Roku makes streaming devices that allow its customers to stream […]

$AMZN Earnings Preview

Amazon's earnings report is one of many tech giants reporting this week. The earnings report will help investors gauge the health of the tech sector and the broader economy.

So far, other tech players in our universe like GOOGL (score was -40), AMD (score was -59), MSFT (score was +12) have posted reports that were in line or above expectations but fell light on guidance, sending shares lower immediately following earnings.

What does LikeFolio data suggest is in store for AMZN?

Much of the same.

Our data places AMZN above the likes of GOOGL and AMD and not as rosy as MSFT.

Here's what we are watching:

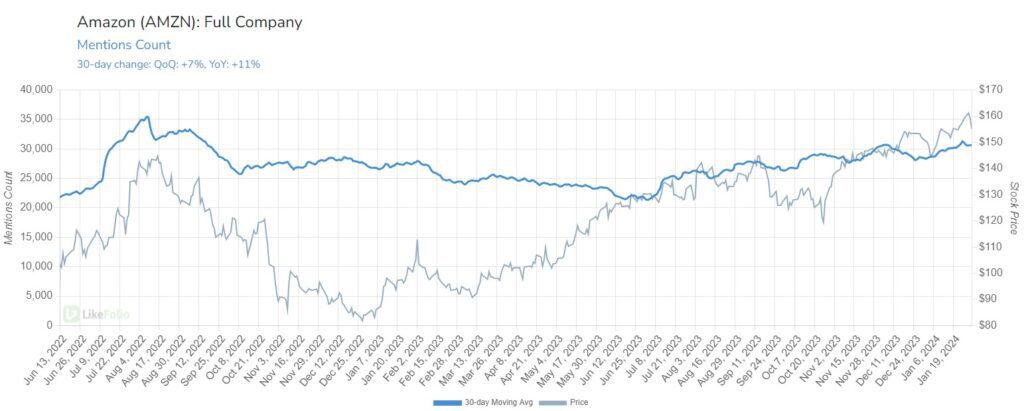

- Cumulative AMZN mentions are higher on a YoY basis: +11% YoY on a 30day Moving Average, bolstered by a nice holiday season on the Prime front (+32% YoY).

We know Amazon is now the major player when it comes to delivery, surpassing UPS last quarter to become America's largest delivery business (it passed FedEx in 2020).

This is impacting UPS top line revenue. In 2021 Amazon comprised 13% In 2022 Amazon comprised 11% and it is expected to drop even lower when UPS files for 2023. This suggests Amazon may not be weighed down as much by parcel weakness if the company is doing more of its own delivering, further boosted by its 'Buy with Prime' option for merchants.

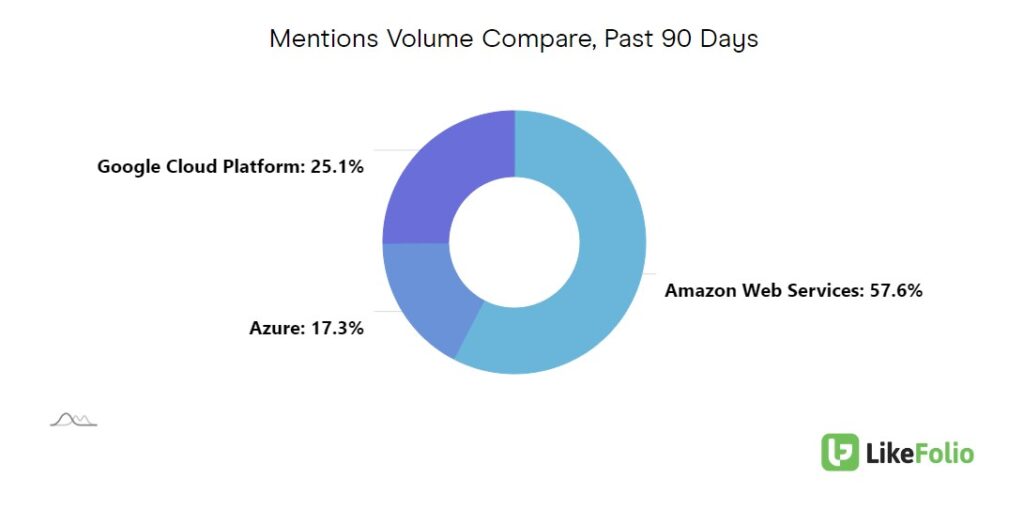

- On the flip side, we do see a continued slowdown in AWS growth, with mentions down -15% YoY.

Market share review shows continued steal from GOOGL and MSFT. AWS comprised 63% of mention volume a year ago vs. 57% today. We see Google's Cloud offerings overperforming here.

Last quarter AMZN earnings beat expectations on the back of a strong Prime Day promotion in October, better-than-expected ad revenue, and effective cost cutting measures.

Now it looks like the bar is much higher.

AMZN shares have pushed more than 50% higher YoY and are approaching pandemic highs. Our data supports a move to the downside following this event, driven by underperformance in its cloud division and high expectations.