Last September we used Purchase Intent data to predict that […]

Have we Reached Peak Podcast?

August 30, 2022

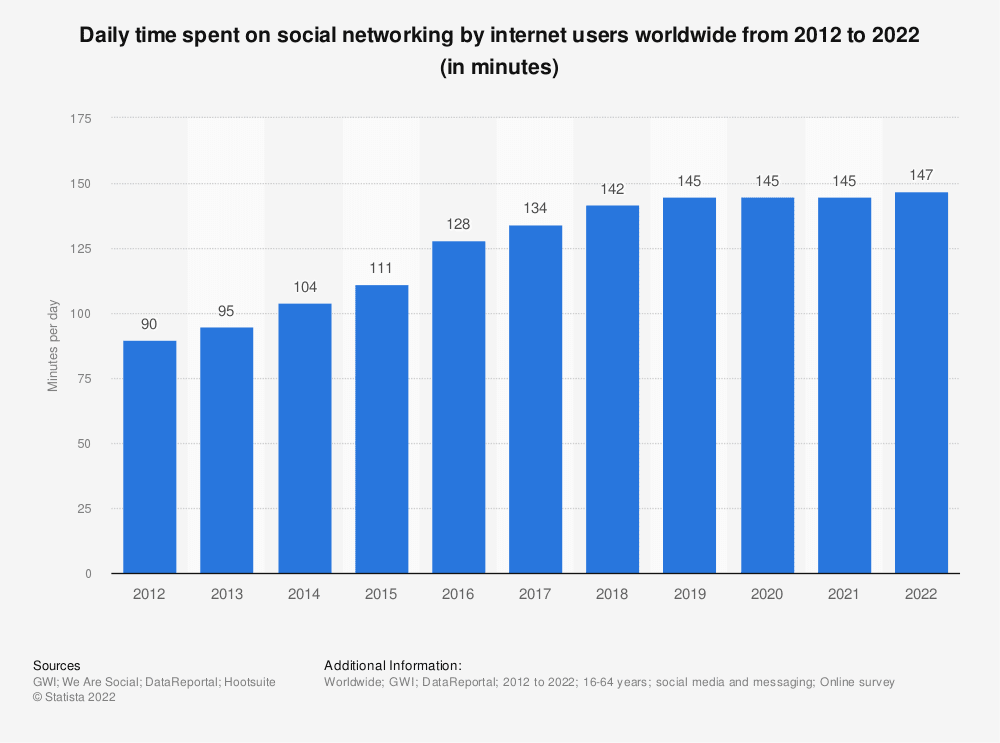

| We’ve all heard the joke about the attention span of a goldfish. But this trend is no laughing matter, especially if you’re in the business of podcasts. Consumer attention spans are shrinking, eroding to just 8 seconds of time spent focused on a task before distraction. When you look at key behavior trends, it's easy to understand why. Consumer daily time spend on social media networks – who operate in the world of short-form content and instant gratification -- reached all-time highs this year. |

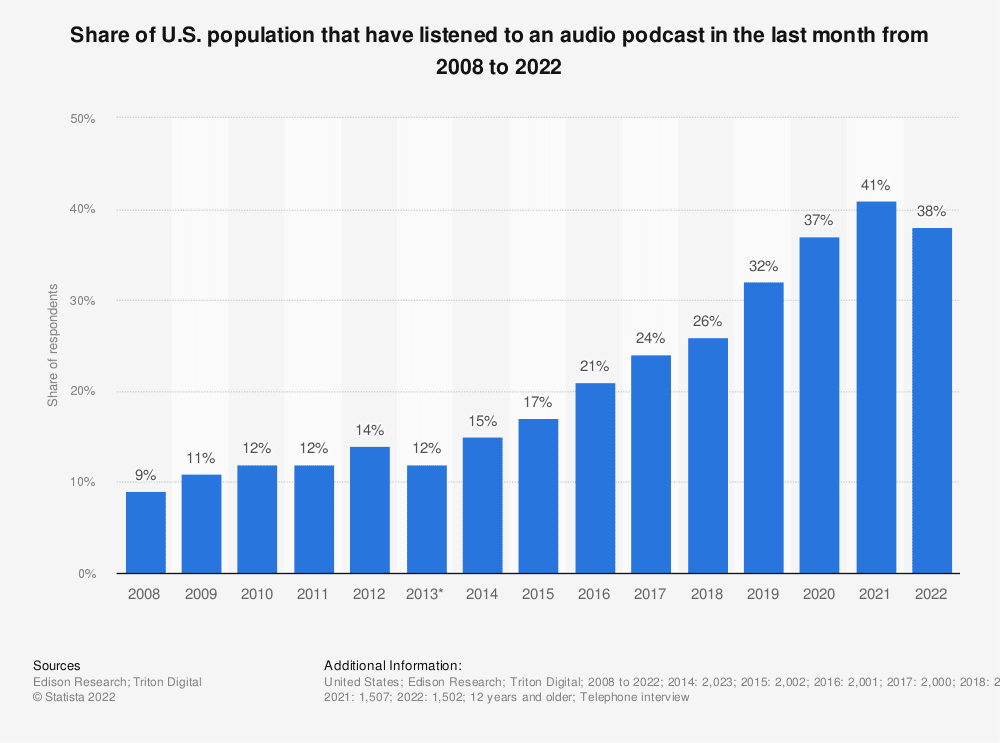

| Meanwhile, the percentage of consumers who listened to a podcast in the last month slipped for the first time in nearly a decade. |

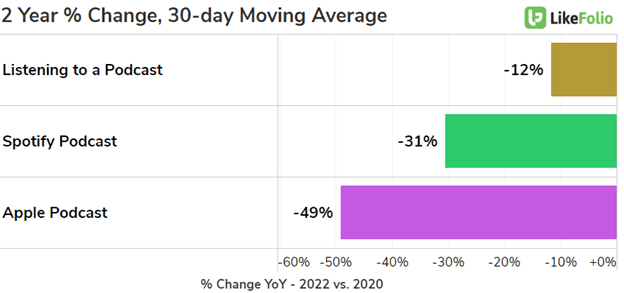

| LikeFolio Data Reveals Drop in Podcast Listening Mentions Across the Board Consumer mentions of listening to podcasts have slipped significantly for the top two players in the podcast sector: Spotify (SPOT) and Apple (AAPL). |

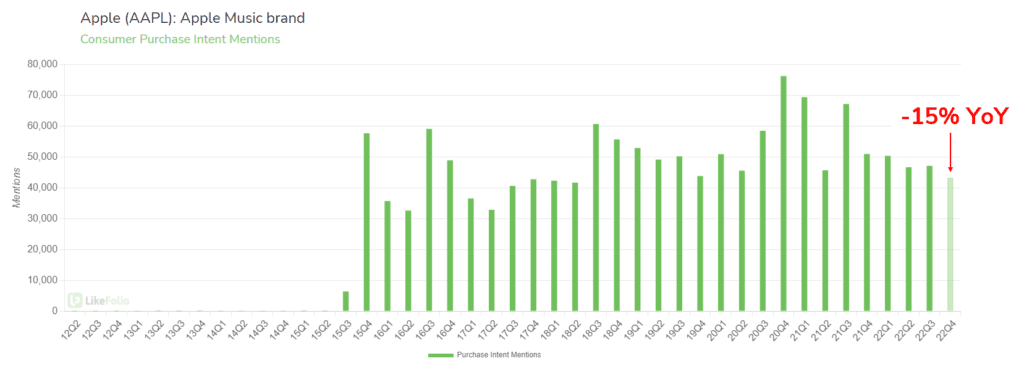

| This drop in podcast engagement for Spotify and Apple comes alongside a loss in momentum for generic mentions of “listening to a podcast.” Looking ahead, here’s what we know: 1. Apple is losing the Podcast Battle Apple Podcast listening mentions have slipped by nearly -50% YoY – the most significant decline of any other podcast provider in our universe. And Apple isn’t just struggling on the podcast front – its other “audible” category, Apple Music, is on pace for the lowest 4th quarter on record since 2018. |

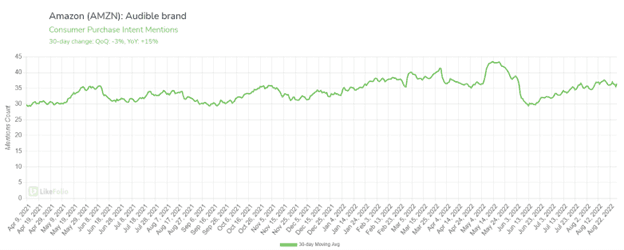

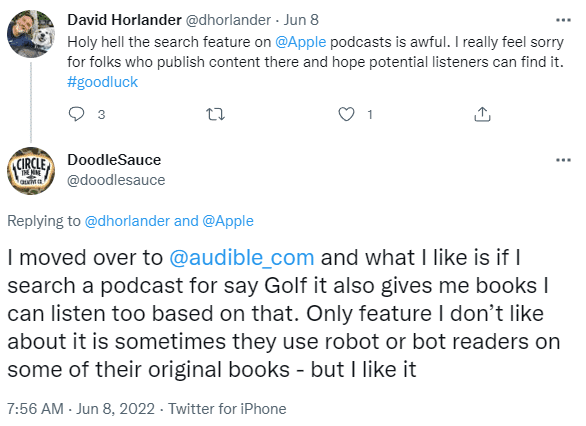

| 2. Spotify Creator Loyalty Could be a Blindspot Last quarter, Spotify premium subscribers grew to 188 million (+14% YoY), besting expectations and sending shares higher. But can you guess what the company’s weak spot was? Shockingly, podcasts. One of the platform’s largest series, ‘Reply All’ capped off its final episode in June. And the Obamas switched their platform home from Spotify to Amazon’s Audible. In fact, Spotify noted its growth strategy includes plans to adopt Audible features, like expanding its audiobook content via its acquisition of Findaway. To be fair, Spotify’s podcast exposure did help to boost the company’s advertising growth by double digits YoY while many other digital media companies slipped. But LikeFolio data suggests loyalty (on behalf of the listener and the creator) isn’t a guarantee. And Spotify podcast listener growth appears to be slowing down. 3. Amazon’s Audible is Well-Positioned for Future Growth In contrast, things appear to be looking up for Amazon’s audio content platform, Audible. Consumer mentions of downloading Audible or listening to content on Audible have increased by +15% YoY. |

| Apple Podcast and Spotify Podcast usage mentions have decreased by -34% and -12% in the same period (30-day Moving Average, YoY). Much of this outperformance is driven by Audible’s expansive library of audiobooks alongside its podcast content. Audiobooks are the fastest growing format in publishing…and consumers are taking note of Audible’s versatile audio platform. |

Moving forward, we’ll be watching Spotify to see if the company can successfully grow into its ultimate audio content platform goal. But we wouldn’t be surprised to see some speedbumps along the way.