Lowe's (LOW) Home Depot is trading ~3% lower today after […]

Home Reno Trends: $HD vs. $LOW

In August of 2022 LikeFolio data detected a critical trend that helped to predict a divergence in performance for HD and LOW for the following month:

Outsized strength in contractor activity vs. DIY was benefitting Home Depot more than home improvement peer, Lowe’s.

Why?

Lowe's generates ~75% of sales from DIY customers and just 25% from professional customers. In contrast, Home Depot's professional customers comprise nearly half of its revenue.

That translated to headlines like this:

However, last quarter both companies posted results that triggered alarm bells.

HD shares dropped -7% following a Q4 earnings report that missed expectations for the first time since 2019 – a miss the company attributed to declining lumber costs.

LOW shares dropped -5% following its Q4 report that featured similar lumber sentiment and also acknowledged headwinds including a slowdown in housing turnover and pull back in consumer discretionary spend.

Both companies weaved a tale of long-term confidence in the power of needed upgrades as housing inventory ages AND a larger theme of uncertainty.

What does the data say?

The Professional Segment Remains Strong

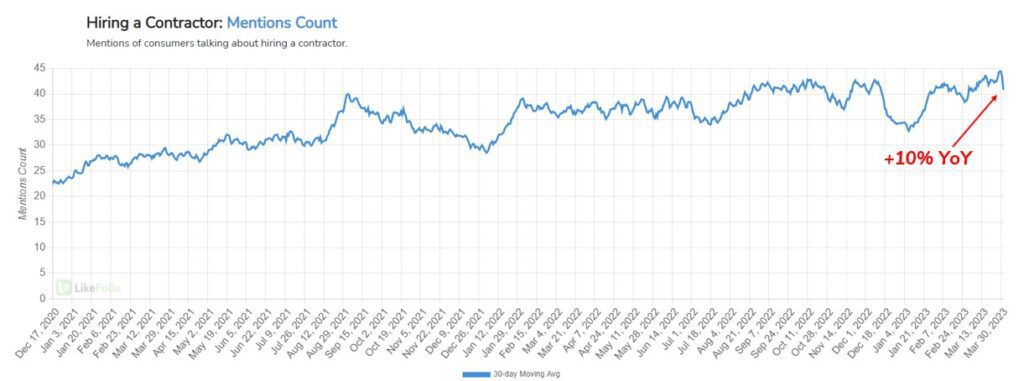

After a lapse in contractor activity mentions over the holidays, contractor activity ramped up again in February.

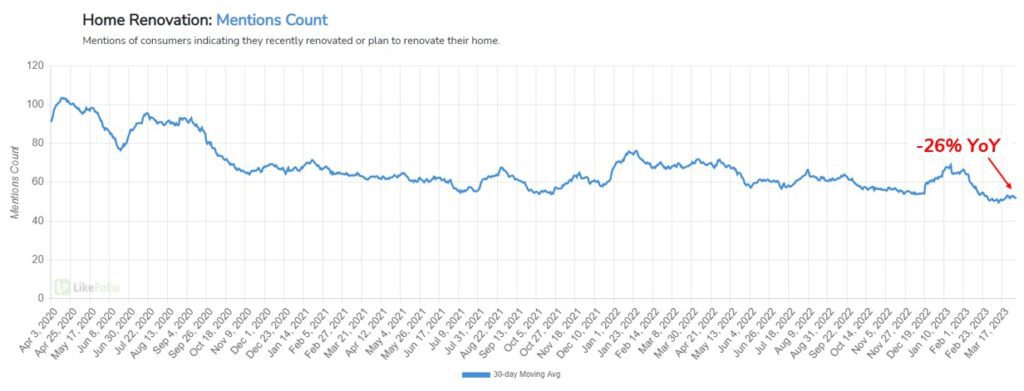

Mentions are currently pacing +10% higher YoY…a stark contrast vs. DIY home renovation mentions which have dropped by -26% in the same time frame.

A pull-back in DIY home renovations will impact both HD and LOW.

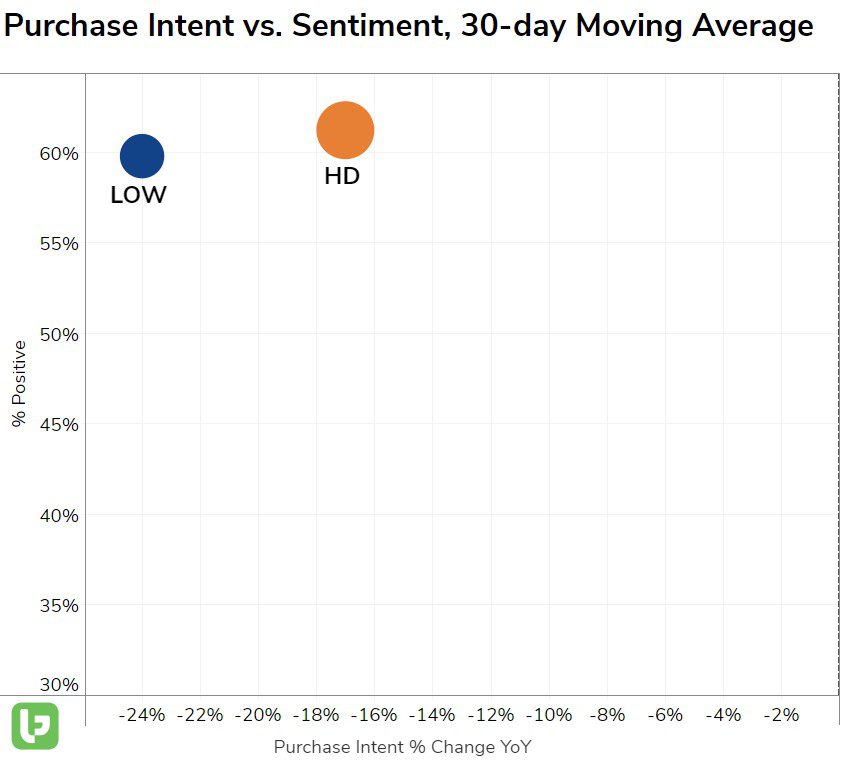

You can see this clearly on the outlier grid below, which displays a double-digit drop in demand for both retailers.

However, Home Depot appears to be recording a lower drop in consumer demand vs. Lowe’s on a YoY basis and boasts higher levels of consumer happiness (even if ever so slight).

DIY Advantage: Home Depot – demand declines pose as a serious headwind for both companies looking ahead. However, Home Depot’s revenue is more balanced and the company appears to be suffering from a lower decline even in the DIY audience.

Can Home Depot Defend its Pro Advantage?

As DIY home renovations mentions stall, Home Depot’s robust professional customer base should help insulate the company more than Lowe’s, right?

Yes, if Home Depot can defend its market share.

Last quarter we know Lowe’s was making strides to capture a portion of the professional sales market (i.e. consumers hiring contractors to complete projects).

Lowe’s noted Pro U.S. growth of +10% YoY, enhanced professional product assortment, and a professional-confirmed backlog booked out the same or more compared to 2022.

“One example of enhancing our Pro product assortment is the exciting news that Klein Tools will be coming back to Lowe's. We know that our Pros are fiercely loyal to certain national brands and Klein is the number one hand tool brand among electrical and HVAC professionals. This creates immediate credibility across trades.”

HD noted that Pro sales growth outpaced DIY in its 4th quarter as well, and touted a backlog that remained elevated vs. historical averages.

Professional Advantage: Still Home Depot, with some traction from Lowe’s.

Looking ahead: HD vs. LOW

- Both Home Depot AND Lowe’s appear vulnerable to weakening consumer demand for home improvement.

- HD shares have underperformed LOW over the last three months, trading -6% lower vs. LOW shares trading +2% higher.

- Consumer Happiness levels suggest HD is strengthening its value proposition to consumers. Long-term investors may view near-term weakness as ideal long-term entry points for the retailer.

Bottom line: HD is holding on to its advantage vs. LOW but may also be more vulnerable to weakness in the professional segment. Right now it looks strong. We’ll be monitoring this trend closely for any signs of degradation.