“You know it's time to sell when shoeshine boys give […]

Bitcoin Rallying on Strong Demand – Crypto Stocks Benefit (BTC-USD, COIN)

Bitcoin Rallying on Strong Demand – Crypto Stocks Benefit (BTC-USD, COIN)

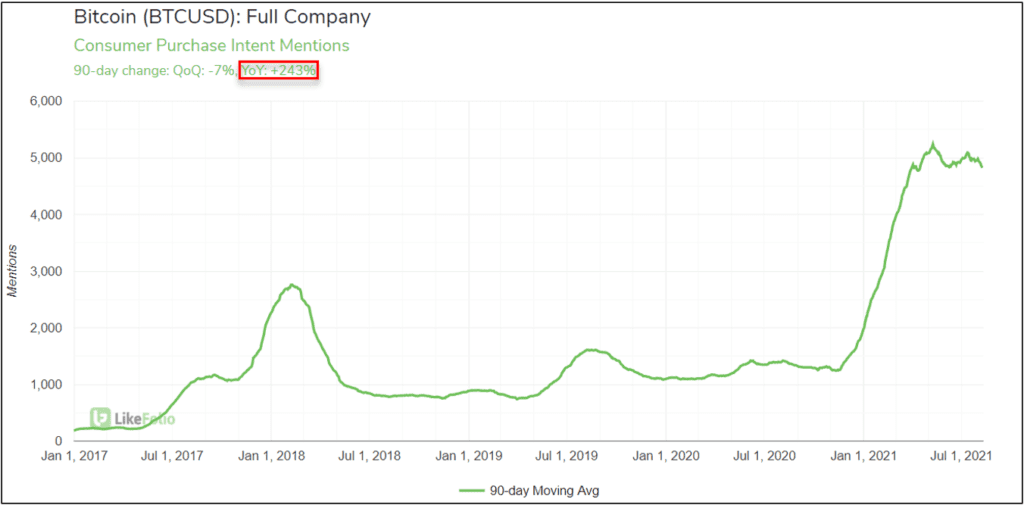

The price of 1 Bitcoin (BTC-USD) has rallied from below $30K to above $45K in less than a month, notably breaking above the 200d MA yesterday. LikeFolio has maintained a firmly bullish outlook on the leading cryptocurrency, based on palpable underlying demand and supporting trends. Retail Investor Mentions of purchasing Bitcoin are up +243% YoY on a 90-day moving average, down just -7% from the all-time highs reached in May.

With the BTC market cap drawing near to $1T again, various blockchain-linked firms are seeing positive momentum alongside the cryptocurrency market.

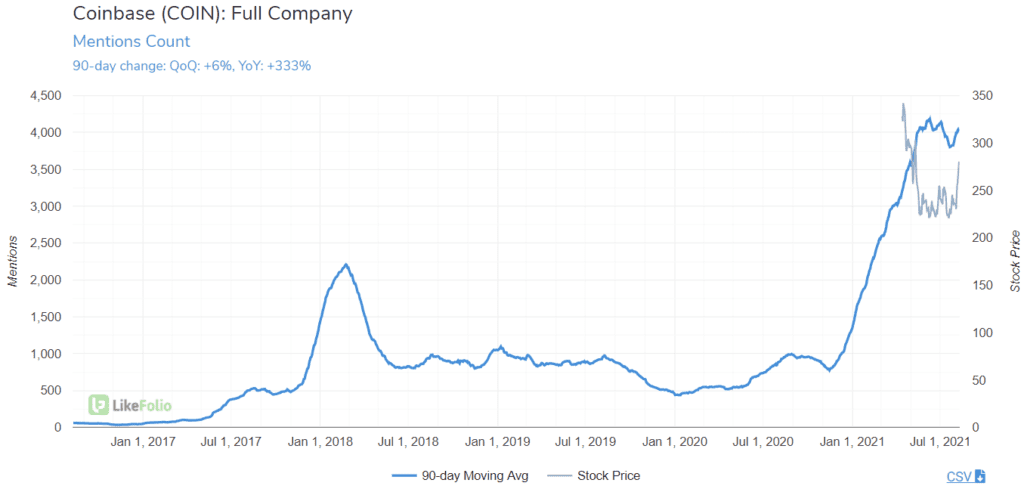

And, one of our favorite stocks with heavy crypto exposure is Coinbase (COIN). Coinbase is the second-largest cryptocurrency exchange in the world, and recently cemented its status as ‘best-positioned in the U.S.’ when COIN shares began trading on the NASDAQ earlier this year.

Much like the trend seen in Bitcoin Demand, Consumer Buzz for Coinbase’s exchange has continued to hold at a higher level, despite falling crypto prices – Coinbase Mentions are trending +6% QoQ and +333% YoY (90-day moving average).

The exchange is set to report Q2 earnings after the bell today. Still, the company’s long-term success remains closely linked to the performance of the underlying assets being traded on the Coinbase platform (cryptocurrencies).

COIN Shares are still more than -35% below their post-IPO highs.