Chipotle (CMG) Chipotle is opening its first "Ghost Kitchen" this […]

DoorDash says Convenience is King

DoorDash is capitalizing on the overarching trend towards greater convenience, according to the CEO's remarks during the latest earnings call.

The CEO highlighted that, despite arguments against the necessity of food delivery, the demand for convenience continues to push the industry forward, indicating a broader shift in consumer behavior towards valuing ease and efficiency in their spending on food.

However, LikeFolio data suggests a potential slowdown in growth and engagement for DoorDash.

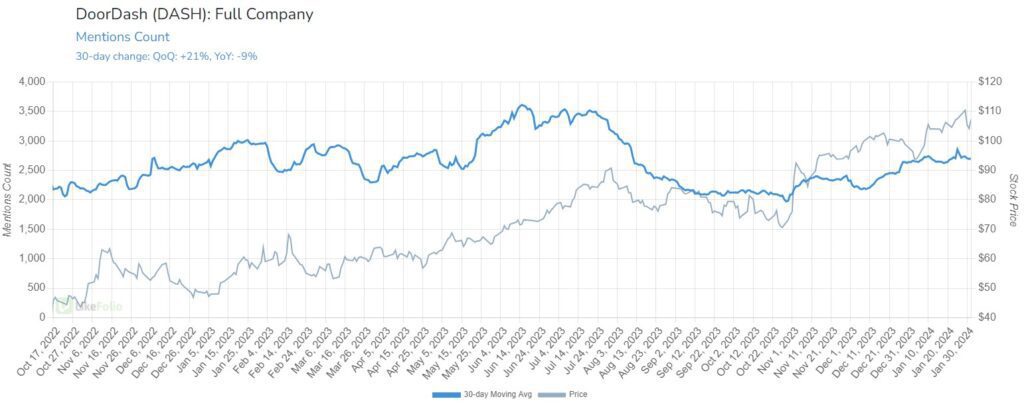

The company's mention volume has slipped by -9% YoY on a 30-day moving average, worsening from -5% on a 90day view.

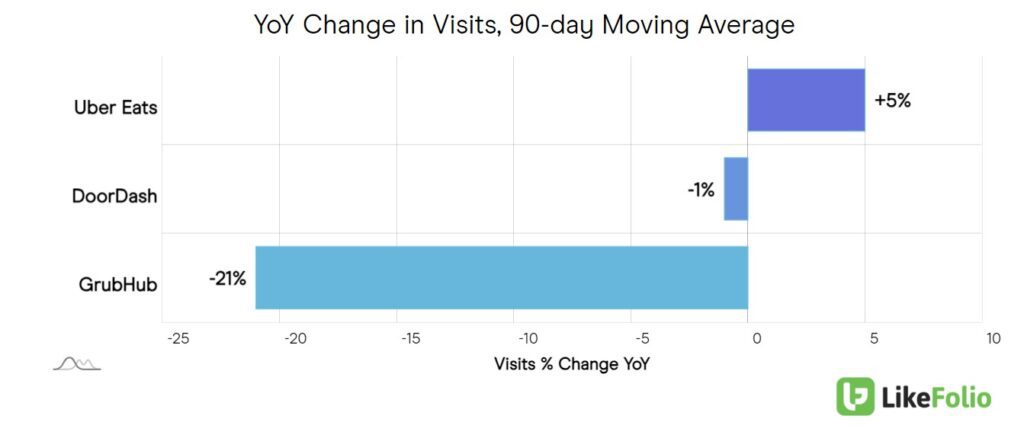

This trend is mirrored by consumer web traffic analysis, which indicates Uber Eats is capturing some of DoorDash's market share.

While DoorDash's web traffic has posted a slight 1-point decrease YoY, Uber Eats has seen a 5 point increase in traffic. Meanwhile, GRUB remains significantly behind its competitors.

Despite these challenges, DoorDash has continued to make significant strides towards profitability.

In the last quarter, the company reported a 27% YoY increase in revenue, reaching $2.2 billion, along with a 24% increase in both Total Orders and Marketplace Gross Order Value (GOV). The company also saw a substantial reduction in losses, narrowing to $75 million from $296 million in the same quarter of the previous year.

The market gobbled this up, sending shares higher immediately following the report.

As DoorDash approaches its next financial report, and with high-profile events like the Super Bowl on the horizon, expectations are mounting.

The stock is currently trading more than 80% higher YoY, reflecting investor optimism about the company's growth trajectory and operational improvements.

Notably, DoorDash distinguishes itself within the sector of growth-oriented companies by maintaining a debt-free balance sheet. This is particularly remarkable among its peers, who often carry a significant level of debt relative to equity. This financial strategy, supported entirely by shareholder funding, eliminates the burden of debt obligations, thus mitigating concerns regarding repayments and presenting DoorDash as a comparatively less risky investment.

On the consumer front, LikeFolio data suggests room for caution ahead of this report. Slowing momentum may hinder this company from clearing a high bar. We’ll be watching over the next few weeks for any significant changes in momentum.