Black Friday Weekend (leading into Cyber Monday) can make or […]

Is Target Over its 2023 Hangover?

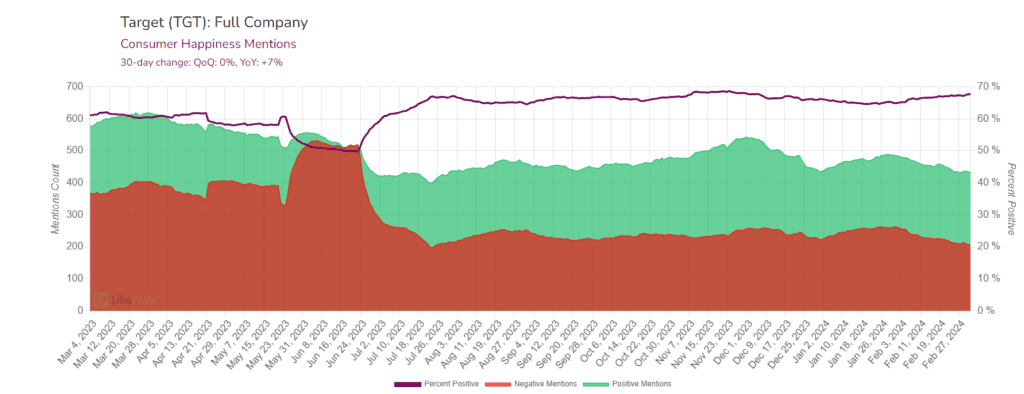

Last year, if you thought of Target, theft and Pride section controversies probably came to mind.

This year's narrative has shifted.

Now, the talk is about Target's seasonal products and unique finds. This change is a positive sign for Target's long-term prospects, despite an expected short-term sales dip this quarter.

Here's a detailed look at what we’re watching ahead of earnings:

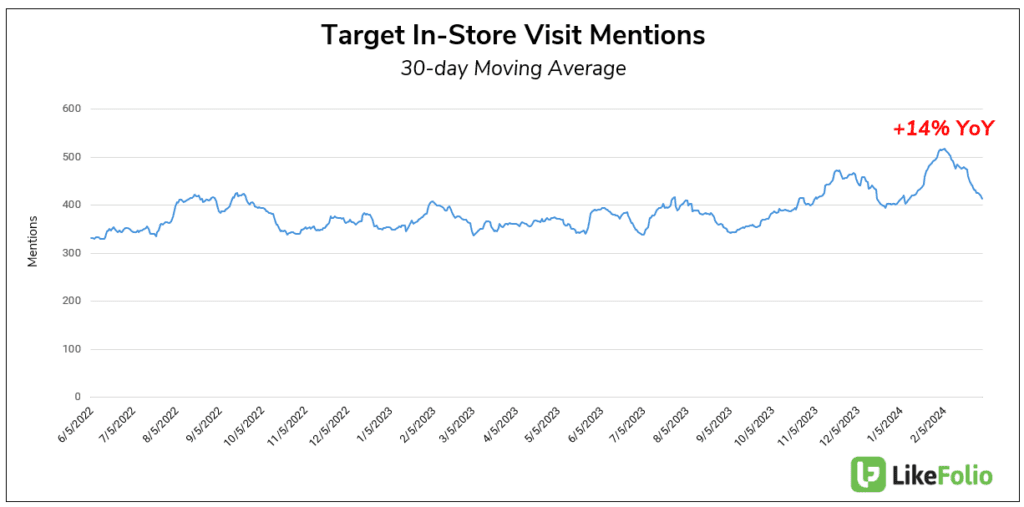

- Store visit mentions have risen by 14% compared to last year, driven by seasonal shopping.

- Customer satisfaction has increased by 7% from last year, moving past previous controversies.

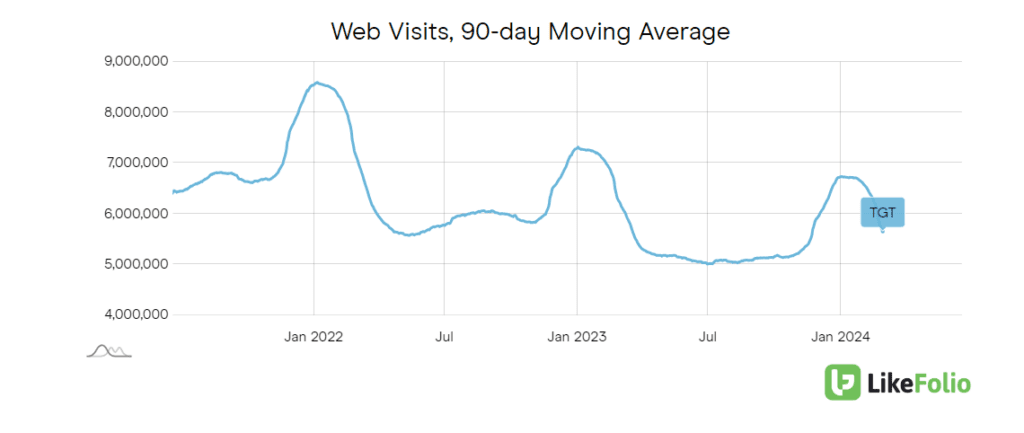

- Target's online performance is lagging, with a 9% drop in web traffic. This decline is sharper than Walmart's and Amazon's, suggesting Target is still playing catch up.

- The third-quarter results for Target were surprisingly strong, with revenue and earnings outperforming due to robust sales in essential categories like food and increasingly beauty. This success pushed shares up nearly 20%.

- The earnings boost appears to be driven by efficient inventory and expense management rather than increased consumer demand. This insight reveals Target's strategic operational adjustments are working.

- Target's collaborations, such as with Kendra Scott for jewelry and the introduction of the "Figment" kitchenware line, are resonating with shoppers. These partnerships deliver attractive, value-driven products.

- The retailer's seasonal merchandise strategy is also paying off. By focusing on periods like Back-to-School and Halloween, Target not only boosts sales but also strengthens customer loyalty. We see this same effect unfolding for Valentines Day and Easter.

Our earnings signal for Target is neutral. While the increase in physical store traffic is promising, it's challenging to predict overall spending and the effectiveness of internal cost controls. This has burned us in the past.

However, the rise in customer satisfaction points to a recovering brand image, which is likely to benefit Target in the future. This suggests that while immediate financial forecasts remain cautious, the improvements in customer engagement and operational efficiency could lead to sustained growth and stronger market positioning for Target.