New Coverage Addition, Upcoming IPO: ON Running Our coverage list […]

Is ON Running just a Victim of Current Market Volatility, or is there more to the Story?

ON Running is a popular athletic shoe and performance sportswear company from Switzerland that owns a large portion of its market share in the European markets.

The shoe company is considered more of a luxury brand with higher price points than traditional companies like Nike or Reebok, but that definitely hasn’t stopped them.

However, ONON's stock price has suffered quite a bit since beating targets and raising $746 million on its IPO last fall.

So, what’s going on?

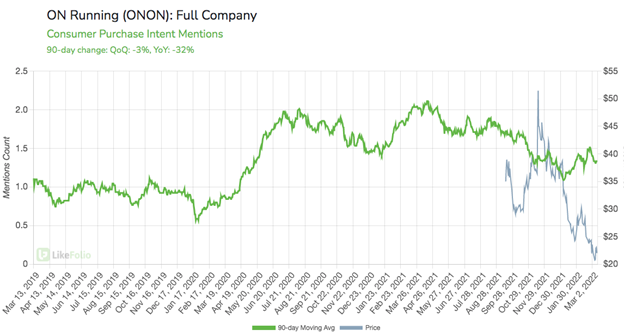

According to LikeFolio data, Purchase Intent Mentions are down -32% YoY... not a great sign.

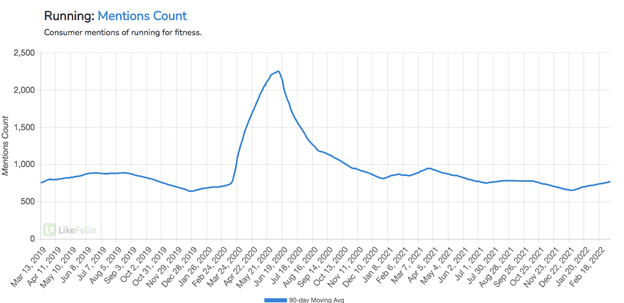

But it could be more than just ON Running itself experiencing issues... Overall Mentions of Consumers Going for a Run, or Running, are down -15 % YoY.

The data could certainly point to the fact that many during the pandemic turned to running and outdoor exercise as many gyms and training classes were closed.

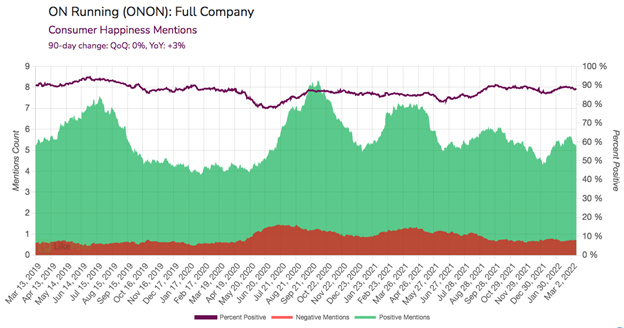

But what do their customers think?

Happiness Mentions are incredibly strong with this name, +87%. Even more, the positive mentions never really dip on a 3-year basis.

To me, this looks like a company that has just cooled off a bit after the post-pandemic era. ONON's IPO was met by Wall Street with high praise and their Happiness Mentions remain unbelievably strong.