Hasbro is clearly a cyclical business with high company seasonality. And […]

Is Chewy still an easy quarantine play?

December 8, 2020

Chewy (CHWY)

Chewy was one of our favorite Covid plays. We featured the name on our Coronavirus Shopping List MegaTrends Report, delivered to clients at the end of March...when shares were around $36. Since then, shares have more than doubled in value. What do we think now?

Here's what we know:

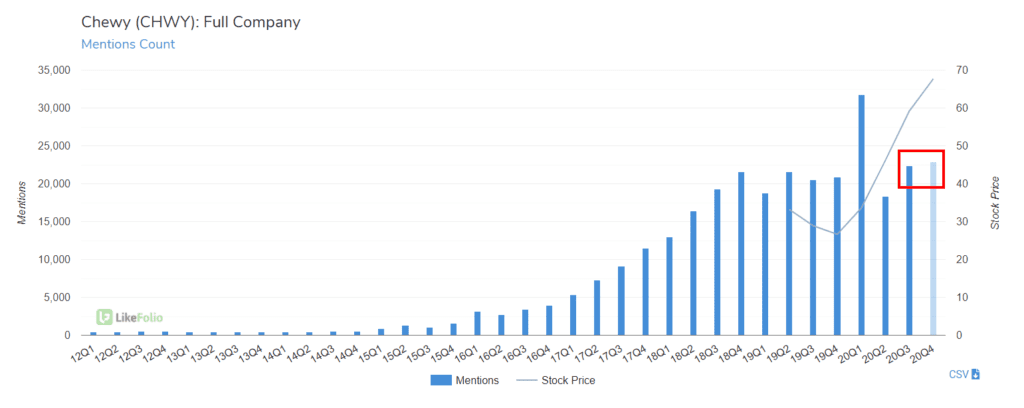

- Mention volume tempered last quarter after a huge Covid-induced surge, and now is on the upswing. In 20Q3, consumers talking about Chewy increased +22% QoQ, +9% YoY. 20Q4 shows continued growth: +4% QoQ.

- Chewy struggles with churn. Chewy's estimated churn rate is relatively high vs. online retail, at 33% (40% for first-year customers). Online retail average churn is 22%. LikeFolio's Chewy cancellation mentions increased +4% YoY in the last quarter.

- Autoship is extremely significant. Autoship sales account for a major portion of total sales ($1.16 billion out of $1.7 billion last quarter). LikeFolio recorded a massive influx of Autoship customers from March-May. Early signs reported by Chewy suggest new customers are surpassing its existing base, and each year a user sticks around, the more the user spends. Investors will have a close eye on the number of active customers, and NSPAC (net sales per active customer).

The company has a high bar to clear as shares trade near all-time highs into earnings. If you play, stay risk defined.

Hasbro (HAS) - Nerf

Yesterday, a video went viral depicting an imposter Santa Clause refusing a request for Hasbro’s (HAS) ever-popular toy, the Nerf Gun, and bringing the hopeful tyke to tears.

LikeFolio Purchase Intent Mentions for the Nerf brand already show an outpouring of support, with demand trending...