% YoY (+21% vs. 2019) -- Nike Direct sales grew +73% YoY, accounting for than a third of total revenue. Underlying digital-specific Mentions confirm the recent DTC success, still trending +150% vs. 2019 on a 90-day moving average.

Still, NKE’s overall momentum is slowing.

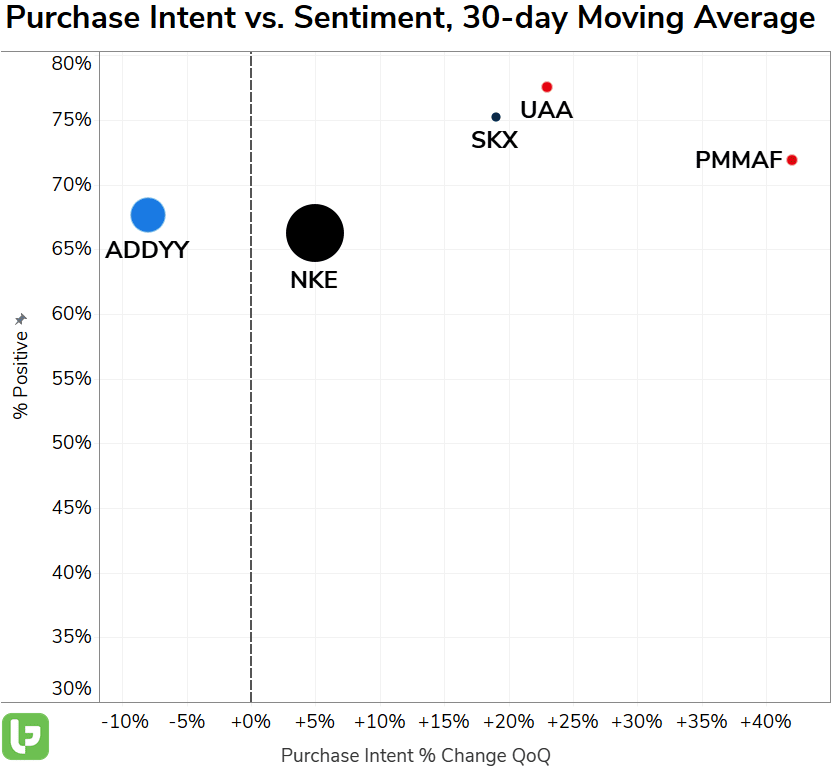

The Footwear Division accounts for 68% of total revenue, and Nike is underperforming some of its smaller rivals in the footwear space.

Notably, PUMA (PMMAF), Under Armor (UAA), and even Skechers (SKX) are all showing stronger near-term Demand growth and higher Consumer Happiness than those of Nike. Nike typically announces quarterly earnings results towards the end of the season, which means its reports garner extra attention from the street. Following the last quarter's blowout report, NKE shares gapped +15% higher, sending the stock to a new ATH in the following weeks.

Now, Investors' expectations have been raised accordingly– Wall St. expects to see Nike report record-high sales and EPS.

Even if Nike posts another dominant sales performance, unforeseen increases in raw materials, labor, or shipping costs could trigger a negative reaction from the street.